Uruguay Customs Import Data Update - July 2024

I. Overall Data Overview

In July 2024, Uruguay's import activities demonstrated significant growth, reflecting the country's robust demand in the global supply chain. Despite a 13.78% month-on-month decrease in the total number of import records and a 10.55% year-on-year decrease, the total import value surged. The total import value for this month reached USD 1.89 billion, representing a 21.73% increase from the previous month and an 11.81% increase compared to the same period last year. This growth indicates strong demand for high-value goods in Uruguay.

The number of active buyers also increased this month, reaching 5,467, a rise of 8.09% month-on-month and 6.67% year-on-year. This data suggests a more dynamic market with increased participation from various enterprises.

II. Top 5 Imported Product Categories

Uruguay's top five imported product categories in July 2024 showed diverse demand across different sectors:

HS Code 470329 - Other Pulp: The total import value for this category was USD 180.78 million, marking a 50.58% month-on-month increase and a 60.21% year-on-year increase. This significant growth underscores the strong demand for raw materials in Uruguay's industrial sector.

HS Code 271600 - Electrical Energy Products: This category maintained a stable import value of USD 112 million, with no month-on-month change but a substantial 47.37% year-on-year increase. This stability reflects Uruguay's ongoing investments in energy supplies.

HS Code 270900 - Crude Oil and Petroleum Products: The total import value for this category was USD 87.06 million. Despite having no import data for the previous month, this category saw a 12.67% year-on-year increase, indicating continued demand for petroleum in Uruguay.

HS Code 300490 - Pharmaceutical Products: This category saw an import value of USD 52.11 million, with a 35.99% month-on-month increase but a 4.72% year-on-year decrease. This fluctuation reflects the dynamic nature of the pharmaceutical market.

HS Code 330210 - Fragrances and Flavors: The import value for this category was USD 42.22 million, with a 4.47% month-on-month decrease but a 3.52% year-on-year increase, suggesting a stable demand for fragrance products.

III. Top 5 Products Imported from the United States

The following are the top five product categories imported from the United States to Uruguay:

HS Code 330300 - Perfume and Cosmetics: The total import value for this category was USD 5.21 million, reflecting a 5.10% month-on-month decrease and a 13.88% year-on-year decrease. Despite these declines, cosmetics remain a key import from the U.S.

HS Code 852872 - Television Receivers: This category experienced a significant month-on-month increase of 120.23% and a 156.87% year-on-year increase, with a total import value of USD 3.75 million. The strong demand for electronics is evident in these figures.

HS Code 841510 - Air Conditioning Machines: The import value for this category was USD 1.40 million, showing a remarkable 707.08% month-on-month increase and a 519.70% year-on-year increase. The surge in demand for air conditioning units is particularly noteworthy.

HS Code 220830 - Whisky: This category saw a total import value of USD 1.21 million, reflecting a 22.43% month-on-month decrease and a 25.90% year-on-year decrease. The decline may suggest changes in consumer preferences or market conditions.

HS Code 220421 - Wine: The total import value for wine was USD 1.01 million, with a 140.91% month-on-month decrease and a 29.42% year-on-year decrease, indicating a significant drop in wine imports.

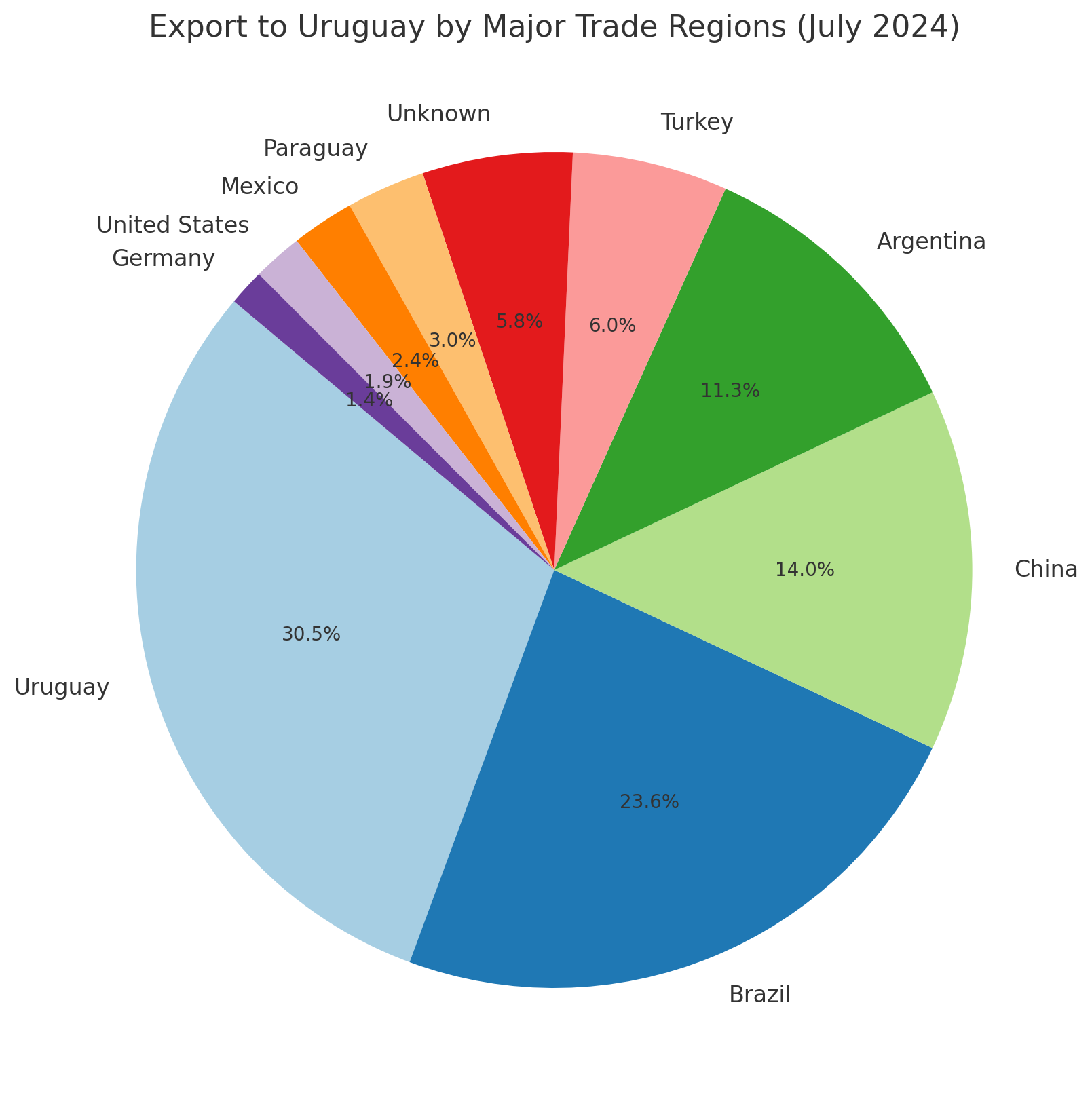

IV. Top 10 Trade Regions Exporting to Uruguay

Uruguay's import sources were diverse, with the top 10 regions contributing significantly to the overall import value:

Uruguay (Domestic Imports): Totaling USD 483.12 million, this category saw a 23.49% month-on-month increase and a 10.80% year-on-year increase, indicating a strong internal trade flow.

Brazil: Imports from Brazil reached USD 374.25 million, with a 17.56% month-on-month increase and a 26.17% year-on-year increase, reflecting robust trade ties.

China: Imports from China amounted to USD 221.76 million, with a 36.48% month-on-month increase and a 50.38% year-on-year increase, highlighting China's growing importance as a trade partner.

Argentina: Argentina's exports to Uruguay totaled USD 178.82 million, showing a 16.25% month-on-month increase but a 19.63% year-on-year decrease, suggesting possible shifts in trade dynamics.

Turkey: Imports from Turkey surged to USD 95.29 million, a staggering 1027.28% month-on-month increase and a 590.25% year-on-year increase, indicating a dramatic rise in trade activity.

Unknown: Imports from unknown regions totaled USD 92.03 million, with a 13.46% month-on-month increase and a 19.86% year-on-year increase, reflecting growing trade from less defined regions.

Paraguay: Imports from Paraguay reached USD 48.17 million, with a 37.44% month-on-month increase but a 17.96% year-on-year decrease, showing mixed trends.

Mexico: Imports from Mexico totaled USD 38.49 million, a 17.24% month-on-month decrease but a 4.03% year-on-year increase, indicating moderate trade activity.

United States: Imports from the U.S. amounted to USD 30.41 million, with a 21.76% month-on-month increase and a 19.96% year-on-year increase, maintaining the U.S.'s strong trade presence.

Germany: Imports from Germany totaled USD 22.22 million, with a 3.70% month-on-month decrease and a 13.69% year-on-year decrease, reflecting a decline in trade with Germany.

Conclusion

Uruguay's import activity in July 2024 showed strong growth, particularly in high-value product categories such as energy products, pharmaceuticals, and automotive components. The data suggests that Uruguay's demand for essential goods and advanced technologies remains strong. NBD Data will continue to monitor global market trends to provide the most accurate and up-to-date customs data analysis to help businesses capitalize on emerging opportunities.

Disclaimer: The data and analysis in this report are derived from NBD Data's statistical results and may contain some errors. Users should verify these data independently. NBD Data is not responsible for any consequences arising from the use of this report's information.

For more detailed information, please visit NBD Data's official website.