Indonesia’s Cosmetic Export Momentum: Lotion Products Leading the Charge

Indonesia’s cosmetic industry has continued to show dynamic growth, with HS Code 33049930 — encompassing lotion products — emerging as one of the nation’s most internationally competitive categories.

According to NBD DATA, Indonesian lotion exports surged across 2024, with brands like KRIS Hand & Body Lotion and CITRA Hand Body Lotion Natural Glow UV representing the diverse range of skincare items being distributed globally. These products highlight Indonesia’s rising capacity to supply affordable yet high-quality personal care solutions to the global market.

I. Export Overview

In 2024, Indonesia’s lotion exports reached a total value of USD 14.77 million, with an export weight of approximately 6,933 tons. Throughout the year, there were 3,204 trade transactions involving 146 exporters and 388 importers, spanning 61 destination countries.

This wide distribution underscores Indonesia’s established position as a key skincare exporter within ASEAN and beyond, supported by efficient manufacturing, strong branding, and flexible trade routes.

Among the exported items, notable examples include:

-

“KRIS Hand & Body Lotion (100 ML X 72 PCS / Carton) – Fresh Hydration”

-

“CITRA Hand Body Lotion Natural Glow UV 4X6X210ML”

-

“NIVEA Body Lotion UV Extra Whitening 200MLX24”

These products exemplify Indonesia’s shift toward diversified, consumer-oriented skincare goods targeting both premium and mass-market segments.

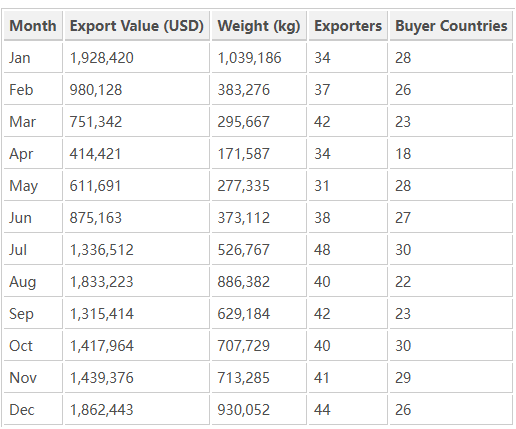

II. Monthly Export Trends

Based on NBD DATA, Indonesia’s lotion exports remained stable throughout the year, with visible peaks in January, August, and December — driven by pre-holiday demand in Asia and the Middle East.

Exports peaked in December (USD 1.86 million), which aligns with global holiday sales. The lowest export period occurred in April, coinciding with Ramadan production slowdowns. The recovery in the second half of the year signals robust international demand for Indonesian lotion products, particularly in ASEAN and Middle Eastern markets.

III. Market Observation: Buyers and Suppliers

Top Global Buyers

According to verified NBD DATA, the largest buyers of Indonesian lotion products in 2024 included both multinational brands and regional distributors:

L'OREAL (THAILAND) LIMITED – imported over 1,027 tons , mainly through its Indonesian subsidiary PT. YASULOR INDONESIA.

VENUS BEAUTY PTE LTD. – a Singapore-based retail distributor sourcing from multiple Indonesian cosmetic producers.

TEMPO SCAN PACIFIC PHILIPPINES INC. – part of the Tempo Scan Group, one of Southeast Asia’s major beauty product distributors.

MODERN SY SDN BHD (1403898-V)– Malaysia-based wholesaler specializing in cosmetic imports.

NURBB TRADING SDN BHD (1395809H) – a key intermediary for re-exporting Indonesian lotion products to Brunei and the Philippines.

These buyers account for the majority of regional trade flows, emphasizing ASEAN’s role as the largest consumer and distribution base for Indonesian skincare goods.

Leading Indonesian Exporters

The supplier side is characterized by both multinational manufacturing arms and independent exporters:

PT. SPARINDO MUSTIKA – the top exporter, serving partners across the Middle East and ASEAN.

PT. YASULOR INDONESIA– a manufacturing subsidiary of L’Oréal Indonesia, the Philippines, and Malaysia.

PT. RAJA IMPEX – a major contract manufacturer and exporter focusing on private-label lotion production.

PT. RUDY SOETADI– an experienced exporter serving regional personal care distributors.

SENSATIA BOTANICALS– Bali-based natural skincare producer, exporting boutique batches to Japan, Singapore, and Europe.

Notably, these companies maintain diversified export portfolios, ranging from mass-market lotion products to niche organic formulations, ensuring resilience against global price fluctuations.

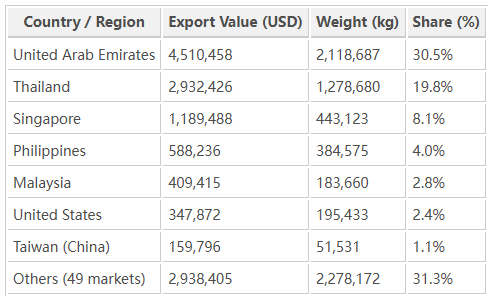

IV. Regional Trade Analysis

Indonesia’s lotion exports covered 61 countries, but the majority of shipments concentrated in Asia and the Middle East.

The top importing regions and their trade shares are as follows:

The United Arab Emirates has become Indonesia’s largest lotion import hub, often serving as a gateway for re-exports to Saudi Arabia and Africa.

Meanwhile, Thailand and Singapore remain dominant within ASEAN, importing both for local consumption and for redistribution through multinational supply chains.

Indonesia’s strong ties with these markets are reinforced by free trade agreements and proximity logistics advantages, allowing exporters to maintain competitive pricing while adhering to diverse regional cosmetic regulations.

V. Focus Country: China Market Outlook

Following the rules for export data, the focus country is China, where Indonesian lotion exports primarily cater to mid-tier retail channels and e-commerce importers.

Although China is not yet a top-five destination, demand for halal-certified and botanical-based skincare from Indonesia is increasing.

Products from PT. SPARINDO MUSTIKA and SENSATIA BOTANICALS are now visible in cross-border online marketplaces such as Tmall Global and Lazada CN.

This emerging channel indicates significant future potential for Indonesia’s lotion exports into the Chinese skincare segment, especially for natural and sustainable product lines.

VI. Industry Insights and Future Trends

-

ASEAN Integration Strengthens Export Synergies

Regional trade agreements and reduced tariffs under RCEP have simplified distribution for Indonesian cosmetic goods, encouraging cross-border brand collaborations within Southeast Asia. -

Halal and Eco-Certification Drive Market Access

Over 60% of Indonesian lotion exports are now halal-certified, giving them a unique advantage in the Middle East and Muslim-majority markets. The increasing adoption of recyclable packaging also appeals to European importers. -

Brand Development and Digital Channels

Exporters like SENSATIA BOTANICALS leverage digital storytelling and influencer marketing to expand brand visibility, while manufacturers such as PT. SPARINDO MUSTIKA invest in co-branding with overseas distributors. -

Rising Competition and Supply Chain Challenges

Global skincare demand is expanding, but so is competition. Exporters face pressure from Vietnamese and Malaysian cosmetic producers. Rising palm oil prices — a key raw material — may affect production costs. -

Outlook for 2025

With expected GDP growth and digital trade expansion, Indonesia’s lotion exports are forecast to grow by 10–12%, particularly through online retail and private-label manufacturing contracts.

VII. Conclusion

The lotion export segment showcases Indonesia’s evolving cosmetic export ecosystem — a blend of industrial scale, creativity, and regional integration.

From mass-market formulations by PT. YASULOR INDONESIA to organic brands like SENSATIA BOTANICALS, the sector demonstrates flexibility in meeting diverse global demands.

ASEAN and the Middle East remain the key growth anchors, while the emerging Chinese market offers fresh momentum for 2025 and beyond.

Indonesia’s continued investment in quality standards, sustainable packaging, and halal compliance ensures its position as a global skincare manufacturing hub.

VIII. Data Source

All data and company records are derived from NBD DATA, based on Indonesia’s 2024 export transactions of LOTION (HS Code 33049930).

Figures originate from verified customs declarations and NBD’s global trade intelligence platform, including transaction totals, partner countries, and verified exporter IDs.

For enterprise-level data access, shipment verification, or importer profiling, please visit NBD DATA Services.