Revealing the Turkey Import Market: Commodity Trends, Buyer List & Exchange Rate Analysis

As global trade continues to grow, Turkey's import market is showing strong demand and abundant opportunities. For foreign trade companies, logistics enterprises, and market analysis professionals, Turkey's customs import data is undoubtedly a valuable resource. This data not only reveals the trends in major imported commodities in Turkey but also showcases the intricate relationships between global suppliers and buyers. In this article, we will provide an in-depth analysis of Turkey's August 2024 import data, helping trade professionals stay ahead of market trends and make informed business decisions.

Overview of Turkey's Import Data This Month

According to Turkey's customs import data for August 2024, the total number of import records this month reached 1,067,904, an increase of 32.1% compared to July's 808,340 records. However, compared to the same period last year, the overall data decreased by 588,285 records, showing a year-on-year decline of 35.5%. This reflects some fluctuations in Turkey's import market, which may be affected by the global economic situation and supply chain changes.

In terms of import value, Turkey's total import value this month was $16.12 billion, which represents a 23.45% increase compared to last month's $13.06 billion. Although there was a decrease compared to last year's $30.56 billion, with a year-on-year decline of 47.26%, the data still demonstrates the resilience and potential recovery of Turkey's import market.

From the perspective of buyers, the number of importers in Turkey in August was 28,956, an increase of 4,482 from last month, showing an 18.31% month-on-month growth. However, compared to the same period last year, which had 37,581 importers, there was a year-on-year decrease of 22.95%. This change could be related to market restructuring and changes in buyer demand. On the other hand, the number of suppliers this month was 55,275, up 22.85% from last month's 44,994 suppliers. Despite this increase, compared to the same period last year, there was a decrease of 18,326 suppliers, showing a 24.89% year-on-year decline. These data illustrate the complexity of Turkey's import market amid adjustments in the global supply chain.

Main Imported Commodities in Turkey This Month

This month, Turkey's imports cover several major categories, with the top-ranking commodities as follows:

Mineral Fuels & Oils (HS Code: 271019): The total import value this month was $897 million, representing a 5.1% increase from last month's $846 million. However, compared to the same period last year ($1.29 billion), the year-on-year decrease was 30.41%. This trend indicates that although Turkey's demand for mineral fuels remains stable, it is impacted by fluctuations in international energy prices.

Aircraft & Spacecraft Parts (HS Code: 880240): The import value for this category this month was $699 million, showing a significant 110.58% increase compared to last month's $332 million. However, compared to the same period last year ($890 million), it represented a 21.39% decrease. The volatility in aircraft imports is mainly related to specific project procurement and the development plans of Turkey's aviation industry.

Precious Metals (HS Code: 710812): The import value for precious metals was $624 million this month, with a month-on-month growth of 7.41%, but a sharp year-on-year decrease of 78.08% compared to $2.84 billion in the same period last year. The significant reduction in precious metals imports may be related to international gold price fluctuations and changing domestic demand in Turkey.

Alloy Steel Scrap (HS Code: 720449): The import value this month was $429 million, which was a 32.54% increase from last month's $324 million. However, compared to the same period last year ($760 million), it represented a decrease of 43.61%. This suggests that Turkey's demand for metal recycling and smelting has adjusted.

Passenger Cars & Other Vehicles (HS Code: 870322): The import value for passenger cars was $350 million this month, showing a 7.56% month-on-month increase but a 51.73% year-on-year decline. The reduction in automobile imports may be due to the increase in domestic automobile production and changes in consumer demand.

These data not only reveal the current dynamics of Turkey's import market but also reflect changes in the country's economic structure and consumption trends.

Top Buyers of Key Commodities in Turkey

Below is a list of key buyers for major imported commodities in Turkey this month, providing potential partners for businesses interested in the Turkish market:

Mineral Fuels & Oils (HS Code: 271019)

OPET PETROLCÜLÜK ANONİM ŞİRKETİ (opet.com.tr) — Purchase value this month: $159 million, MoM value: $94 million, MoM increase: $65.05 million, YoY value: $168.58 million, YoY decrease: $9.46 million.

PETROL OFISI ANONIM SIRKETI (petrolofisi.com.tr) — Purchase value this month: $137 million, MoM value: $137 million, MoM decrease: $0.67 million, YoY value: $194 million, YoY decrease: $57.90 million.

GÜZEL ENERJİ AKARYAKIT ANONİM ŞİRKETİ (guzelenerji.com.tr) — Purchase value this month: $112 million, MoM value: $61 million, MoM increase: $51.52 million, YoY value: $79 million, YoY increase: $32.69 million.

Passenger Cars & Other Vehicles (HS Code: 870322)

DOĞUŞ OTOMOTİV SERVİS VE TİCARET ANONİM ŞİRKETİ (dogusotomotiv.com.tr) — Purchase value this month: $95.49 million, MoM value: $38.34 million, MoM increase: $57.15 million, YoY value: $226.32 million, YoY decrease: $130.83 million.

YÜCE AUTO MOTORLU ARAÇLAR TİCARET ANONİM ŞİRKETİ (skoda.com.tr) — Purchase value this month: $66.20 million, MoM value: $53.34 million, MoM increase: $12.85 million, YoY value: $34.03 million, YoY increase: $32.16 million.

STELLANTIS OTOMOTİV PAZARLAMA ANONİM ŞİRKETİ (stellantis.com) — Purchase value this month: $55.62 million, MoM value: $73.17 million, MoM decrease: $17.54 million, YoY value: $189 million, YoY decrease: $133.39 million.

Polypropylene (HS Code: 390210)

POLIBAKPLASTIK FILM SANAYI VE TICARET ANONIM SIRKETI (polibak.com.tr) — Purchase value this month: $9.64 million, MoM value: $6.91 million, MoM increase: $2.73 million, YoY value: $10.15 million, YoY decrease: $0.51 million.

GÜLSAN SENTETİK DOKUMA SANAYİ VE TİCARET ANONİM ŞİRKETİ (gulsanholding.com) — Purchase value this month: $7.88 million, MoM value: $9.22 million, MoM decrease: $1.34 million, YoY value: $12.52 million, YoY decrease: $4.64 million.

SÜPER FİLM AMBALAJ SANAYİ VE TİCARET ANONİM ŞİRKETİ (superfilm.com) — Purchase value this month: $7.15 million, MoM value: $5.62 million, MoM increase: $1.53 million, YoY value: $4.51 million, YoY increase: $2.64 million.

These buyers are key players in Turkey's major imported commodities, playing indispensable roles in the global supply chain. If you are interested in entering the Turkish market, these companies are potential partners worth investigating.

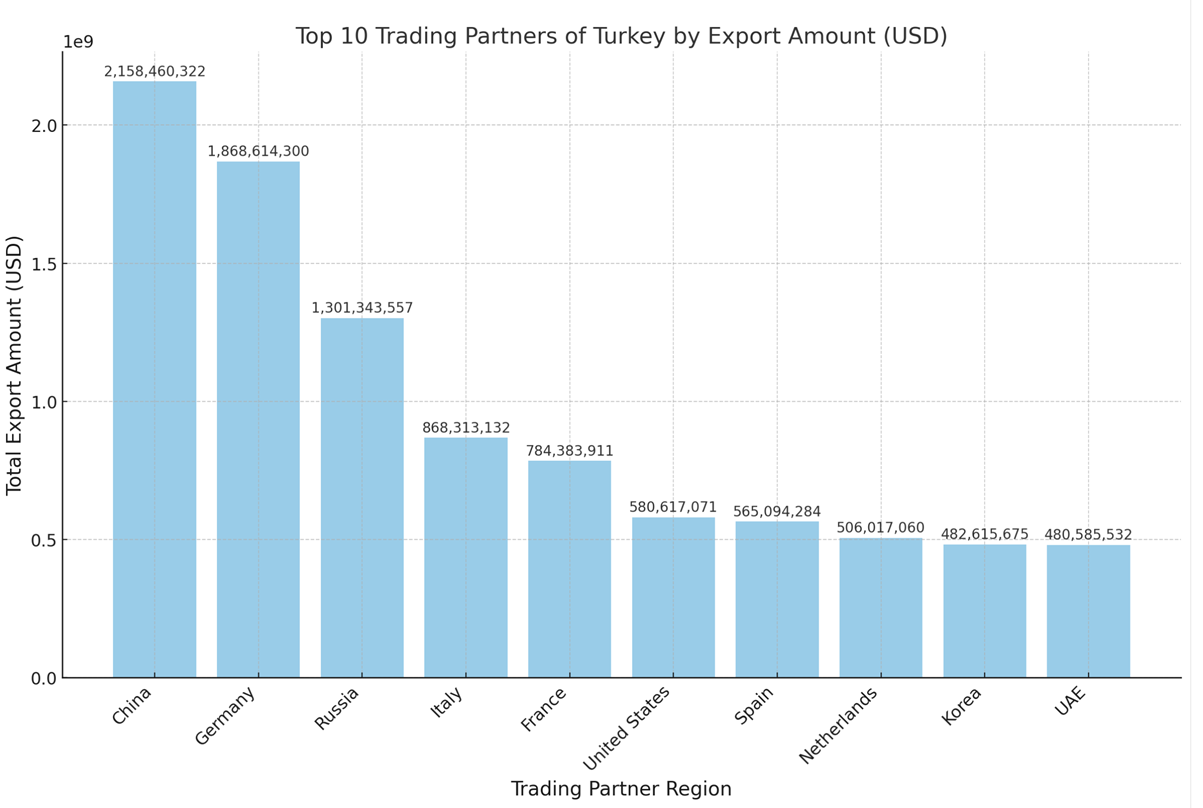

Major Trading Partners of Turkey

The table below shows an analysis of Turkey's top 10 trading partners in terms of export data, including the number of records, total value, and number of exporters, providing a clearer understanding of these trading partners' performance in the Turkish market.

From the analysis of Turkey's major trading partners, it can be seen that China, Germany, and Russia remain Turkey's most important trading partners, especially China, which leads in both the number of records and total value. Month-on-month, China, Germany, and Spain saw significant growth in export value, particularly China, with an increase of $550 million. This shows that the trade ties between these regions and Turkey continue to strengthen.

However, compared to the same period last year, the export value of most major trading partners declined, possibly due to global economic uncertainties, logistics issues, and trade restrictions. For example, trade between Russia and Turkey saw a year-on-year decrease of 2,735 records, with a reduction in total value exceeding $2 billion, indicating a notable decline in trade.

Overall, although trade between some countries and Turkey has slowed, the penetration and growth of China and Germany in the Turkish market are evident, especially in key industries such as electronics, automobiles, and mineral fuels.

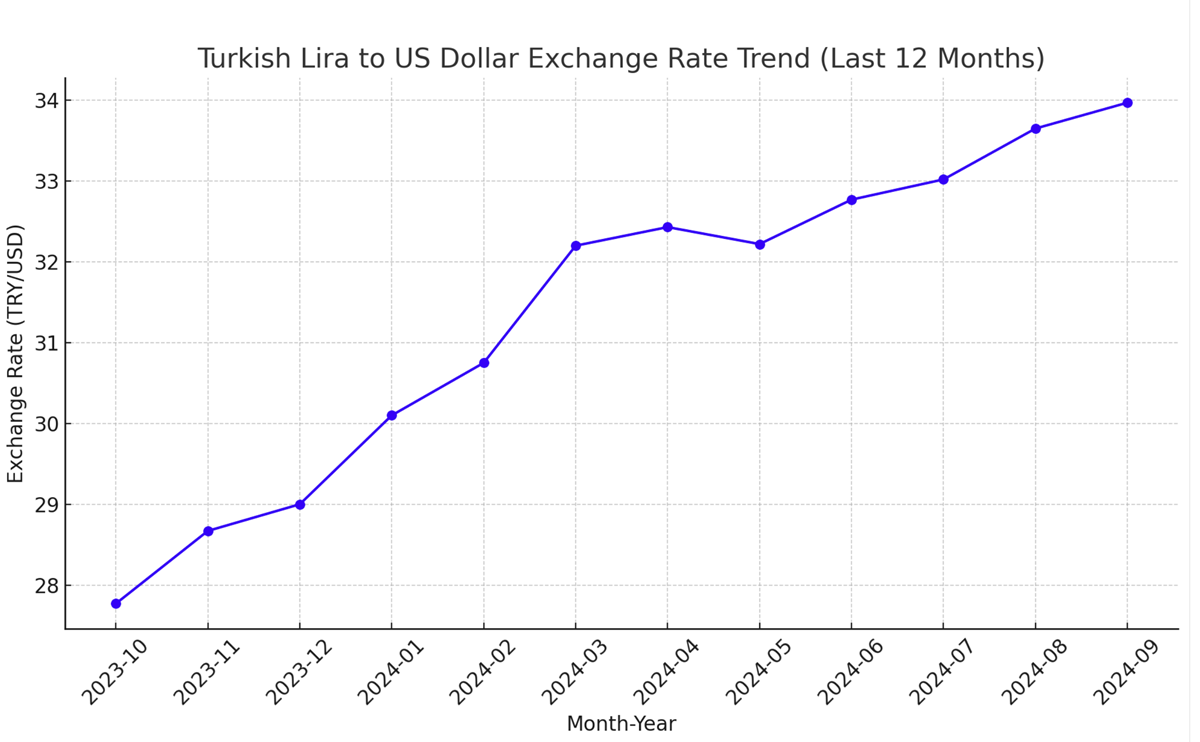

Exchange Rate Trends in Turkey

Over the past 12 months, the exchange rate of the Turkish Lira (TRY) against the US Dollar has shown a significant depreciation trend. The chart below illustrates the trend from October 2023 to September 2024.

From the chart, it can be seen that the exchange rate of the Turkish Lira against the US Dollar has increased from 27.77 in October 2023 to 33.97 in September 2024

Disclaimer: The data and analysis in this report are derived from NBD Data's statistical results and may contain some errors. Users should verify these data independently. NBD Data is not responsible for any consequences arising from the use of this report's information.