Germany Dominates Chile’s Import of Control Units, Supplying Over Half the Market Value in Early 2025

Between January and June 2025, Chile’s import market for control units (HS Code 90328900

To illustrate, common imported examples include “vehicle control modules” and “electronic automation units”, highlighting the automotive and machinery focus of this market.

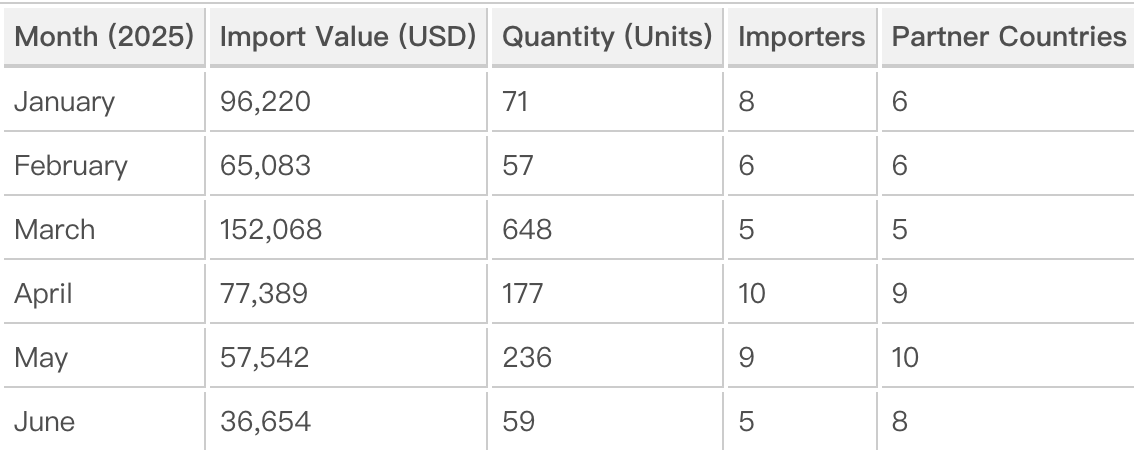

Monthly Import Dynamics: January–June 2025

From a month-by-month perspective, Chile’s import trend for HS 90328900 showed moderate fluctuations but retained a stable overall trajectory in value and volume. The total value remained concentrated between USD 36,000 and USD 152,000 per month, reflecting consistent industrial demand rather than sporadic bulk imports.

In March 2025, the import value peaked at USD 152,068, driven primarily by several large-scale shipments from Germany. This month alone accounted for nearly one-third of the total half-year import value. The subsequent months, from April through June, saw a moderate contraction, likely linked to seasonal adjustment in Chile’s automotive assembly and heavy-equipment maintenance sectors.

Despite these changes, the first half of 2025 indicates stable procurement activity, demonstrating that Chilean industries view control unit imports as an essential part of ongoing production rather than discretionary spending.

Leading Importers in Chile

Chile’s import market for control units is notably concentrated among a handful of automotive and industrial distributors. The top importers together represent over 90 % of total import value, underscoring a high degree of market centralization.

Key companies include:

-

COMERCIAL KAUFMANN S.A.

– The undisputed leader, responsible for USD 334,761, or nearly 69 % of total imports. This company, a major distributor of Mercedes-Benz vehicles and parts, maintains extensive import links with German suppliers. SKC SERVICIOS AUTOMOTRICES S.A. – Recorded USD 46,271 in import value, mainly for truck and agricultural machinery control systems.

SKC MAQUINARIAS S.A. – Imported USD 41,552, supplying automation components to the construction and equipment sectors.

VOLVO CO. VEH. CE SPA – Managed USD 13,432, focusing on specialized vehicle electronics.

PORSCHE CHILE SPA. – Imported USD 2,767, primarily for diagnostic and control systems used in luxury vehicles.

These leading buyers clearly reflect the dominance of the automotive electronics segment in Chile’s demand for control units. Most of the imports are tied to vehicle assembly, diagnostic systems, and after-sales maintenance, confirming the direct relationship between industrial modernization and electronic automation.

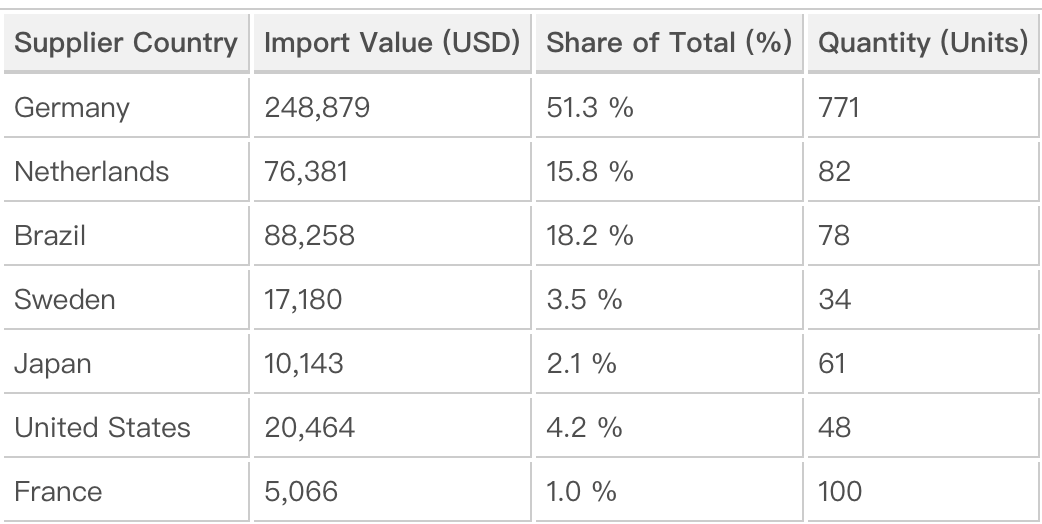

Supplier and Regional Concentration: Germany Leads the Way

In the first half of 2025, Germany emerged as the top supplier, providing USD 248,879, equivalent to 51 % of Chile’s total import value for HS 90328900. This clearly places Germany as the dominant trade partner for control units, followed by the Netherlands, Brazil, and Sweden.

German dominance is not coincidental. The country’s strong manufacturing ecosystem—anchored by automotive and industrial automation giants such as Bosch, Siemens, and Continental—gives it a structural advantage in exporting high-precision control units. These components are often embedded in complex systems for trucks, machinery, and high-end vehicles.

Meanwhile, the Netherlands and Brazil appear as secondary hubs. The Netherlands functions mainly as a re-export platform, while Brazil benefits from proximity and existing trade links in the Mercosur region.

Focus Country Analysis: Germany–Chile Trade Link

When focusing on Germany as the primary exporter, trade data reveals an advanced and diversified flow of control unit products to Chile. German exports include modules for vehicle diagnostics, hydraulic control, and automation logic systems.

Product examples sampled from recent customs records include:

-

Vehicle control module for truck transmission systems

-

Electronic unit for braking system management

-

Automation logic control board (industrial application)

These items align with Chile’s rising investment in transport and logistics infrastructure, where equipment reliability and precision are key. The bilateral trade channel is further strengthened by long-term partnerships between German manufacturers and Chilean distributors such as COMERCIAL KAUFMANN S.A., which represents German automotive brands locally.

In addition, Germany’s share of Chile’s import value (over 50 %) also reflects a trust-based supply pattern—German components maintain a reputation for high performance and durability, a critical factor in Chile’s harsh operating environments, including mining and construction.

Market Observations and Industrial Implications

-

Automotive sector remains dominant.

More than two-thirds of Chile’s control unit imports are linked to vehicle and heavy-equipment applications. This confirms that the country’s automotive aftermarket and industrial service sectors are the key drivers of demand. -

High technological dependency.

With nearly all suppliers located in Europe or Asia, Chile’s domestic capacity for electronic component manufacturing remains limited. This dependency highlights opportunities for technology transfer and local assembly partnerships. -

Stable importer structure.

The limited number of recurring importers, led by long-established firms like Kaufmann and SKC, ensures stable supply channels but also restricts new market entry for smaller distributors. -

Shift toward integrated systems.

Several import records indicate growing adoption of smart control systems integrating software diagnostics and telematics—an early sign of Chile’s move toward Industry 4.0 practices.

Regional Trade Viewpoint: Germany as a Consistent Export Hub

Beyond Chile, Germany exports control units across South America, including Argentina, Peru, and Brazil. The country’s consistent presence in the region ensures that Chile’s procurement from German suppliers is both cost-efficient and logistically streamlined.

In 2025 H1, German shipments to Chile averaged USD 4,978 per transaction, reflecting a mix of standard vehicle modules and high-end automation electronics. These are typically transported via maritime routes through Hamburg and Rotterdam, reaching Chilean ports such as San Antonio and Valparaíso.The resilience of German supply chains, even under global logistics pressures, enhances Chile’s confidence in sourcing from Europe rather than relying solely on regional partners.

Data Source

All statistics and company information cited in this article are derived from verified Chilean import customs records, processed and analyzed by NBD DATA.

For more detailed access to company-level transaction data, contact our service page at https://en.nbd.ltd/service.