Analyzing India’s Spring Imports in 2025: Trade Flows, Top Buyers, and Regional Insights

Springs, categorized under HS code 73209090, play a crucial role in India’s industrial manufacturing chain, covering sectors from automotive and heavy machinery to electronics and oilfield equipment. As 2025 progressed, India’s import data for SPRING reflected both the country’s expanding industrial demand and its reliance on globally specialized suppliers. According to trade intelligence from NBD DATA, India’s imports of mechanical springs continued to demonstrate strong growth in both value and shipment frequency.

Market Overview

In 2025, India imported a total of 91,744 spring shipments, valued at USD 71.86 million, involving 3,000 importers, 5,334 exporters, and 71 trading countries. The imported volume reached nearly 957 million units, with an aggregate weight of about 1.03 million kg. This high level of trade activity underscores India’s strong industrial consumption capacity and the continued integration of its manufacturing sector into the global component supply network.

Common imported product types included:

-

Valve and compression springs for automotive and machinery applications.

-

Retaining and locking springs used in control valves and industrial fittings.

-

Air springs and torsion springs for suspension and vibration control.

-

Precision coil and disc springs for electronic assemblies and energy equipment.

Sample imports recorded in NBD’s dataset include:

“VALVE SPRING V12K PART NO 7618835”, “AIR SPRING ASSY 24C7201”, and “SPARE PARTS FOR FILLING MACHINES COMPRESSION SPRING 2522235 0000”, reflecting diverse mechanical use cases.

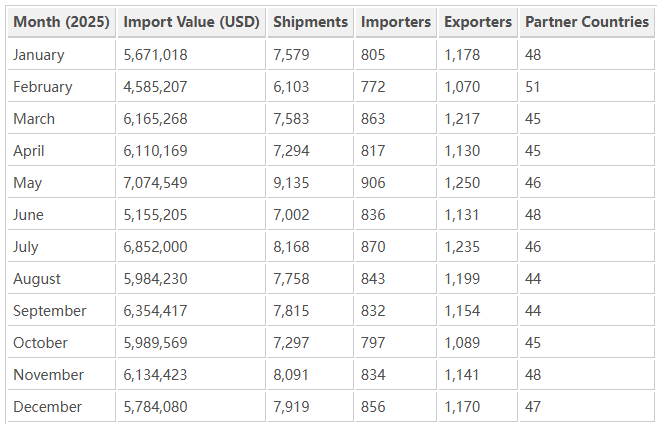

Monthly Import Performance

Throughout 2025, India’s spring import activity showed steady momentum, with a moderate seasonal peak during the second and third quarters — aligning with fiscal restocking and industrial production cycles.

The value trend indicates consistent import levels, with May to July representing the most active phase. This reflects India’s mid-year production surge in automotive and mechanical assembly sectors.

Market Observation: Key Importers and Suppliers

Top Indian Importers of Springs (HS 73209090)

SCHAEFFLER INDIA LIMITED – USD 5.57 million

FIBRO INDIA PRECISION PRODUCTS PRIVATE LIMITED – USD 1.84 million

HYOSUNG T & D INDIA PRIVATE LIMITED – USD 0.84 million

LESER INDIA PVT LTD – USD 0.65 million

TETRA PAK INDIA PRIVATE LIMITED – USD 0.32 million

These leading Indian companies reflect diverse end-use industries. Schaeffler India supplies precision components to automotive and industrial systems, while Fibro India and Hyosung T&D specialize in manufacturing automation and power equipment. The presence of Leser India and Tetra Pak India emphasizes the import of springs for valves, packaging machinery, and process equipment — critical for the food, beverage, and energy sectors.

Top Global Suppliers to India

STROMSHOLMEN AB (Sweden) – USD 1.83 million

DENSO CORPORATION (Japan) – USD 1.43 million

AISIN CORPORATION(Japan) – USD 0.47 million

LESER GMBH & CO KG (Germany) – USD 0.59 million

M S SPECIAL SPRINGS S R L (Italy) – USD 0.34 million

Global supply leadership remains with high-precision European and Japanese manufacturers, indicating that India’s import preference tilts toward technologically advanced products used in automotive systems, compressors, and industrial machinery.

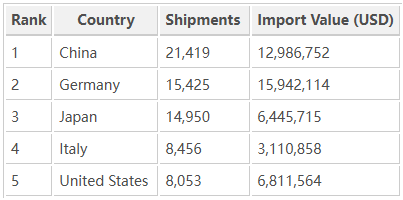

Regional Trade Distribution

India’s imports of springs during 2025 were sourced from 71 countries, reflecting a wide-reaching supply chain.

The top contributors by shipment and value were as follows:

China leads by shipment count, primarily serving India’s demand for mid-tier and low-cost automotive and industrial springs. Germany and Japan, however, account for higher per-unit value due to advanced manufacturing standards. The United States maintains relevance in oilfield and aerospace-grade spring exports. Italy and Sweden supply high-end industrial springs used in hydraulic and process systems.

This diversified structure ensures resilience in India’s import supply chain, minimizing dependency on any single source market.

Regional Focus: Trade with China

In India’s 2025 spring imports, China remained the most frequent trading partner. With over 21,000 shipments, Chinese manufacturers supplied a significant portion of standard mechanical and precision springs used in machinery, electronics, and vehicles. The price-performance ratio from Chinese suppliers continues to attract Indian SMEs, especially those in Tier 2 and Tier 3 manufacturing clusters such as Pune, Ahmedabad, and Coimbatore.

However, India’s sustained trade with Germany, Japan, and the U.S. indicates a dual sourcing strategy: importing cost-efficient items from Asia and high-specification parts from Europe and North America.

Industrial Interpretation

The 2025 data highlights India’s strong industrial rebound, reflected by the high import frequency of precision and heavy-duty springs. Several macro trends can be inferred:

-

Manufacturing Expansion – Consistent monthly imports reveal growing demand in India’s automotive and machinery production sectors.

-

Technological Upgrade – Imports from advanced economies suggest increasing adoption of high-performance mechanical components.

-

Supply Chain Diversification – India sources from 70+ countries, mitigating risk amid shifting global logistics.

-

Investment Correlation – Foreign Direct Investment (FDI) in manufacturing complements the steady inflow of critical mechanical components like springs.

Conclusion

India’s import performance under HS 73209090 illustrates a balanced combination of cost efficiency and technology-driven sourcing. The USD 71.86 million trade value for 2025 confirms the importance of springs in sustaining industrial productivity and assembly-line operations across sectors. With 5,334 exporters and 3,000 importers, the ecosystem reflects a competitive, globalized market environment.

Going forward, India is expected to retain a strong import flow of springs to support its expanding automotive, energy, and manufacturing sectors. At the same time, localized production will likely rise under the “Make in India” initiative, gradually reducing dependency on imports for standardized components while maintaining imports for advanced technologies.

Data Source

All quantitative data and trade intelligence in this report are based on 2025 import records from NBD DATA, processed through its verified trade database.

For deeper analytics or enterprise-level data services, please visit the NBD DATA Service Portal.