Inside Colombia’s PVC Panel Market: Import Trends, Major Players, and Trade Regions (Jan–Jun 2025)

During the first half of 2025, Colombia’s import market for PVC panels (HS 3925900000) demonstrated a dynamic recovery and diversification pattern, reflecting the growing domestic demand for decorative and construction materials. According to data from NBD DATA

PVC panels—such as decorative wall boards, ceiling panels, and cladding components—are widely applied in interior finishing for residential and commercial buildings. Sample imports recorded under this HS code include plastic decorative sheets and PVC wall ceiling boards, typically used for low-cost renovation projects in Colombia’s housing and retail sectors.

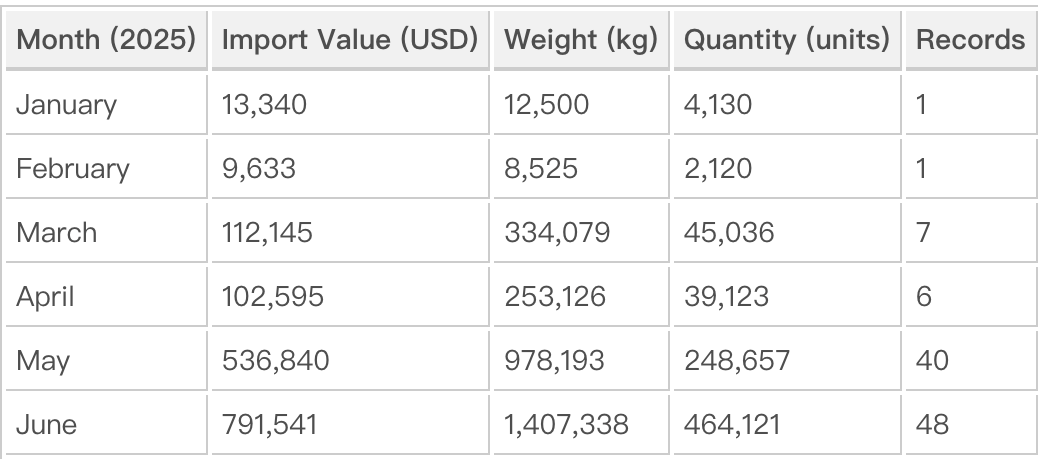

Monthly Import Trends

Colombia’s PVC panel imports in the first half of 2025 displayed a distinct upward trajectory, particularly in May and June.

Imports began modestly in the early months, averaging below USD 15 k per month in January–February, before accelerating rapidly from March onward. The surge in May and June, totaling nearly USD 1.33 million, suggests a rebound in building materials demand and pre-stocking for upcoming construction projects in Colombia’s urban centers such as Bogotá and Medellín.

Market Observation: Importers and Suppliers

The PVC panel trade between China and Colombia is characterized by long-standing partnerships between Chinese manufacturers and Colombian importers specializing in decorative products. Among 48 importers, a few stand out for their consistent trade records and high shipment volumes.

Leading Importers

TERRENOS PR SAS — the largest importer, accounting for USD 292,788 and 566,319 kg of imports. The company sourced primarily from Haining Wannaisi Decoration Material Co., Ltd. and several other Zhejiang-based suppliers.

HOMEGA Colombia S.A.S. — imported 295,144 kg, valued at USD 81,914, cooperating mainly with Zhejiang Jinfeng New Material Co., Ltd..

ANTIA LAB SAS — purchased 143,046 kg worth USD 32,904, mostly from Haining Chaodi Plastic Co., Ltd. and Ruoze Plastic Products Co., Ltd.

INVERSIONES Y ADQUISICIONES G&T SAS — focused on specialty decorative panels, totaling USD 56,371.

DISART ENTRETENIMIENTO CREATIVO SAS — imported USD 52,129 worth of PVC materials, indicating diversification toward event and retail decoration applications.

Major Suppliers

Chinese companies dominate Colombia’s PVC panel supply chain, accounting for over 96% of total imports. The following are the key exporters serving the Colombian market:

Haining Wannaisi Decoration Material Co., Ltd. — Colombia’s top supplier, exporting USD 237,268 (453,730 kg).

Haining Yayuanshi Plastic Ind Co., Ltd. — shipped 224,258 kg valued at USD 136,139, serving multiple buyers.

Haining Ruoze Plastic Products Co., Ltd. — exported USD 58,242, mainly to ANTIA LAB SAS and TERRENOS PR SAS.

Haining Zhuangheng Plastic Ind. Co., Ltd. — supplied USD 59,272 worth of panels.

Hangzhou Twyford Import & Export Co., Ltd. — exported USD 98,721 in high-quality PVC profiles to Colombian distributors.

The trade matrix indicates a dense network connecting Zhejiang’s manufacturing hubs with Colombian importers, often through repeat, small-to-medium batch shipments. This pattern suggests strong business relationships and stable product demand rather than speculative trading.

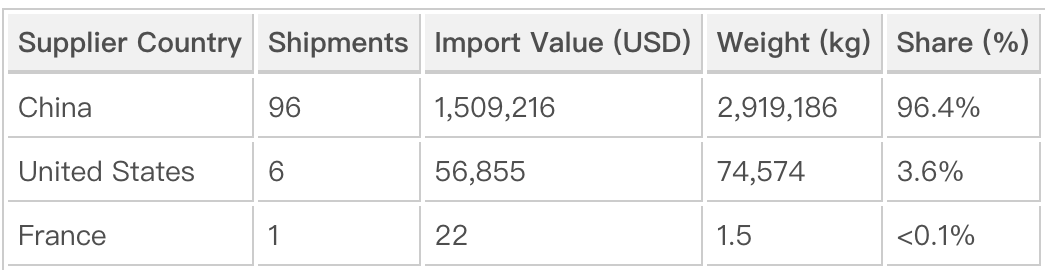

Trade Regions and Partner Countries

Regional Composition

Colombia’s PVC panel imports are overwhelmingly sourced from Asia, particularly China. The country breakdown for Jan–Jun 2025 is as follows:

China’s dominance reflects its mature PVC extrusion industry and cost advantages in decorative plastics. The U.S. share, though minor, often includes specialty products or re-exported materials. France’s minimal record likely represents a sample or test shipment.

Focus Country Spotlight — China

Given China’s near-total share in Colombia’s PVC panel imports, it remains the focal point for trade relations. Chinese suppliers such as Haining Wannaisi, Ruoze Plastic, and Yayuanshi Plastic collectively handled the majority of Colombia’s import volume. Their competitive edge lies in mass production efficiency, diversified product lines (including printed, laminated, and fire-resistant panels), and flexible shipping options through Ningbo and Shanghai ports.

On the demand side, Colombian importers exhibit a preference for ready-to-install decorative panels, emphasizing moisture resistance and affordability for retail expansion and residential remodeling projects.

Market Insights

-

Construction Sector Recovery: The Colombian housing and commercial renovation market rebounded during early 2025, driven by urban infrastructure projects and private housing refurbishments.

-

China–Colombia Supply Chain Stability: The consistency of top exporters and importers indicates stable bilateral trade channels and growing supplier trust.

-

Import Concentration: The top 5 importers accounted for roughly 65% of total import value, reflecting a semi-concentrated market where long-term partnerships determine pricing and logistics efficiency.

-

Sustainable Growth Outlook: PVC panels continue to gain traction as an affordable, low-maintenance alternative to wood and ceramic materials, particularly in cost-sensitive segments.

Summary

In summary, Colombia’s PVC panel import market in the first half of 2025 was shaped by strong Chinese dominance, steady expansion in trade volumes, and the continued alignment of importers with established Asian suppliers. The steady increase from March to June underscores the resumption of construction and renovation activities, positioning PVC panels as a leading product in Colombia’s building materials import structure. Looking ahead, diversification into eco-friendly PVC alternatives and localized distribution networks may become key themes for the remainder of the year.

Data Source

This report is based on verified customs and trade records provided by NBD DATA

The dataset includes aggregated trade statistics, monthly transaction details, and verified importer–exporter linkages. For access to full datasets, professional dashboards, and company-level trade profiles, please visit NBD DATA Service