February 2025 Bangladesh Import Data Insight: Trade Partners, Product Trends, and Key Players

According to the latest data released by NBD DATA, Bangladesh imported a total of $6,694,771,616 worth of goods in February 2025, across 338,552 customs declarations. While there was a slight month-over-month decline of 2.40%, the overall volume reflects a strong and active trade position for the country. This continued demand reinforces Bangladesh’s growing role in global supply chains and manufacturing networks.

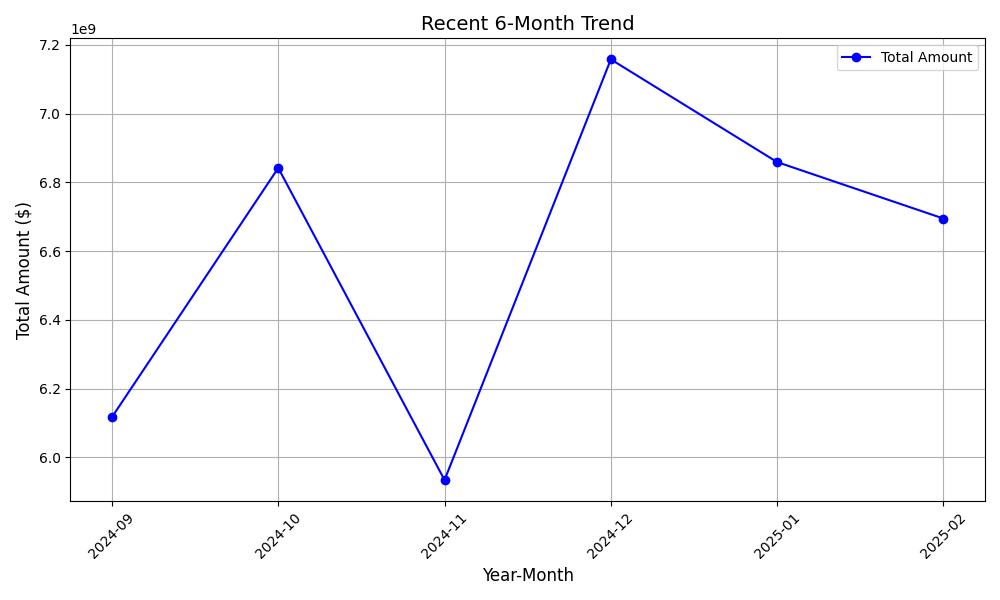

Monthly Import Trend: High-Level Stability with Structural Adjustments

Looking at the past six months, Bangladesh’s import trajectory shows both resilience and strategic adjustment. After peaking in December 2024 at $7.16 billion, imports slightly declined in January 2025 to $6.86 billion, and continued a mild drop to $6.69 billion in February. This trend is consistent with seasonal and structural recalibration, as Bangladesh transitions from volume-driven to value-driven import growth, particularly in high-tech materials and manufacturing inputs.

Product Highlights: PTFE and Apparel Components Lead Growth

Among the top-performing product categories this month, two stood out due to extraordinary growth rates.

HS Code 390461 — PTFE (Polytetrafluoroethylene) powder saw an explosive month-over-month increase of 5275320.00%, with a total import value of $263,771. PTFE is widely used in high-performance applications such as electronics insulation, chemical-resistant coatings, and semiconductor manufacturing. This surge indicates that Bangladesh is intensifying its investment in precision manufacturing and industrial infrastructure. Key importers include:

Another high-growth product is HS Code 620140 — jackets made of synthetic fibers, primarily imported as semi-finished goods for local processing. Imports reached $361,847, up 3289418.18% from the previous month. The key trader, KIDO BD CO. LIMITED, reflects how Bangladesh’s apparel sector continues to be a global outsourcing hub for fashion and garments.

Product keywords worth noting:

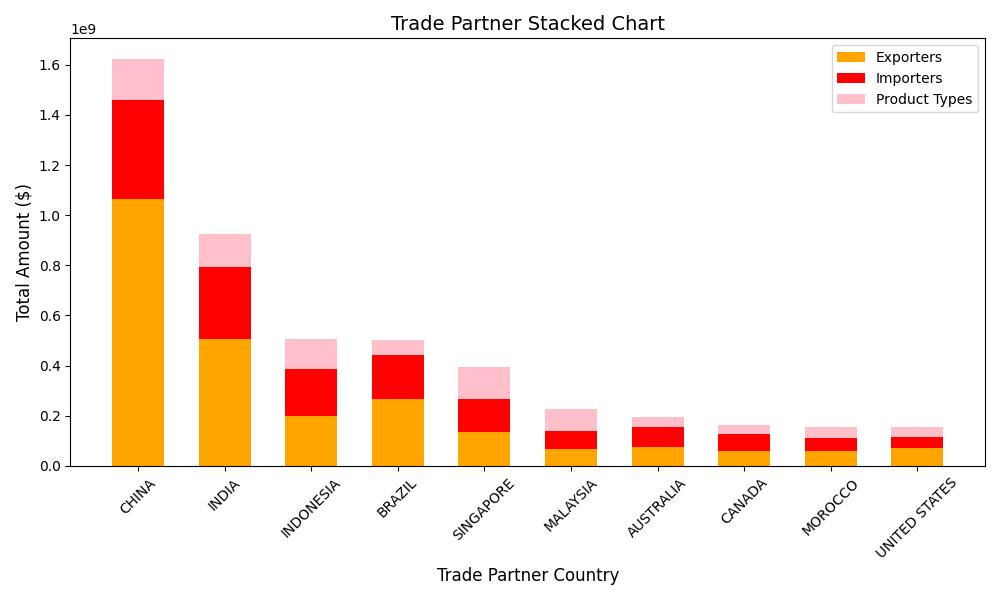

Top 10 Trade Partners: Dominance of Asia with Strategic Western Links

Bangladesh’s imports are primarily sourced from a stable network of regional and global partners. February’s top 10 countries by import volume include:

China tops the list with $1.62 billion in goods, accounting for over 24% of total imports. With 21,831 exporters, 8,078 importers, and over 3,413 product categories, China remains Bangladesh’s primary supplier for machinery, electronics, chemicals, and textiles.

India follows with $924.87 million, 9,462 exporters, and 2,446 product types, reflecting a diverse portfolio including pharmaceuticals, fertilizers, and automotive components.

Indonesia comes third with $508.05 million, and more concentrated trading activity across 606 exporters and 561 importers, mainly in palm oil, rubber, and industrial inputs.

Brazil stands out for bulk commodities like soybean, meat, and pulp, contributing $503.22 million despite just 296 exporters.

Singapore supplied $393 million, largely consisting of re-exported electronics and telecom equipment. The trade was distributed across 396 exporters and 380 product categories, showcasing its role as a logistics hub.

Rounding out the list are Malaysia, Australia, Canada, Morocco, and the United States. Notably, the U.S. provided 841 product types, more than any country after China, indicating the diversity of American exports, particularly in high-tech and medical sectors.

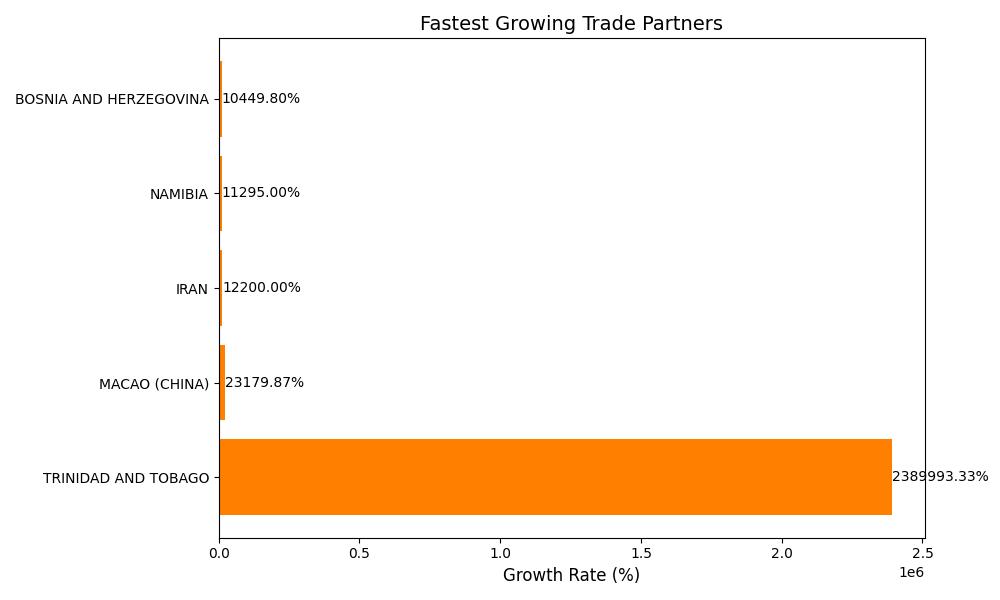

Fastest Growing Trade Partners: Emerging Opportunities

Smaller economies made surprising entries into Bangladesh’s import ecosystem:

-

Trinidad and Tobago registered an astounding 2389993.33% growth, likely due to first-time bulk orders in chemicals or fuels.

-

Macao (China), Iran, Namibia, and Bosnia and Herzegovina also saw growth rates exceeding 10,000%, signaling new supply routes or product categories entering the market.

These shifts point to Bangladesh’s evolving trade diversification strategy, exploring new sources to enhance supply chain resilience.

HS Code Growth Insight: Key Products Powering Industrial Transformation

Beyond PTFE and garments, several other product categories showed significant growth:

HS Code 848180 — Industrial valves, used in oil, gas, and infrastructure projects, saw increased demand, supporting heavy industrial growth.

HS Code 721934 — Cold-rolled stainless steel plates, vital for machinery and building construction.

HS Code 850440 — Power converters and voltage regulators, indicating rising investment in energy systems and electronics manufacturing.

These trends underline Bangladesh’s gradual shift from labor-intensive processing to capital- and technology-intensive production.

Strategic Outlook from NBD DATA

As analyzed by NBD DATA, the February 2025 import snapshot provides more than just trade figures — it outlines Bangladesh’s accelerating path toward industrial diversification, digital infrastructure, and global manufacturing integration. From engineering plastics to advanced apparel processing, opportunities abound for exporters who can align with Bangladesh’s evolving demand.