Revealing! Côte d'Ivoire Import Data Latest Release: Top Five Products Unveiled!

Recently, we conducted a comprehensive analysis of Côte d'Ivoire's customs import data for August 2024, offering insights into the latest trends in the import market. This analysis covers the total number of imported goods, total value, and the number of buyers and suppliers. Through this data, we can gain an overview of the overall dynamics of the Côte d'Ivoire import market and the performance of various product categories. Whether you are an international trade company, a logistics provider, or a market analysis professional, this report will provide valuable insights.

Overview of Côte d'Ivoire Import Data for August 2024

In August 2024, the Côte d'Ivoire customs import data recorded a total of 66,368 entries, a decrease of 1,599 entries from the previous month, marking a month-on-month decline of 2.35%. Compared to the same period last year, there was a decrease of 1,521 entries, representing a year-on-year decrease of 2.24%. The total import value for this month reached $2.83 billion, a decrease of $476 million from the previous month, down by 14.4% month-on-month; compared to the same period last year, it decreased by $716 million, down by 20.2%.

The number of buyers this month was 2,519, a decrease of 59 compared to the previous month, down by 2.29% month-on-month; compared to the same period last year, the number of buyers decreased by 98, a year-on-year decline of 3.75%. Meanwhile, the total number of suppliers this month was 9,357, a decrease of 143 compared to the previous month's 9,500, marking a month-on-month decline of 1.51%. It is worth noting that due to the unavailability of data from the same period last year, the year-on-year change could not be calculated.

Overall, the import market in Côte d'Ivoire showed signs of contraction this month, with decreases in the total number of imports, total value, and the number of buyers and suppliers. This trend may be influenced by various factors such as the global economic environment and changes in market demand. Next, we will delve into the import categories in August 2024 and the specifics of imports from China.

Côte d'Ivoire's Top Five Imported Goods for August

In August 2024, the top five imported goods in Côte d'Ivoire were mainly concentrated in petroleum products and mechanical parts:

HS Code 271012 - Light Oils & Preparations: The total import value this month reached $790 million, showing a 23.3% increase compared to the same period last year. This indicates a steady demand for light oil products amid the growing global energy demand.

HS Code 271019 - Lubricating Oils & Related Products: The total import value was approximately $733 million, down by 3.8% year-on-year. These products are primarily used in industrial and automotive sectors. The decline in both month-on-month and year-on-year comparisons could be linked to recent market price fluctuations and demand changes.

HS Code 270900 - Crude Oil & Crude Oil Products: The total import value this month was $103 million, marking a month-on-month decrease of 66.4% and a year-on-year decrease of 69.6%. The significant drop in crude oil imports may be due to fluctuations in global crude oil market supply and demand, as well as price adjustments.

HS Code 848180 - Mechanical Equipment Parts (Faucets, Valves, etc.): The total import value this month was about $46.4 million, with a month-on-month surge of 1209.8% and a year-on-year growth of 970.8%. The sharp increase in demand for mechanical equipment parts could be related to the advancement of Côte d'Ivoire's domestic industry and infrastructure construction.

HS Code 271113 - Liquefied Natural Gas (LNG): The total import value this month was approximately $38.5 million, showing a 9.4% increase year-on-year. As a clean energy source, LNG has seen steady demand growth in the global market in recent years.

Recommended Côte d'Ivoire Buyers for Major Products

This month, the import market in Côte d'Ivoire featured several noteworthy buyers across different product categories:

HS Code 271012 - Light Oils & Preparations

GESTOCI-STE DE GESTION:

- Purchase Amount: $387,183,917

- Month-on-month Growth: $32,347,603

- Year-on-year Growth: $34,591,315

- Website: gestoci.ci

- A key player in the energy sector, showing steady demand for light oil products with increases in both month-on-month and year-on-year figures.

PETROCI HOLDING:

- Purchase Amount: $229,497,086

- Month-on-month Growth: $32,191,898

- Year-on-year Growth: $229,497,086 (no purchase in the same period last year)

- Website: petroci.ci

- A state-owned oil company in Côte d'Ivoire, showing significant growth in the light oil market.

SIR (SOCIETE IVOIRIENNE RAFFINAGE):

- Purchase Amount: $67,343,193

- Month-on-month Decrease: $-69,030,573

- Year-on-year Growth: $67,343,193 (no purchase in the same period last year)

- Website: sir.ci

- A major refinery company with a significant increase year-on-year, indicating a possible influence of market dynamics on their procurement strategy.

HS Code 271019 - Lubricating Oils & Related Products

GESTOCI-STE DE GESTION:

- Purchase Amount: $408,503,477

- Month-on-month Growth: $46,205,884

- Year-on-year Growth: $12,029,567

- Website: gestoci.ci

- Shows steady demand for these products with positive growth in both month-on-month and year-on-year comparisons.

PETROCI HOLDING:

- Purchase Amount: $131,191,833

- Month-on-month Decrease: $-49,233,378

- Year-on-year Growth: $131,191,833 (no purchase in the same period last year)

- Website: petroci.ci

- The company shows a slight decline month-on-month but an overall increase year-on-year, indicating a strategic adjustment in their procurement.

VIVO ENERGY CI:

- Purchase Amount: $74,976,552

- Month-on-month Growth: $3,992,770

- Year-on-year Growth: $9,765,017

- Website: vivoenergy.com

- Exhibits a steady growth trend in the lubricating oil market, with positive figures in both month-on-month and year-on-year comparisons.

HS Code 270900 - Crude Oil & Crude Oil Products

- SIR (SOCIETE IVOIRIENNE RAFFINAGE):

- Purchase Amount: $102,804,740

- Month-on-month Decrease: $-202,741,860

- Year-on-year Decrease: $-235,152,030

- Website: sir.ci

- Displays a significant decrease in crude oil purchases, likely influenced by fluctuations in global crude oil prices or changes in domestic demand.

- SIR (SOCIETE IVOIRIENNE RAFFINAGE):

HS Code 848180 - Mechanical Equipment Parts (Faucets, Valves, etc.)

BAKER HUGHES EHO LTD.:

- Purchase Amount: $43,692,404

- Month-on-month and Year-on-year Growth: $43,692,404 (no purchase in the previous month or same period last year)

- Website: bakerhughes.com

- Showed outstanding performance in mechanical equipment parts, indicating potential business expansion in the Côte d'Ivoire market.

FADCO COMPANY:

- Purchase Amount: $394,211

- Month-on-month Growth: $5,744

- Year-on-year Growth: $394,211 (no purchase in the same period last year)

- Website: fadcoksa.com

- Shows stable demand for mechanical equipment parts with positive month-on-month and year-on-year growth.

OLAM COCOA PROCESSING CI:

- Purchase Amount: $319,394

- Month-on-month Growth: $311,412

- Year-on-year Growth: $284,779

- Website: fmo.nl

- Exhibits significant growth in the demand for mechanical equipment parts.

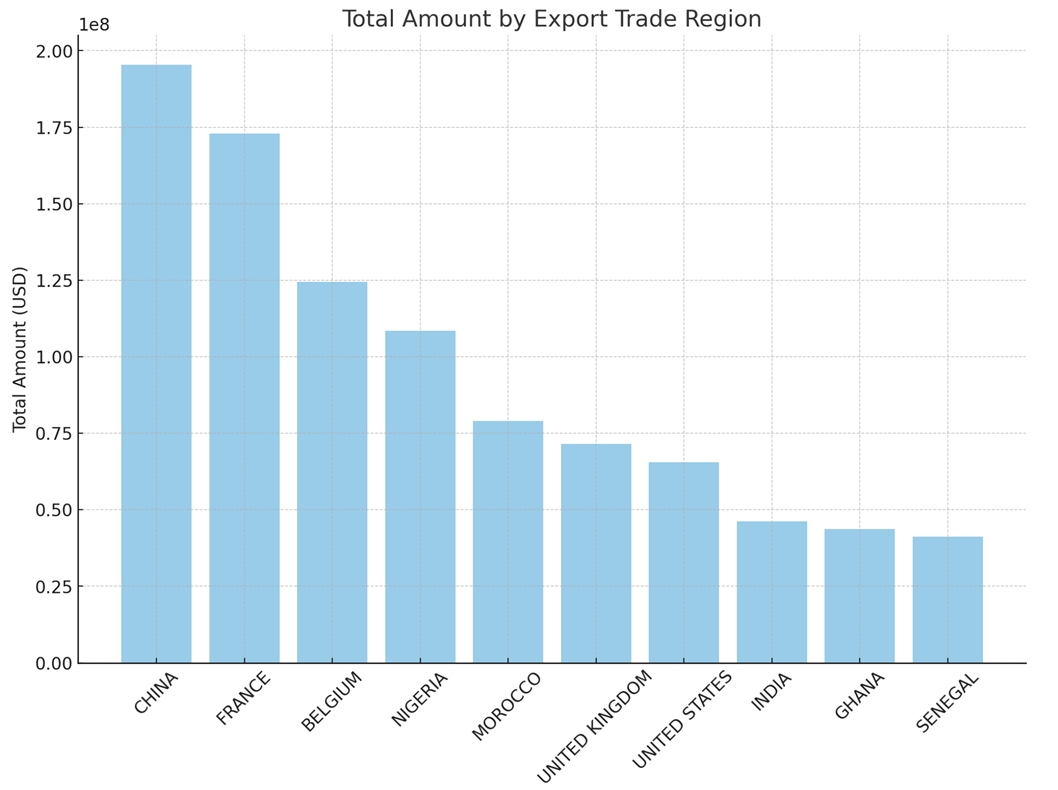

Côte d'Ivoire's Major Trade Partners

In August 2024, China and France continued to dominate as Côte d'Ivoire's top trade partners:

China: Maintains its position as the largest trade partner with a total export value of $195 million, though there was a month-on-month decrease of $9.89 million (5.4%) and a year-on-year decrease of $26.76 million (12%). Despite this decline, China remains a key partner, offering a diverse range of export goods.

France: The total export value amounted to $173 million, with a month-on-month increase of $19.16 million (12.5%) and a year-on-year increase of $3.09 million (1.8%). France continues to show steady growth in trade with Côte d'Ivoire, highlighting the strength of their trade relationship.

Belgium: Exported goods worth $124 million, with a significant month-on-month decrease of $71.09 million (36.4%) but a year-on-year increase of $33.43 million (37%). The month-on-month decline may be due to market demand fluctuations, while the year-on-year growth indicates enhanced trade relations.

Nigeria: The export value was $108 million, showing a sharp month-on-month decrease of $133 million (55.2%) and a year-on-year decrease of $240 million (68.8%). This significant drop may be attributed to macroeconomic conditions and changes in trade policies.

Morocco: Exported goods valued at $79 million, with a month-on-month decrease of $12.09 million (13.3%) and a year-on-year decrease of $57.58 million (42%). Morocco's market share in Côte d'Ivoire has declined, possibly due to intensified competition or price fluctuations.

United Kingdom: Exported $71.58 million worth of goods, with a substantial month-on-month increase of $58.27 million (437.7%) and a year-on-year increase of $51.51 million (257%). The surge in export value may be driven by increased demand in specific sectors or products.

United States: The export value was $65.57 million, with a month-on-month increase of $29.51 million (81.8%) and a year-on-year increase of $44.51 million (211%). The U.S. shows remarkable export growth, indicating a competitive edge in certain market areas.

India: Exported goods valued at $46.26 million, with a month-on-month increase of $7.75 million (20.1%) but a year-on-year decrease of $31.52 million (40.5%). The mixed performance may reflect changes in commodity prices or market demand.

Ghana: The export value was $43.75 million, showing a slight month-on-month decrease of 2.04% and a marginal year-on-year decline. Ghana's trade with Côte d'Ivoire remains relatively stable with minimal fluctuations.

Senegal: Exported goods valued at $41.25 million, with a month-on-month decrease of 6.8% but a significant year-on-year increase of 91.5%. This indicates a growth trend in trade with Côte d'Ivoire.

Overall, the data reveals that China and France remain the most important trade partners for Côte d'Ivoire, with varying changes in export values. Countries like Nigeria and Morocco have experienced notable declines in exports, likely due to a range of influencing factors. In contrast, the United Kingdom and the United States have shown strong growth momentum, indicating a competitive position in the Côte d'Ivoire market.

Conclusion

The Côte d'Ivoire import market in August 2024 exhibits a diversified development trend. The primary imported goods are concentrated in petroleum, mechanical parts, and agriculture-related products. As for major trade partners, China and France continue to lead, while countries like the United Kingdom and the United States show strong growth. All these data points highlight the dynamic changes in Côte d'Ivoire's foreign trade data, customs data, and import-export data. By analyzing this data, we gain deeper insights into the development trends of Côte d'Ivoire's import market, providing valuable support for international trade companies and market analysts.

Disclaimer: The data and analysis in this report are derived from NBD Data's statistical results and may contain some errors. Users should verify these data independently. NBD Data is not responsible for any consequences arising from the use of this report's information.

For more detailed data, please visit NBD Data's official website: en.nbd.ltd