Inside Ghana’s Import Growth: February 2025 Trade Highlights and Strategic Insights

n February 2025, Ghana's import sector showcased remarkable growth, signaling new trade opportunities and shifting dynamics among key products and partners. According to trusted trade analytics from NBD DATA, Ghana recorded $1.58 billion USD in total imports, reflecting an 8.29% increase from January’s $1.46 billion. This surge is backed by high activity across multiple industries, with 249,073 import records filed in February alone.

Product Categories with Explosive Growth

Among the standout performers in February were several HS codes that saw unprecedented month-over-month increases. Notably:

HS 470321: Chemical wood pulp, soda or sulphate, unbleached — commonly used in tissue and sanitary product manufacturing. This product dominated the growth chart, with companies such as:

SOFTCARE FM MANUFACTURING LIMITED CO. importing $952,318

DELTA PAPER MILL LTD. importing $215,757

AYAPON A B WINSUN LTD. importing $91,757

These firms sourced mainly from the United States and Brazil, highlighting Ghana’s increasing demand for raw pulp materials in its hygiene product sector.

HS 283429: Other nitrates, including lead nitrate, an industrial chemical used in mining and metallurgy. Import value surged by over 532,000%, primarily by:

KIAKA SA, importing $417,770 from South Africa.

These explosive figures illustrate a clear trend: Ghana is rapidly expanding its industrial and manufacturing capacity, with high-value imports to support domestic production.

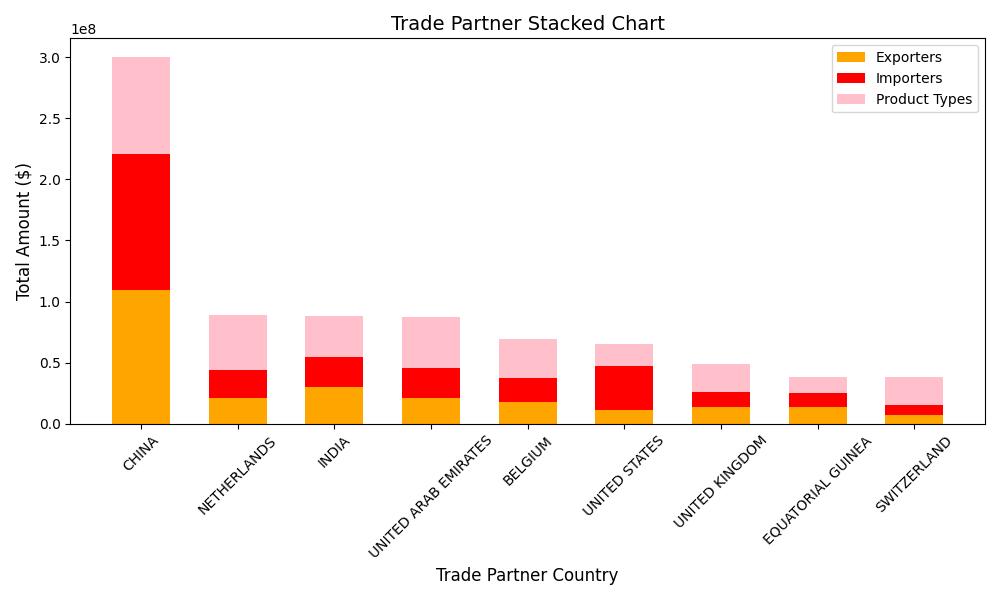

Ghana's Top Import Partners – February 2025

As of February, China remained Ghana’s largest import partner, contributing $300.6 million USD in goods. Other top countries include:

-

Netherlands: $88.6 million

-

India: $88.5 million

-

United Arab Emirates: $87.3 million

These nations not only supplied a wide variety of goods but also maintained high engagement, with thousands of importers and exporters involved. Notably, China accounted for 3,758 exporters and 3,846 importers, dealing in over 2,700 distinct product categories.

This diversified import structure emphasizes Ghana’s multi-polar sourcing strategy and resilience against single-market dependency.

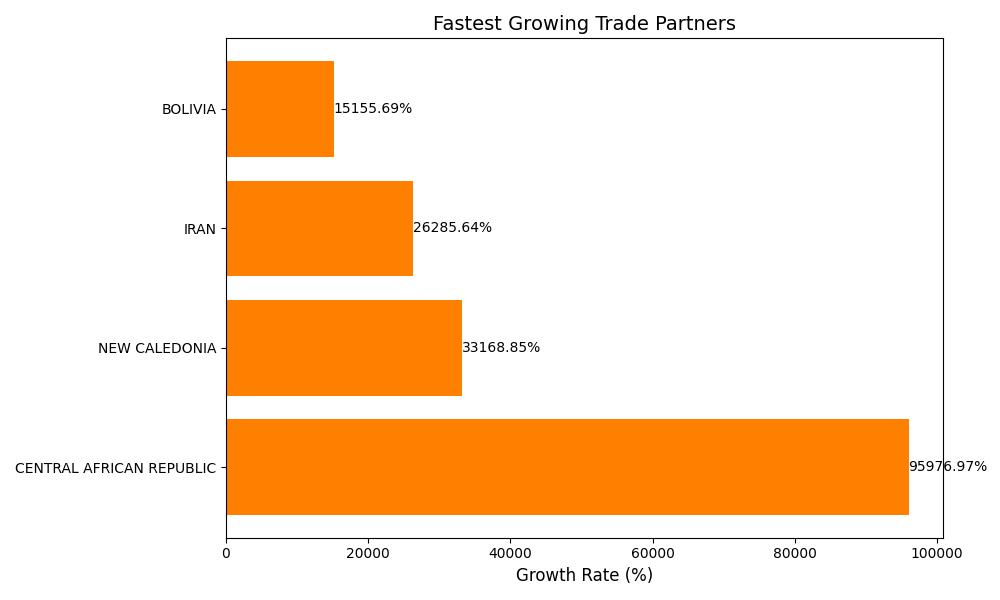

Rapidly Growing Trade Relationships

Beyond traditional partners, Ghana is forming fast-growing trade ties with several emerging markets. In February 2025, the five fastest-growing trade partner countries in terms of import value were:

-

Bangladesh

-

Turkey

-

Indonesia

-

Vietnam

-

Malaysia

These countries are increasingly supplying Ghana with consumer electronics, textiles, and light machinery, marking a new trend in the country's import diversification strategy.

Fastest Growing Product Categories by HS Code

Ghana also witnessed rapid growth across several strategic product categories, particularly:

HS 852872: Reception apparatus for television, color

HS 300490: Medicaments not in measured doses

HS 870899: Parts and accessories of motor vehicles

HS 392690: Other articles of plastics

HS 841869: Refrigerating or freezing equipment

These imports signal a rising demand for consumer goods, medical items, and vehicle components, pointing to a maturing consumer market and an expanding middle class.

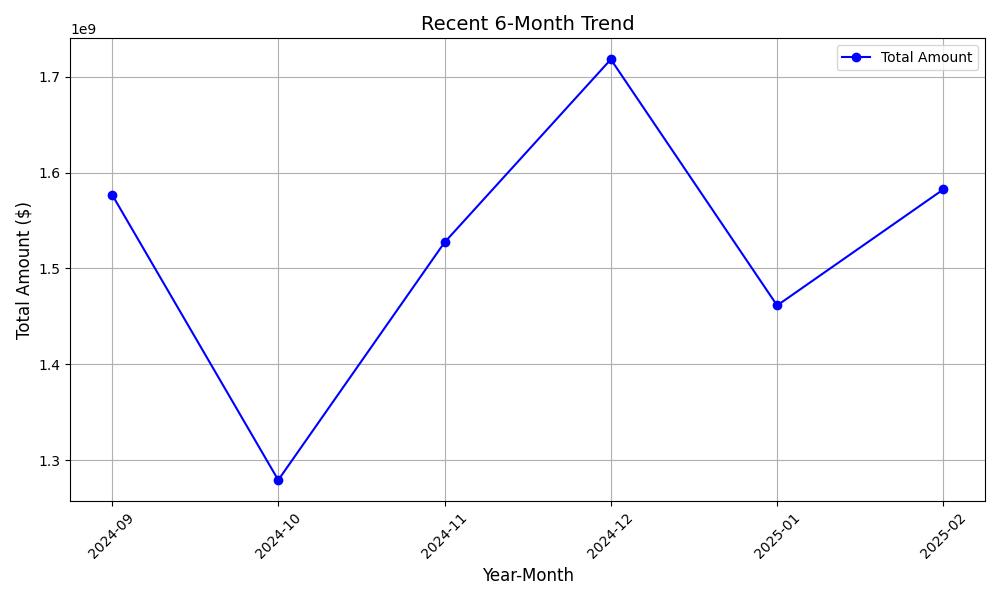

Monthly Import Trend: What Lies Ahead?

Looking at the last six months, Ghana's import performance reveals a healthy but volatile trajectory:

-

September 2024: $1.58 billion

-

October 2024: $1.27 billion

-

November 2024: $1.53 billion

-

December 2024: $1.72 billion (peak)

-

January 2025: $1.46 billion

-

February 2025: $1.58 billion

Despite fluctuations, the overall trend points to a strong recovery from October's dip, with February regaining momentum. The pattern suggests a stable upward trajectory as Ghana navigates inflationary pressures and global supply chain adjustments.

With importers becoming more sophisticated in sourcing and category selection, and trade volumes diversified across continents, Ghana's foreign trade is entering a more resilient phase.

Conclusion: What This Means for Traders and Analysts

As Ghana's trade dynamics continue to evolve, February 2025 serves as a bellwether month. The surge in high-value imports, expanding partnerships, and rising demand across core categories underscores the need for businesses to monitor market movements closely.

Platforms like NBD DATA provide real-time access to customs-level trade intelligence, empowering exporters, manufacturers, and policy makers with actionable insights across over 40+ countries.

If you're targeting growth in West Africa, now is the time to understand what Ghana is importing, who the top players are, and where the momentum is building.