India’s Oil Seal Market Overview : Major Importers, Top Exporting Partners, and Industrial Applications

According to NBD DATA, India’s imports of Oil Sealsunder HS code 40169330 reached a total value of USD 11,584,390 between January and June 2025. The country recorded 10,643 import transactions involving 539 importers, 684 exporters, and 32 supplying countries. The total import quantity exceeded 15.4 million units, confirming India’s continued reliance on imported oil seals for its fast-expanding automotive, machinery, and construction equipment sectors.

Product samples extracted from customs data include “T2044161 – OIL SEAL (PARTS FOR MOTORCYCLE)”, “SERVICE PARTS FOR CNC MACHINE TOOL – SEAL OIL R55554”, and “90311-T0036 SEAL, TYPE T OIL TOYOTA GENUINE PARTS”. These descriptions reveal a broad application range—from motorcycles and cars to industrial machinery and hydraulic systems—underscoring the versatility and ubiquity of oil seals in mechanical assemblies.

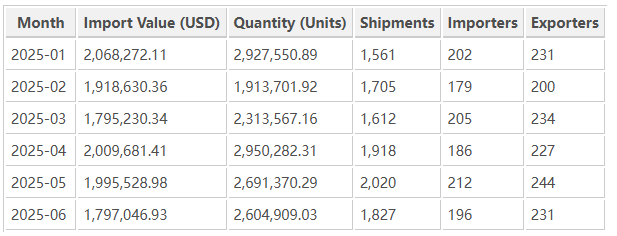

Monthly Import Trends

India’s oil seal imports maintained consistent activity throughout the first half of 2025, peaking in April and May as manufacturing orders surged.

The import trend shows steady procurement across the first quarter and a surge in Q2, corresponding with post-holiday production recovery in India’s automotive and heavy-machinery plants.

Key Importers and Industrial Usage

India’s oil seal demand is driven by a mix of global manufacturers and domestic industrial players who rely on precision sealing solutions for vehicles, engines, gearboxes, and hydraulic systems. The top importers in H1 2025 include:

TOYOTA KIRLOSKAR MOTOR PRIVATE LIMITED — valued at USD 0.88 million, from suppliers such as Toyota Motor Asia (Singapore) and Toyota Motor Corporation (Japan). The imported seals support automotive assembly and maintenance for both domestic and export vehicle lines.

KOMATSU INDIA PRIVATE LIMITED— mainly from KOMATSU LOGISTICS CORP. (Japan) and UCHIMURA CO., LTD. (Thailand). These seals are used in excavators, hydraulic pumps, and construction machinery components.

TETRA PAK INDIA PRIVATE LIMITED —primarily from Tetra Pak Technical Service AB (Sweden) and Alfa Laval Kolding A/S (Denmark), supporting sealing systems in food-processing and packaging equipment.

GAINWELL COMMOSALES PRIVATE LIMITED — mainly from Caterpillar S.A.R.L. (Singapore), serving the mining and heavy-equipment sectors.

TATA HITACHI CONSTRUCTION MACHINERY COMPANY PRIVATE LIMITED — oil seals from Hitachi Construction Machinery Asia & Pacific and Daemo Engineering Co., Ltd. (South Korea) for excavators and loaders.

Together, these companies accounted for more than 60% of India’s total oil seal imports, revealing a strong linkage between the country’s manufacturing clusters and global component supply networks.

Major Exporting Partners

India sourced oil seals from a diverse set of 32 countries, with Japan, Germany, Thailand, China, and Taiwan(China) leading the supply.

-

Japan accounted for nearly 25% of imports, led by Toyota, Komatsu, and Hitachi supply chains.

-

Germany supplied high-precision sealing systems via Trelleborg and Freudenberg affiliates.

-

Thailand and Taiwan(China) were major regional suppliers of NBR and FPM shaft seals used in rotating machinery and automotive engines.

-

China contributed cost-effective industrial seals for aftermarket and equipment maintenance applications.

This diversified sourcing structure ensures India’s industrial resilience and supports multiple downstream sectors including automotive, construction machinery, packaging, and manufacturing equipment.

Industrial Applications and Product Characteristics

Oil seals play a crucial role in preventing lubricant leakage and protecting mechanical assemblies from contamination. Based on import declarations, India’s major categories include:

-

Automotive oil seals for engine crankshafts, transmissions, and wheel hubs;

-

Hydraulic and pneumatic seals used in construction equipment and CNC machinery;

-

Specialized shaft seals (NBR / FPM materials) for industrial and chemical processing machines;

-

Genuine OEM parts for Toyota, Komatsu, and Caterpillar machinery.

The frequent reference to “shaft seals used in rotating parts to prevent leakage of oil or lubricant” in customs records underscores the dominant industrial-grade usage rather than consumer-level imports.

Market Outlook

India’s import trend for oil seals during H1 2025 highlights three key insights:

-

Strong industrial recovery — Rising imports reflect stable growth in India’s automotive and capital-goods sectors following global supply normalization.

-

Supply chain localization with global integration — Domestic subsidiaries of global brands such as Trelleborg, Komatsu, and Tetra Pak increasingly combine local assembly with imported precision components.

-

Material and technology diversification — Imports include both conventional NBR (nitrile rubber) and advanced FPM / fluoroelastomer types, aligning with the shift toward high-temperature, high-pressure applications.

With continued investment in automotive manufacturing and infrastructure, India’s oil seal import volumes are projected to maintain moderate growth through 2026, supported by expanding demand in electric vehicles, industrial machinery, and construction equipment.

Data Source

All trade statistics in this report are derived from NBD DATA, based on verified customs import declarations of India between January 1 and June 30, 2025. The dataset includes transaction-level details on values, quantities, and trading entities. For detailed company profiles or import-export analytics, please visit NBD DATA Services.