Exploring India’s Capacitor Import Market: Trends, Suppliers, and Key Buyers in 2025

In 2025, India’s import activity for CAPACITOR (HS Code 85322990) demonstrated both volume growth and diversification in its supply chain. According to data compiled by NBD DATA, the country imported capacitors worth approximately $390.54 million, involving 687,735 shipments from 67 supplier countries. The market was primarily driven by demand from major electronics manufacturers and assembly plants that rely on multilayer ceramic and film capacitors for smartphones, PCs, and communication modules.

Examples of capacitor models imported include MLCC 22uF 16V 0603 and AEC-Q200 100V MLCC 0402, commonly used in power management circuits and PCB assemblies.

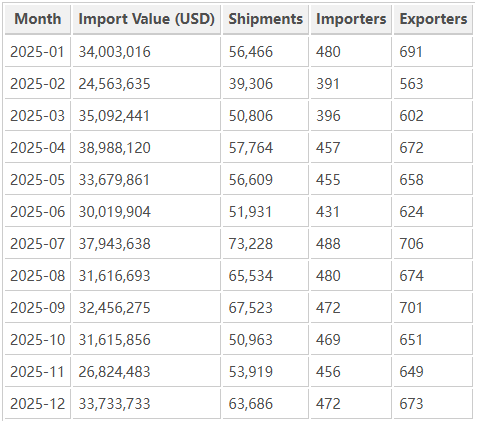

Monthly Import Overview

India’s capacitor imports exhibited a stable trajectory across 2025. The strongest months by import value were July (US$37.94 million) and December (US$33.73 million), while lower but steady levels were observed in February and March. The monthly trend suggests consistent sourcing by OEM assemblers to support year-round manufacturing cycles.

Overall, imports remained balanced, signaling India’s robust downstream demand for components across electronics manufacturing.

Key Importers and Buyers in India

Among the top Indian buyers, the mobile electronics and automotive sectors were dominant. The following companies accounted for the majority of capacitor imports:

PADGET ELECTRONICS PRIVATE LIMITED– The largest importer with over 27.6 billion units, primarily sourcing capacitors from Motorola Mobility, Tecno Mobile, and Xiaomi.

ELEMENT14 INDIA PRIVATE LIMITED – A major distributor importing from global component suppliers like Farnell and Newark.

BYD INDIA PRIVATE LIMITED – Focused on imports supporting its electronics and EV assembly operations.

UNITED TELELINKS NEOLYNCS PRIVATE LIMITED – Supplier for Motorola’s local PCB manufacturing.

JABIL CIRCUIT INDIA PRIVATE LIMITED – Part of the global Jabil group, importing for consumer and industrial electronics assembly.

These importers show India’s shift from raw material imports toward integrated assembly operations that depend on international suppliers for passive components.

Leading Foreign Suppliers

India’s top capacitor suppliers in 2025 reveal a mix of multinational manufacturers and specialized distributors:

MOTOROLA MOBILITY LLC– The leading foreign supplier, exporting over 20 billion units worth US$37.3 million.

FARNELL ELEMENT 14– Distributed electronic components totaling US$1.34 million in capacitor shipments.

XIAOMI H.K. LIMITED – Exported 4.7 billion capacitors valued at US$8.5 million, mainly supporting India’s smartphone production.

TECNO MOBILE LIMITED. – Supplied over 2.9 billion units to its Indian subsidiaries.

MURATA ELECTRONICS SINGAPORE (PTE) LTD. – A globally renowned capacitor manufacturer, delivering US$5.2 million in high-grade multilayer capacitors.

This supplier network demonstrates India’s deep integration into global supply chains dominated by Japanese, Singaporean, and Chinese-origin producers.

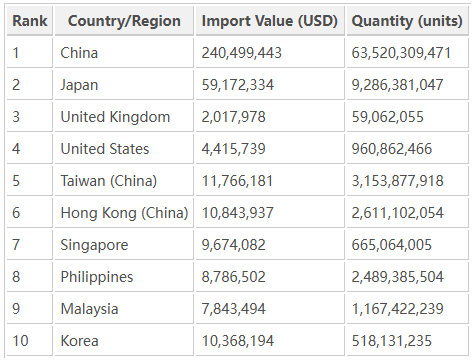

Major Trading Regions

In 2025, China remained India’s top source, supplying US$240.5 million worth of capacitors — over 61% of total imports. Other important supply regions included Japan, the United States, and Taiwan(china), highlighting India’s reliance on East Asian component ecosystems.

China’s dominance underscores its role as the regional hub for capacitor production and distribution, particularly in MLCC (Multilayer Ceramic Capacitor) manufacturing.

Market Insights and Observations

The 2025 data reflects several key patterns:

-

Smartphone and IoT expansion: Continuous demand from smartphone assemblers (Xiaomi, Tecno, Motorola) and emerging IoT device producers sustained capacitor imports.

-

Diversified sourcing: Despite China’s lead, Indian buyers maintained sourcing from Japan, Taiwan(china), and Singapore to mitigate supply risks.

-

Growth in automotive applications: Companies such as BYD India and United Telelinks expanded imports for electric mobility and infotainment systems, signaling India’s evolving EV ecosystem.

-

Component standardization: The frequent appearance of “AEC-Q200” and “X7R” series capacitors suggests increased focus on automotive-grade and high-reliability components.

Summary

In summary, India’s capacitor import market (HS 85322990) in 2025 was valued at approximately US$390.5 million, representing a technologically diversified and resilient supply structure. The import mix — driven by major assemblers, distributors, and OEMs — demonstrates India’s critical role as both a consumer and processor within global electronics manufacturing networks.

The data provided by NBD DATA reveals a stable market trajectory and highlights potential opportunities for component manufacturers to strengthen their presence in India’s expanding high-tech manufacturing landscape.

Data Source:

All statistics are based on authorized import transaction data collected and analyzed by NBD DATA. For detailed datasets or custom intelligence services, please visit our service page.