Inside Mexico’s Fastener Market: TORNILLO Imports Reflect Expanding Manufacturing Ties with Asia

In the first half of 2025, Mexico’s imports of screws and bolts (HS 73181504, known locally as “TORNILLO”) demonstrated solid growth, reflecting robust industrial activity and Mexico’s expanding role in the global automotive and machinery supply chain. According to NBD DATA, Mexico recorded 13,780 trade transactions related to this product category between January and June 2025, with total imports reaching USD 10.74 million and 2.9 million units.

These figures highlight how Mexico’s manufacturing base — especially in automotive assembly, electronics, and heavy machinery — continues to attract investment and reinforce its connection with Asian and European component suppliers.

Product Overview and Market Context

Under customs classification HS 73181504, “TORNILLO” encompasses steel screws and bolts used in vehicles, motorcycles, industrial machinery, and construction equipment. They are small but critical elements ensuring mechanical integrity across sectors.

The keyword TORNILLO covers a wide range of products — from automotive-grade screws and fasteners to specialized high-tensile bolts used in manufacturing plants. The growth of this segment mirrors the expansion of Mexico’s industrial output and its integration into global production networks.

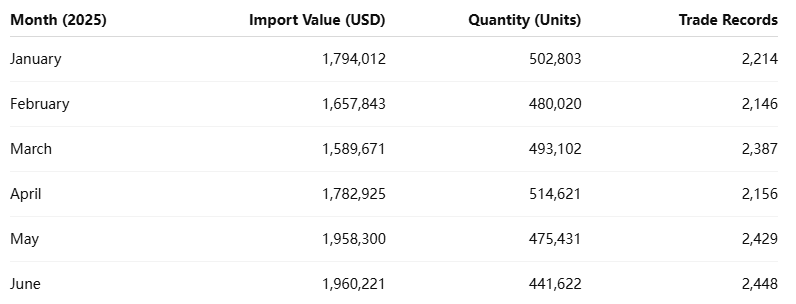

Monthly Import Trends (Jan–Jun 2025)

Mexico’s fastener imports displayed stable activity through the first half of 2025, driven by consistent automotive production and ongoing infrastructure projects.

The monthly average import value stood at approximately USD 1.79 million, with peak volumes recorded in May and June, aligning with increased production activity among automotive OEMs such as Volkswagen, Audi, and Honda.

Overall, the data reflects a consistent recovery following earlier supply chain disruptions, particularly in steel component sourcing.

Market Structure and Trade Overview

During the first half of 2025, Mexico’s TORNILLO imports were supplied by over 100 exporters from 15 countries, but the market was concentrated among a few dominant buyers — primarily multinational vehicle manufacturers and industrial distributors.

Top Importing Companies

According to NBD DATA, the leading importers of TORNILLO components were:

-

AUDI MEXICO S.A. DE C.V. – The top importer, with 910 trade transactions, importing 1,339,109 units valued at USD 5.28 million. Major suppliers included REVOCOAT FRANCE S.A.S and SIKA AUTOMOTIVE HAMBURG GMBH, reflecting deep integration with European manufacturing networks.

-

HONDA DE MEXICO S.A. DE C.V. – Managed 1,684 transactions, importing 465,886 units worth USD 3.00 million, mainly from Honda subsidiaries in Japan, China, and India.

-

FASTENAL MEXICO S. DE R.L. DE C.V. – Recorded 558 trade records, importing 761,364 units valued at USD 1.92 million from multiple Asian suppliers including TONG HEER FASTENERS (Thailand), NINGBO JINDING FASTENING PIECE (China), and SE FA ENTERPRISE CO., LTD. (China Taiwan).

-

JATCO MEXICO S.A. DE C.V. – Logged 841 transactions, importing 57,129 units valued at USD 1.12 million, sourced primarily from JATCO, LTD. (Japan) for automatic transmission manufacturing.

-

TRUPER, S.A. DE C.V. – Conducted 874 records, importing 736,207 units worth USD 896,779, collaborating mainly with ZHEJIANG YILI MACHINERY AND ELECTRIC CO., LTD. (China) and local distributor PARCELMOBI S.A. DE C.V.

Together, these five importers accounted for more than 80% of Mexico’s total screw import value during the period, showing the dominance of automotive and hardware manufacturing sectors in the fastener market.

Leading Global Suppliers

The global supplier network for Mexico’s TORNILLO imports reflects strong participation from Asia and Europe.

-

China and China Taiwan provided mass-produced fasteners for automotive and construction applications.

-

Thailand and Vietnam supplied precision fasteners for assembly plants through companies such as TONG HEER FASTENERS and KPF VINA CO., LTD.

-

Japan maintained leadership in high-tensile automotive screws, exported by JATCO, LTD. and KAWASAKI MOTORS LTD.

-

Germany and France contributed specialized coatings and engineered fastener systems via SIKA AUTOMOTIVE HAMBURG GMBH and REVOCOAT FRANCE S.A.S.

This diversified supplier structure supports Mexico’s multi-industry manufacturing ecosystem, balancing low-cost sourcing with high-quality OEM requirements.

Regional Trade Insights

Mexico’s geographic trade links continue to strengthen with Asia and Europe as primary fastener suppliers. The first half of 2025 saw:

-

Over 60% of imports originating from Asia, led by China, Thailand, and China Taiwan.

-

About 30% from Europe, dominated by Germany and France.

-

The remainder from North America and South America, mostly regional redistribution through U.S. logistics partners.

The ongoing shift toward Asian supply emphasizes Mexico’s dual role — both as a regional assembly hub for North America and a consumer of Asian industrial components.

Corporate and Supply Chain Dynamics

NBD trade data reveals several prominent supply relationships between Mexican manufacturers and global fastener suppliers:

-

AUDI MEXICO’s partnership with REVOCOAT FRANCE and SIKA AUTOMOTIVE (Germany) ensures consistent supply of specialized coated fasteners used in luxury vehicle assembly in Puebla.

-

HONDA DE MEXICO imports screws and bolts directly from its subsidiaries in India, China, and Japan, reflecting its vertically integrated supply chain strategy.

-

FASTENAL MEXICO acts as a central distributor, bridging multiple Asian producers with Mexico’s local industrial market.

-

TRUPER, S.A. DE C.V., one of Mexico’s largest hardware tool companies, maintains trade channels with ZHEJIANG YILI MACHINERY (China) and local partners for nationwide distribution.

-

JATCO MEXICO, a major transmission manufacturer, sources precision fasteners directly from Japan for its Nissan-affiliated operations in Aguascalientes.

These relationships underline Mexico’s increasing reliance on cross-border component specialization and the global integration of its industrial base.

Industry Analysis and Trends

The surge in TORNILLO imports during early 2025 can be linked to several structural trends:

-

Automotive Expansion: Mexico remains the seventh-largest vehicle producer globally. OEMs such as Audi, Volkswagen, Nissan, Honda, and Toyota continue to expand assembly capacity, increasing demand for precision fasteners.

-

Industrial Recovery: Manufacturing indices show continuous improvement post-2024, especially in steel-based sectors.

-

Diversification of Supply Sources: Mexican importers are increasing procurement from Southeast Asia (Thailand, Vietnam) to reduce dependency on any single market.

-

Logistics and Trade Integration: The USMCA framework and modernized port logistics support Mexico’s role as a continental manufacturing bridge.

Together, these dynamics indicate that fasteners like TORNILLO will remain indispensable to Mexico’s industrial ecosystem.

Focus Region: Asia’s Dominant Role

Asian suppliers — especially from China, China Taiwan, and Thailand — dominate Mexico’s TORNILLO imports, providing over 60% of all recorded trade transactions in early 2025.

-

Chinese manufacturers such as Ningbo Jinding Fastening Piece Co., Ltd. and Good Glory Industrial Ltd. supply large-volume standard screws for industrial use.

-

Thailand’s TONG HEER FASTENERS specializes in stainless and automotive-grade fasteners for OEM applications.

-

China Taiwan’s SE FA ENTERPRISE CO., LTD. exports high-precision components used in electronics and automotive assembly.

This Asian dominance is reinforced by cost competitiveness, production scale, and reliable logistics, positioning the region as Mexico’s essential partner in industrial manufacturing.

Market Summary and 2025 Outlook

From January to June 2025, Mexico’s TORNILLO imports under HS 73181504 reflect an expanding and resilient industrial market.

Key insights include:

-

Total Imports: USD 10.74 million across 13,780 trade transactions and 2.9 million units.

-

Top Importers: Audi Mexico, Honda de Mexico, and Fastenal Mexico together accounted for more than half of total import value.

-

Regional Structure: Asia supplied 60% of imports; Europe 30%; North America 10%.

-

Sectoral Focus: Automotive assembly, machinery, and tool manufacturing dominated demand.

-

Forecast: With ongoing vehicle production expansion and increased infrastructure investment, Mexico’s fastener imports are projected to grow 8–10% by year-end 2025.

Overall, the TORNILLO market exemplifies how Mexico leverages international manufacturing networks to sustain industrial growth, positioning itself as a bridge between Asian component suppliers and North American assembly plants.

Data Source Statement

All figures in this report are derived from verified customs transaction data provided by NBD DATA.

For detailed company profiles, transaction insights, and professional analytics, please visit NBD DATA Service.