Kazakhstan’s Container Imports Surge : China and UAE Dominate Supply Chain

In 2025, Kazakhstan’s import market for containers (HS code 8609009009) showed strong growth momentum, with total imports reaching 15.77 million USD, covering 6,737 transactions and involving 47 partner countries. According to data from NBD DATA, the import trend reflects the country’s expanding infrastructure, logistics needs, and transit trade through Central Asia. Representative products include КОНТЕЙНЕР (steel freight and intermodal containers) widely used in railway and maritime transport.

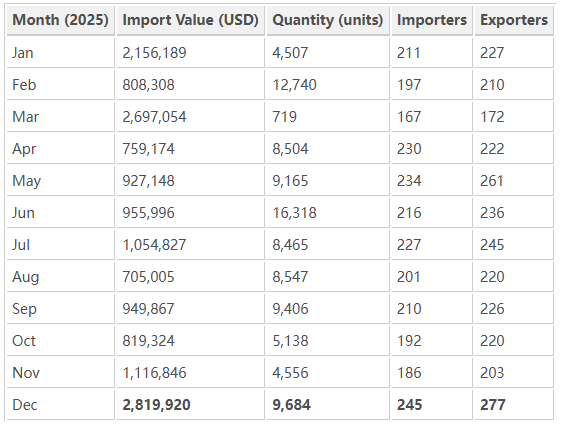

Monthly Import Trend

Across 2025, Kazakhstan maintained an active import pace. Import values fluctuated but demonstrated an overall upward trend from mid-year onward, culminating in a December peak.

December’s surge to nearly 2.82 million USD underscored Kazakhstan’s strong year-end demand for intermodal containers, likely linked to logistics expansion before the winter season.

Market Overview and Top Importers

During 2025, Kazakhstan imported containers mainly from China, the United Arab Emirates, and South Korea. These three markets collectively accounted for more than 85 % of import volume.

Top importing companies included:

ТОО «CONTAINER SERVICE GROUP» — largest importer, primarily sourcing from Hong Kong and South Korea.

ТОО КАЗАХСТАН КАСПИАН ОФФШОР ИНДАСТРИЗ — 1purchasing offshore and industrial containers from Finland.

ТОО «WAN SHENG CERAMIC (ВАН ШЭН КЕРАМИК)»— importing specialized container components from China.

Other active buyers such as ТОО «МЕРЕЙ 2021» and ТОО «PARTNERS PARTS» also contributed to Kazakhstan’s logistics supply network.

Major Exporting Partners

On the supply side, China firmly led the list of source countries, followed by the UAE, Korea, and Japan.

Top suppliers included:

CIMC Intermodal Equlink (Hong Kong) Ltd. — providing intermodal containers to major Kazakh logistics firms.

Wärtsilä Finland Oy — focusing on offshore container solutions.

Honeytak Intermodal Ltd.— supplying advanced modular containers for railway transport.

XINJIANG Sheng Ruixiang International Trade Co., Ltd. — facilitating cross-border trade between China and Kazakhstan.

Qingdao Sunway International Co., Ltd. — a stable supplier of general-purpose freight containers.

These enterprises demonstrate a highly internationalized supply chain dominated by Chinese and East Asian manufacturers.

Trade Regions

Kazakhstan’s container imports covered 47 countries, but most trade concentrated in Asia and Europe.

Top 10 trading regions in 2025:

-

China — 21.1 million USD, 102,511 units

-

United Arab Emirates — 0.99 million USD

-

Korea — 1.57 million USD

-

Japan — 0.13 million USD

-

Finland — 0.97 million USD

-

Germany — 0.38 million USD

-

Switzerland — 0.14 million USD

-

Hong Kong (China) — 1.75 million USD

-

United States — 0.20 million USD

-

Poland — 0.17 million USD

China remained the dominant supplier, accounting for over 90 % of total import value, with the UAE serving as a re-export logistics hub.

Market Insights

Kazakhstan’s demand for containers mirrors its strategic role as a transit hub between China and Europe. The dominance of Chinese suppliers aligns with infrastructure projects under the Belt and Road Initiative, enhancing railway and intermodal logistics capacity.

European suppliers like Wärtsilä Finland and Asian logistics firms such as CIMC and Honeytak show that Kazakhstan’s market demands both standard freight containers and specialized modular systems for industrial use.

Regional Focus: China’s Role

With over 21 million USD in shipments, China remains Kazakhstan’s largest source of containers. Chinese producers such as CIMC Intermodal Equlink and Honeytak Intermodal deliver via Xinjiang–Kazakhstan rail corridors, ensuring efficiency in transcontinental logistics.

Representative products include 20-foot dry containers and high-cube cargo units, illustrating China’s comprehensive manufacturing capabilities for regional logistics infrastructure.

Summary

Overall, the 2025 performance of container imports (HS 8609009009) demonstrates Kazakhstan’s logistics and construction sectors entering a modernization phase. The steady increase in imports, particularly from China and the UAE, underscores growing investment in intermodal transportation and cross-border trade. Demand for containers is expected to remain strong through 2026 as the nation deepens its connectivity within Eurasia.

Data Source

All trade data and enterprise details are provided by NBD DATA, based on Kazakhstan’s 2025 customs import records. For further enterprise analytics, visit the NBD DATA Service Portal.