Heavyweight Report! India’s August Import Data Unveiled, A Must-Read for Trade Enterprises

In the midst of an ever-changing global economic landscape, India's import-export trade dynamics have garnered significant attention. As a representative of emerging economies, India's monthly customs import data provides crucial market signals for global trade enterprises. The August 2024 Indian customs import data is particularly important, especially given the disruptions in global supply chains. India's procurement trends and market demand have become focal points of attention. This article provides a comprehensive analysis of India's import data for August 2024, revealing the products most favored by Indian buyers and the implications of these trends for import-export businesses. Whether you are a foreign trade company, a SOHO professional, or a market analysis expert, this article will provide forward-looking insights to help you better capture market opportunities.

Overview of India's August Import Data

According to India's customs import data for August 2024, the country recorded 5,019,114 import entries, representing a decrease of 393,117 entries compared to the previous month, a month-over-month (MoM) decline of 7.26%. However, when compared to the same period last year, with 4,383,435 entries, this marks an increase of 635,679 entries, a year-over-year (YoY) rise of 14.50%. Despite the monthly decline, this shows a significant improvement in overall import activity compared to last year, indicating steady growth in India's market demand.

In terms of monetary value, India’s total imports in August 2024 reached $68,040,457,047, reflecting a 14.87% decline from the previous month's total of $79,923,423,894, a reduction of $11,882,966,847. However, compared to August 2023’s $53,303,800,292, the total import value increased by 27.65%. This notable rise suggests a strong recovery in India’s market demand, particularly in the sectors of bulk commodities and manufacturing raw materials.

The number of import buyers in August 2024 was 59,269, a 2.33% decrease from last month, with a drop of 1,415 buyers. However, compared to the same period last year, the number of buyers increased by 2,374, marking a 4.17% YoY rise. This indicates that, despite short-term fluctuations, the overall demand for imported goods in the Indian market is steadily increasing.

On the supplier side, a total of 111,888 suppliers were involved in India’s import and export activities this month, a 3.13% decrease from the previous month, with a reduction of 3,609 suppliers. Nevertheless, YoY data shows an increase of 8,659 suppliers, an 8.39% growth. This trend suggests that while certain suppliers have temporarily reduced exports to India, the overall supply chain is still expanding, and India’s appeal to global suppliers remains strong.

This overview provides the macroeconomic background for the article. We will now delve into the specific products and market trends in India's imports this month.

Top 5 Imported Goods in India for August

According to India’s customs import data for August 2024, the top five imported goods covered a range of sectors including energy, precious metals, and electronics. Here’s a breakdown of the top categories:

HS Code 270900 - Crude Oil & Unprocessed Petroleum

This month’s import value reached $10.745 billion, representing a 44.10% decrease from last month’s $19.221 billion and a 12.98% year-over-year (YoY) decline. The fluctuation in international oil prices and adjustments in India’s domestic demand are the primary reasons for this drop.

HS Code 710812 - Non-Industrial Diamonds (Uncut or Simply Cut)

Imports amounted to $8.949 billion this month, a massive 181.01% increase from the previous month and a 253.27% YoY surge. The sharp rise in imports is largely driven by a booming demand in the jewelry industry.

HS Code 270119 - Coal (Unprocessed)

This month saw coal imports valued at $2.43 billion, a 35.57% decline from last month, but a 17.61% YoY increase. India’s reliance on coal as a primary energy source remains strong, despite short-term fluctuations in imports.

HS Code 854231 - Semiconductor Devices

The import value for semiconductors was $1.57 billion this month, reflecting a slight 2.18% month-over-month (MoM) decrease, but a 19.29% YoY growth. The continuous demand for semiconductors underscores their importance in India’s expanding electronics industry.

HS Code 851779 - Communication Equipment

Imports in this category reached $1.457 billion, a 4.92% MoM decrease, but an 18.87% YoY increase. The ongoing development of 5G networks has sustained high demand for communication equipment.

Key Buyers for India’s Major Imported Goods

Based on India’s customs import data for August 2024, below are the top product categories and their major buyers. The purchasing amount, as well as month-over-month (MoM) and year-over-year (YoY) changes for each buyer, highlight their importance in the Indian market.

HS Code 270900 - Crude Oil & Unprocessed Petroleum

- HINDUSTAN PETROLEUM CORPORATION LIMITED (hindustanpetroleum.com)

August Purchase Amount: $2.264 billion | MoM: $2.620 billion | MoM Decrease: -$356 million | YoY: $2.488 billion | YoY Decrease: -$223 million - INDIAN OIL CORPORATION LIMITED (iocl.com)

August Purchase Amount: $1.802 billion | MoM: $3.125 billion | MoM Decrease: -$1.323 billion | YoY: $3.015 billion | YoY Decrease: -$1.213 billion - BHARAT PETROLEUM CORPORATION LIMITED (bharatpetroleum.in)

August Purchase Amount: $1.775 billion | MoM: $2.520 billion | MoM Decrease: -$745 million | YoY: $2.073 billion | YoY Decrease: -$297 million

HS Code 710812 - Non-Industrial Diamonds (Uncut or Simply Cut)

- MMTC - PAMP INDIA PRIVATE LIMITED (mmtcpamp.com)

August Purchase Amount: $2.103 billion | MoM: $1.171 billion | MoM Increase: +$931 million | YoY: $716 million | YoY Increase: +$1.387 billion - HDFC BANK LIMITED (hdfcbank.com)

August Purchase Amount: $1.803 billion | MoM: $264 million | MoM Increase: +$1.539 billion | YoY: $248 million | YoY Increase: +$1.555 billion - ICICI BANK LTD. (icicibank.com)

August Purchase Amount: $1.229 billion | MoM: $365 million | MoM Increase: +$864 million | YoY: $158 million | YoY Increase: +$1.071 billion

HS Code 270119 - Coal (Unprocessed)

- TATA STEEL LIMITED (tatasteel.com)

August Purchase Amount: $344 million | MoM: $582 million | MoM Decrease: -$238 million | YoY: $150 million | YoY Increase: +$194 million - JSW STEEL LIMITED (jsw.in)

August Purchase Amount: $332 million | MoM: $206 million | MoM Increase: +$125 million | YoY: $281 million | YoY Increase: +$50 million - STEEL AUTHORITY OF INDIA LIMITED (sail.co.in)

August Purchase Amount: $306 million | MoM: $613 million | MoM Decrease: -$307 million | YoY: $373 million | YoY Decrease: -$67 million

HS Code 854231 - Semiconductor Devices

- FOXCONN HON HAI TECHNOLOGY INDIA MEGA DEVELOPMENT (foxconn.com)

August Purchase Amount: $336 million | MoM: $342 million | MoM Decrease: -$6 million | YoY: $413 million | YoY Decrease: -$77 million - DBG TECHNOLOGY INDIA PRIVATE LIMITED (dbgindia.in)

August Purchase Amount: $123 million | MoM: $128 million | MoM Decrease: -$5 million | YoY: $122 million | YoY Increase: +$1 million

HS Code 851779 - Communication Equipment

- FOXCONN HON HAI TECHNOLOGY INDIA MEGA DEVELOPMENT (foxconn.com)

August Purchase Amount: $542 million | MoM: $638 million | MoM Decrease: -$96 million | YoY: $667 million | YoY Decrease: -$125 million - PEGATRON TECHNOLOGY INDIA PRIVATE LIMITED (pegatroncorp.com)

August Purchase Amount: $102 million | MoM: $65 million | MoM Increase: +$37 million | YoY: $84 million | YoY Increase: +$19 million

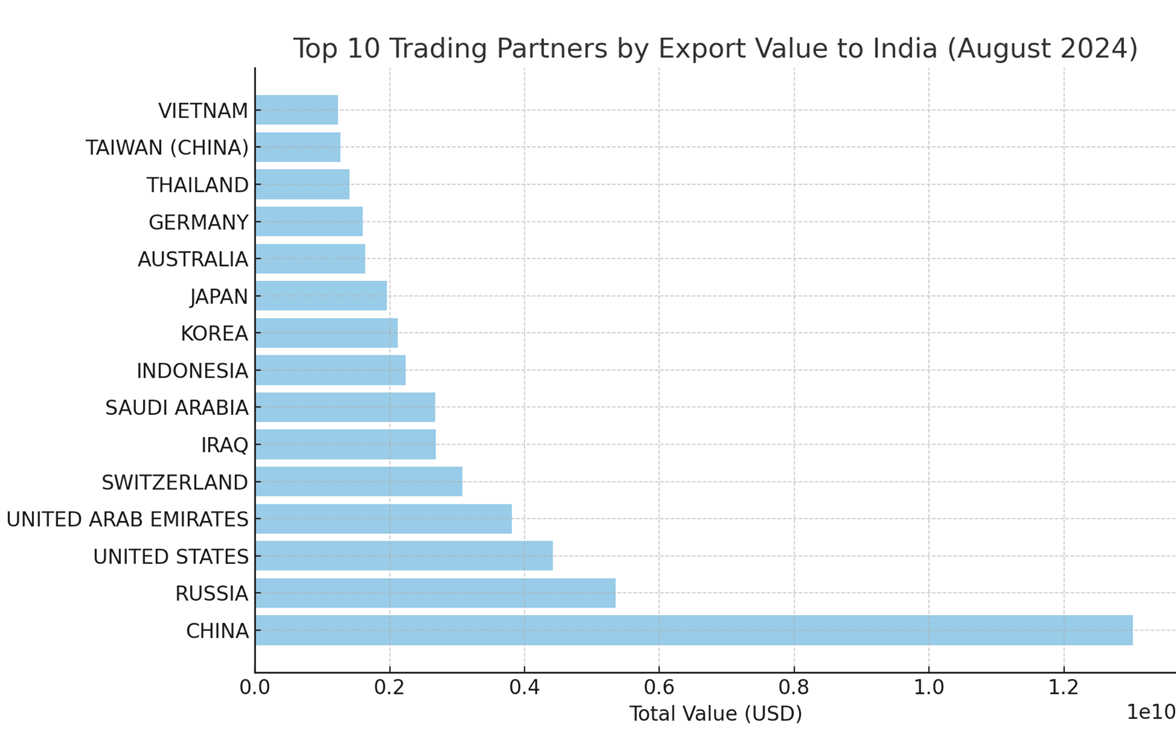

The chart illustrates the export value of India's top 10 trading partners for August 2024. China leads with an export value of over $13 billion, followed by Russia and the United States. The chart, based on total export value, clearly reflects the contribution of each major trading partner to India's imports.

Analysis:

China is India’s largest trading partner, with a total of 2,060,523 import entries and 50,097 exporters in August. Despite a month-over-month decrease in total entries (-91,337), the year-over-year increase is significant, with entries up by 386,894 and a total value increase of $2.652 billion. This indicates India’s growing dependence on Chinese goods, particularly in communication equipment and electronic components.

Russia is India’s primary supplier of energy products. Although it has fewer export entries compared to other partners, the total export value reached $5.349 billion. However, the export value saw a sharp month-over-month decline (-$5.148 billion), likely due to energy price fluctuations.

The United States ranks as India’s third-largest trading partner, with a total export value of $4.42 billion. The year-over-year value grew by $881 million, primarily driven by increased demand for technology products and medical equipment.

The United Arab Emirates (UAE), which primarily exports oil and gold, saw a total export value of $3.808 billion. The year-over-year increase of $1.014 billion reflects sustained demand in the energy and jewelry sectors.

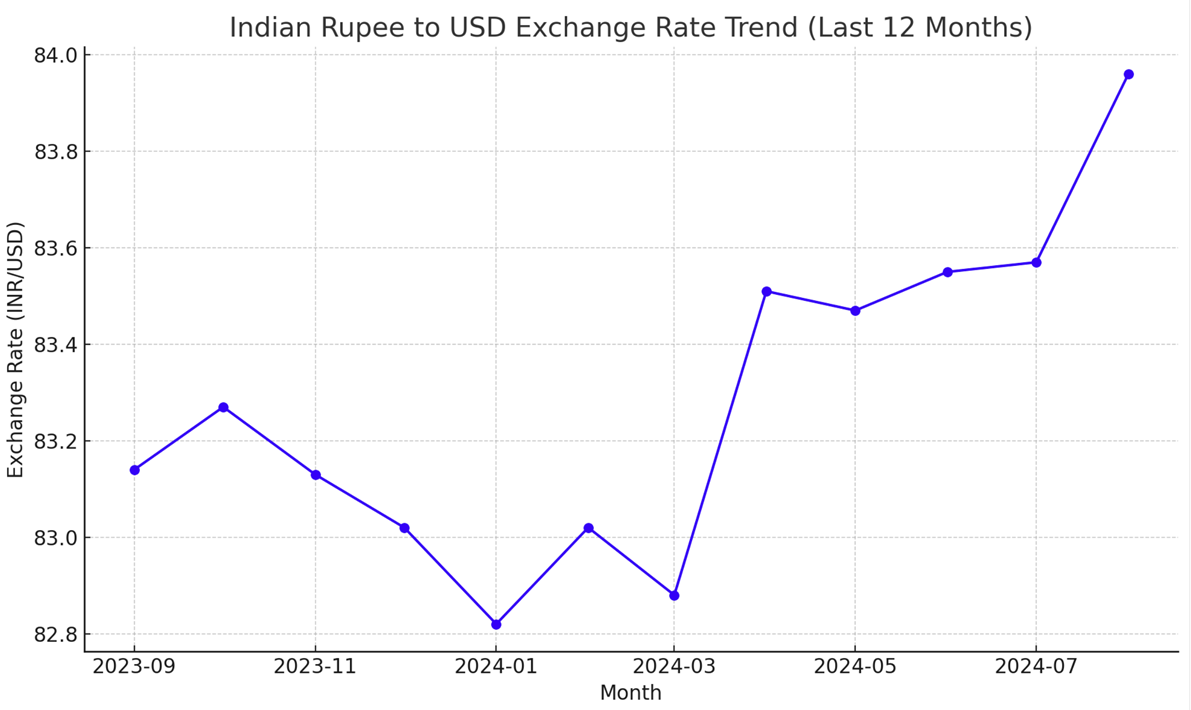

The chart illustrates the exchange rate trend of the Indian Rupee (INR) against the US Dollar (USD) over the past 12 months. The data shows that there was some fluctuation in early 2024, and particularly after April 2024, the Indian Rupee began to depreciate, with the exchange rate rising to 83.96.

Analysis:

From September 2023 to March 2024, the INR/USD exchange rate remained relatively stable with minor fluctuations. This stability is likely tied to a relatively calm global market and steady domestic economic conditions in India.

After April 2024, the exchange rate saw a sharp increase, indicating a depreciation of the Indian Rupee. The exchange rate climbed from 83.02 to 83.96. This change is likely influenced by global market volatility, inflation, and international capital flows.

Future Outlook:

The depreciation of the Indian Rupee against the US Dollar is likely to continue, especially given increasing global economic uncertainty. If India is unable to control inflation or attract more foreign investment, the exchange rate may rise even further, signaling continued pressure on the Rupee.

Through a comprehensive analysis of India’s August 2024 customs import data, it is clear that India's demand for imports continues to grow across several key sectors, particularly in energy, communication equipment, and electronic components. China, as India’s largest trading partner, maintains a strong presence in the import market, while other major partners such as the United States, Russia, and the UAE also play crucial roles in India’s import landscape.

From the exchange rate trend, the continued depreciation of the Indian Rupee against the US Dollar is likely to further impact import costs, especially in the context of rising international oil prices and global supply chain disruptions. Over the coming months, India’s import dynamics may be influenced by exchange rate fluctuations, changes in the global economy, and adjustments in domestic demand.

For foreign trade companies, understanding and navigating the trends in India’s import market is essential. By closely monitoring India’s import data, particularly for major commodities and key trade partners, businesses can better strategize, optimize their supply chains, and seize market opportunities. NBD Data will continue to provide you with the latest and most comprehensive customs data to support every step of your global trade decision-making process.

Disclaimer: The data and analysis in this report are derived from NBD Data's statistical results and may contain some errors. Users should verify these data independently. NBD Data is not responsible for any consequences arising from the use of this report's information.

For more detailed data, please visit NBD Data's official website: en.nbd.ltd