How Much Does Ghana Spend on Wheat Imports Per Year?

Ghana has been a significant importer of wheat, with the country consistently increasing its wheat imports year after year. Understanding how much Ghana spends on wheat imports annually is crucial for businesses and stakeholders involved in the international trade of wheat. In this article, we will analyze Ghana's wheat import statistics, highlighting key figures and trends for 2023 and 2024, as well as identifying the major wheat suppliers and importers in the country.

Ghana's Wheat Import Trends in 2023 and 2024

In 2023, Ghana imported a total of 554,983,540 kg of wheat, amounting to $214,542,433 USD in spending. This reflects the country's strong reliance on wheat imports to meet its domestic demand for this vital grain. The total import volume for 2024 (January to September) already reached 577,661,271 kg, with a total expenditure of $214,372,696 USD.

These figures demonstrate that Ghana has maintained a high level of wheat imports, with a slight increase in volume in the first three quarters of 2024. This continued demand highlights the importance of wheat as a staple food and key ingredient in the local food processing industry.

Monthly Breakdown of Wheat Imports

To provide a clearer picture, let's examine the monthly import statistics for wheat in Ghana. The data below presents the total weight and monetary value of wheat imports for each month in 2023 and 2024:

The monthly breakdown clearly shows fluctuations in both the volume and cost of wheat imports, with the highest import volumes recorded in May, August, and February, while the lowest figures occurred in March, November, and December.

Leading Wheat Importers and Suppliers

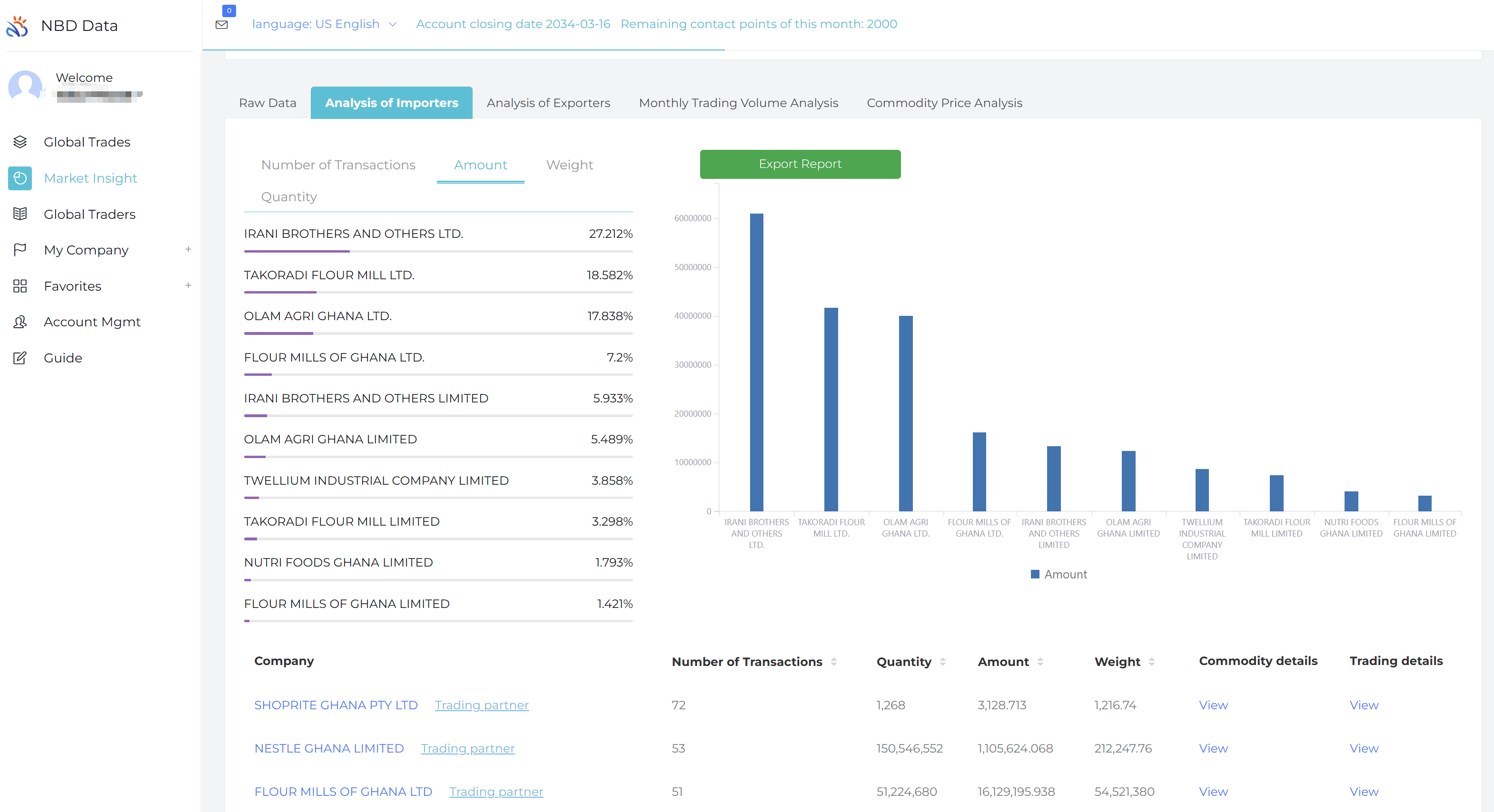

The major wheat importers in Ghana are key players in the wheat trade sector. According to data, the top ten wheat importers by value in Ghana are:

- IRANI BROTHERS AND OTHERS LTD. – 27.2%

- TAKORADI FLOUR MILL LTD. – 18.6%

- OLAM AGRI GHANA LTD. – 17.8%

- FLOUR MILLS OF GHANA LTD. – 7.2%

- IRANI BROTHERS AND OTHERS LIMITED – 5.9%

- OLAM AGRI GHANA LIMITED – 5.5%

- TWELLIUM INDUSTRIAL COMPANY LIMITED – 3.9%

- TAKORADI FLOUR MILL LIMITED – 3.3%

- NUTRI FOODS GHANA LIMITED – 1.8%

- FLOUR MILLS OF GHANA LIMITED – 1.4%

On the other hand, the leading wheat suppliers to Ghana are predominantly large international trading companies:

- IFACO S.A. – 20.96%

- AGRI COMPANY S.A. – 18.73%

- OLAM GLOBAL AGRI PTE LTD. – 16.45%

- AGRICO COMPANY S.A. – 8.48%

- OLAM GLOBAL AGRI PTE LTD. – 5.5%

These suppliers dominate the wheat export market to Ghana, with each accounting for significant portions of the wheat supply.

Conclusion

In summary, Ghana continues to be a major importer of wheat, with substantial expenditures on wheat imports every year. The figures provided above show that in 2023, Ghana spent over $214 million USD on wheat imports, and in 2024, the country is set to spend a similar amount. The key importers and suppliers in Ghana's wheat market are concentrated among a few major players, indicating a competitive and concentrated import and export landscape. For businesses and stakeholders looking to enter or expand within this market, NBD DATA provides comprehensive trade data and analysis, including detailed information on wheat imports, suppliers, and market trends, helping you make informed decisions.