Trade Analysis of Mexico’s SOPORTE Exports: Data, Destinations, and Top Manufacturers

In the first half of 2025, Mexico’s exports of SOPORTE — classified under HS Code 87089999 — demonstrated solid performance within the automotive components sector. According to NBD DATA, the total export value reached USD 2.86 million across 1,358 recorded transactions from January to June 2025. These exports include structural supports, mounts, and brackets widely used in both vehicle manufacturing and aftermarket applications.

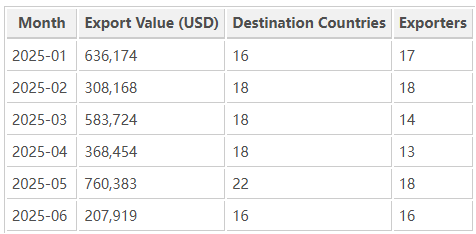

Monthly Export Trends

Mexico’s SOPORTE exports showed steady activity throughout early 2025, with the highest export value recorded in May 2025 at USD 760,383, followed by March and January. Early-year performance indicates robust regional demand for vehicle components across North and South America.

Overall, Mexico exported SOPORTE products to 33 destination countries through 31 major exporters, serving assembly plants and distributors across North America, Latin America, and Europe.

Key Importing Markets and Clients

Export records reveal Mexico’s critical role as a regional supplier of automotive components. Major international buyers include:

FORD MOTOR COMPANY SA DE CV — The leading importer, with purchases totaling USD 442,365, mainly for vehicle chassis and mounting components.

AUDI MEXICO S.A DE C.V.— Imported USD 106,506 in SOPORTE parts for export-oriented assembly lines.

MAZDA MOTOR MANUFACTURING DE MEXICO S.A. DE C.V.— Recorded USD 13,429 in imports of specialized supports for compact vehicle assembly.

VOLKSWAGEN DE MEXICO S.A. DE C.V. — Continued to source SOPORTE parts from local suppliers to sustain assembly operations.

STELLANTIS MEXICO SA DE CV — Imported USD 5,527, reinforcing integration with regional automotive supply chains.

Together, these firms represented nearly 70% of Mexico’s total SOPORTE export value in the first half of 2025, confirming Mexico’s strong position as an export base for automotive components.

Top Mexican Exporters

Mexico’s export strength in SOPORTE products stems from a network of capable component manufacturers and distributors:

VAZLO COMERCIAL S.A. DE C.V. — The top exporter, shipping goods worth USD 81,782, mainly to Central and South America.

FUNDILAG HIERRO SA DE CV — Exported USD 214,586, including key shipments to JOHN DEERE USINE DE SARAN in France.

GAFF INTERNATIONAL SA DE CV — Specialized in heavy-vehicle components, with total exports of USD 57,243.

NORTH POLE STAR S DE RL DE CV — Recorded USD 161,965 in exports to POLARIS INDUSTRIES INC. in the U.S. market.

INDUSTRIAS JOHN DEERE S DE RL DE CV— Delivered USD 66,190 worth of SOPORTE components to Argentina.

These leading exporters illustrate Mexico’s advanced capability in precision metal fabrication and automotive component engineering, which underpin its global competitiveness.

Regional Export Destinations

Mexico’s SOPORTE exports reached a wide range of destinations, reflecting diversified demand across continents:

-

United States – The primary export market, accounting for about 40% of total trade value.

-

Brazil and Argentina – Key Latin American destinations for both OEM and aftermarket parts.

-

Germany and France – European importers sourcing specialized supports for manufacturing networks.

-

Costa Rica and Chile – Consistent smaller markets for vehicle assembly support parts.

This spread highlights Mexico’s pivotal role in global automotive supply integration, supported by trade frameworks such as USMCA and the EU-Mexico Partnership Agreement.

Market Outlook

Mexico’s SOPORTE exports are expected to continue expanding throughout 2025 due to:

-

Strong vehicle production by multinational automakers operating in Mexico.

-

Enhanced integration with U.S. and Latin American supply chains.

-

Growth in precision casting and lightweight materials driven by technology investment.

Potential challenges include steel price fluctuations, logistics costs, and emission regulations affecting component production. Nonetheless, the industry is shifting toward sustainable manufacturing and regional diversification to ensure long-term growth.

Comprehensive data and enterprise analysis are available from NBD DATA, offering global insights into automotive component trade and market intelligence.