Examining Nigeria’s Safety Valve Import Trends: Leading Buyers, Global Suppliers, and Trade Regions

In the first half of 2025, Nigeria’s industrial sector saw continued reliance on imported SAFETY OR RELIEF VALVES—key components used in oil, gas, and heavy manufacturing systems. According to NBD DATA, trade under HS Code 8481400000 reveals the scale of Nigeria’s engagement with global industrial supply chains. This report analyzes the country’s import performance, top corporate buyers, international suppliers, and trade region trends shaping the mechanical equipment market.

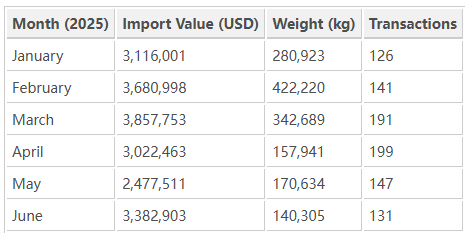

Overview of Nigeria’s Safety Valve Imports (January–June 2025)

From January to June 2025, Nigeria imported over 1.51 million kilograms of safety and relief valves, with a total import value reaching USD 19.54 million across 935 transactions. The trade involved 213 importers and 345 exporters from 41 countries, underscoring the complexity and diversity of the market.

The import peak occurred in March 2025, coinciding with increased procurement for oilfield maintenance and industrial construction projects. Heavy inflows during the first quarter demonstrate sustained investment by Nigeria’s energy and infrastructure sectors in upgrading safety-critical systems.

Leading Buyers

Nigeria’s safety valve imports are primarily driven by large multinational energy operators and local industrial firms that maintain complex engineering operations. The top importers in 2025 H1 include:

TOTAL ENERGIES EP NIGERIA LIMITED – The largest importer, purchasing over 49.6 tons of valves worth USD 4.55 million. Imports originated mainly from France and the UAE through logistics partners such as BOLLORE LOGISTICS and LSCM.

SCHLUMBERGER NIGERIA LIMITED – Imported 21.8 tons of valves valued at USD 2.01 million, supplied largely by PETROLEUM EQUIPMENT & SUPPLIES FZE (UAE) and SCHLUMBERGER OILFIELD EQUIPMENTS (CHINA).

MOBIL PRODUCING NIGERIA UNLIMITED – Brought in 7.5 tons of safety valves worth USD 1.38 million, sourced via DSV AIR & SEA operations.

TOTALENERGIES UPSTREAM NIGERIA LTD. – Recorded imports of 15.6 tons, valued at USD 998,379, primarily linked to offshore exploration support and maintenance activities.

FLOUR MILLS OF NIGERIA PLC– Imported 1.7 tons of valves worth USD 229,897, supplied by STAR TRADING COMPANY LIMITED for industrial plant systems.

These firms represent the core industrial consumers of safety valves in Nigeria, with applications spanning oil exploration, refinery operations, and manufacturing plant pressure systems.

Top Global Suppliers

Nigeria’s imports reveal a network of international exporters specialized in oilfield and industrial components. The leading suppliers during this period include:

PETROLEUM EQUIPMENT & SUPPLIES FZE (UAE) – The top exporter to Nigeria, delivering USD 1.61 million in safety valves to Schlumberger and its affiliates.

SCHLUMBERGER OILFIELD EQUIPMENTS (CHINA) – Exported approximately USD 214,334, reflecting strong inter-company sourcing within the Schlumberger group.

LSCM FRANCE – Supplied high-value components to TotalEnergies, totaling USD 37,429 in precision-engineered valve assemblies.

STAR TRADING COMPANY LIMITED – Provided USD 226,638 in industrial valves to Flour Mills of Nigeria.

PARVEEN INDUSTRIES PVT. LTD. (India) – Exported USD 59,274 in safety valve units to SHELF DRILLING NIGERIA LIMITED for offshore platform operations.

The supplier landscape highlights the significance of the UAE and China as regional distribution hubs for energy equipment, with additional technical support coming from France and India.

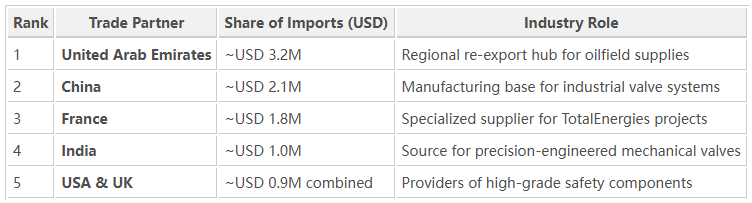

Major Trade Regions

Nigeria’s valve imports originate from a diverse range of countries across Asia, Europe, and the Middle East. While detailed country-level totals vary, NBD DATA shows a concentration of trade links with major oilfield equipment hubs such as the United Arab Emirates, China, France, and India.

The dominance of these regions reflects Nigeria’s integration with global petroleum and manufacturing equipment supply chains, particularly those catering to offshore and energy infrastructure sectors.

Market Insights

Three key themes define Nigeria’s safety valve import dynamics in 2025:

-

Energy Sector Dependence – The vast majority of imports serve oil exploration, gas processing, and petrochemical operations.

-

Cross-Border Corporate Logistics – Multinational corporations such as Schlumberger, TotalEnergies, and Mobil coordinate imports through global affiliates, enabling optimized cost and delivery structures.

-

Technology Upgrading – A gradual shift toward European and Asian-made precision valves underscores a focus on system reliability and industrial safety compliance.

Nigeria’s oil-dependent economy continues to drive demand for industrial hardware, making safety valves indispensable to both upstream and downstream operations.

Outlook

As Nigeria advances industrial expansion and oilfield modernization through 2025, demand for safety and relief valves is projected to stay strong. Infrastructure projects, refinery upgrades, and private manufacturing investments will sustain imports.

However, local fabrication capacity remains limited, ensuring continued reliance on foreign suppliers in the short term. Strengthening partnerships with global OEMs and developing local assembly operations may gradually reduce import dependency.

Data Source

All data in this analysis is sourced from NBD DATA, based on official customs trade records between January 1 and June 30, 2025, under HS Code 8481400000 (Safety or Relief Valves).

For additional insights or customized market analytics, visit NBD DATA Service Portal.