Rising Demand for Measuring and Control Instruments in Paraguay’s 2025 Import Market

In 2025, Paraguay’s import market for measuring and control instruments (HS Code 90262090), covering devices like pressure gauges and optical measurement systems, showed a robust performance despite fluctuations across the year. According to data compiled by NBD DATA, the total import value reached USD 2,183,224, encompassing 2,590 individual shipments from 536 exporters across 32 countries. The volume of imports totaled 117,755 units, revealing Paraguay’s steady reliance on technologically advanced measurement devices for industrial, automotive, and engineering applications.

Representative imported items included precision and optical measurement instruments, components used in industrial control systems, and accessories for automotive diagnostics. These examples—such as INSTRUMENTOS DE MEDIDA and “INSTRUMENTOS Y APARATOS DE CONTROL DE PRECISIÓN”—highlight the technical diversity of this segment in Paraguay’s industrial ecosystem.

Monthly Import Trends

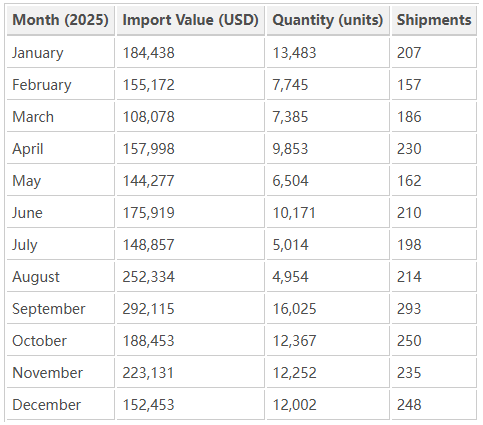

Throughout 2025, Paraguay’s imports of measuring instruments displayed moderate seasonal variations. Monthly trade data showed consistent demand from local distributors and engineering firms:

The third quarter (July–September) recorded the strongest import activity, peaking in September 2025 at nearly USD 292,000. This uptick aligns with seasonal equipment upgrades in Paraguay’s automotive, agricultural machinery, and manufacturing industries—sectors that heavily depend on precise measurement and calibration instruments.

Market Overview and Import Value Distribution

Measured over twelve months, Paraguay’s market for HS 90262090 products maintained stable growth, with monthly import values averaging around USD 182,000. Despite fluctuations in shipment counts, the consistency in supplier diversity (536 exporters) indicates a competitive and decentralized sourcing structure.

The import structure reveals strong integration with regional suppliers, particularly Brazil, which has long been Paraguay’s largest partner for automotive and industrial equipment. The data also points to consistent sourcing from Germany, China, and the United States, reflecting the country’s effort to balance cost-efficiency with technological reliability.

Leading Importers in Paraguay

In 2025, over 340 Paraguayan importers participated in this category. Among them, several large firms stood out for their import volume, value, and supplier network diversity:

EVEREST INGENIERIA S.R.L– A major player specializing in engineering equipment, recorded imports worth USD 185,098, including products from WINTERS INSTRUMENTS LATIN AMERICA, FESTO, and SICK AG.

VALPARTS S.A. – Focused on automotive components, it imported measuring instruments valued at USD 102,199, working with suppliers like BARUQUE EXPORTADORA DE AUTO PECAS LTDA.

KUROSU Y CIA S.A.– Imported precision control devices worth USD 86,704, sourced mainly from INDUSTRIAS JOHN DEERE and YANMAR SOUTH AMERICA.

SACI H. PETERSEN – Reported imports totaling USD 184,638, primarily from CATERPILLAR and CNHI INTERNATIONAL S.A., supporting heavy equipment maintenance operations.

DIESA S.A. – Brought in components worth USD 52,206, largely from SCANIA and VOLKSWAGEN for the commercial vehicle segment.

These importers collectively account for a significant portion of the country’s instrument trade, reflecting the growing need for measurement and diagnostic devices across automotive, machinery, and energy industries.

Key Foreign Suppliers

The supplier landscape for HS 90262090 imports into Paraguay in 2025 demonstrates a highly diversified sourcing pattern. Major suppliers include both regional exporters and global technology companies:

-

WINTERS INSTRUMENTS LATIN AMERICA S.A. – Specialized in pressure and temperature measurement equipment, supporting industrial automation.

-

FESTO AG & CO. KG – Provided control and pneumatic systems that integrate measurement functionality.

-

CATERPILLAR AMERICAS C.V. – Supplied monitoring and diagnostic tools for heavy machinery.

-

SICK AG – Contributed optical sensors and control devices essential for factory automation.

-

TRUPER, S.A. DE C.V. – Delivered basic measurement tools and calibration devices.

This mix of high-tech and industrial suppliers shows Paraguay’s strategy to upgrade its industrial capabilities by sourcing from reliable multinational brands.

Trade Regions and Geographic Distribution

Paraguay’s imports of measuring instruments were sourced from 32 countries in 2025, emphasizing its broad trade connections. The top contributing regions include:

-

Brazil – Paraguay’s principal supplier for automotive and machinery components, accounting for the majority of shipments.

-

China – Provided cost-efficient electronic instruments and digital meters.

-

Germany – Key source of precision-engineering and automation technology.

-

United States – Exported diagnostic devices and process measurement systems.

-

Spain – Supplied specialized optical and industrial control equipment.

This multi-source model ensures supply resilience and access to both premium and mid-range technologies, contributing to Paraguay’s industrial modernization.

Market Observation

A deeper look at firm-level transactions shows how large importers like EVEREST INGENIERIA S.R.L leverage diversified suppliers across continents to optimize product availability. The involvement of CATERPILLAR, FESTO, and WINTERS INSTRUMENTS underscores Paraguay’s increasing adoption of digital and precision measurement technologies, moving toward smarter industrial control systems.

Local distributors, in turn, play a vital role in re-supplying these imported instruments to agriculture, construction, and energy sectors. Such dynamics highlight Paraguay’s gradual transition toward automation-driven industry, supported by sustained import flows of technical equipment.

Trade Outlook for 2026

Based on 2025’s data, Paraguay’s imports of HS 90262090 instruments are likely to continue growing moderately in 2026. Industrial expansion projects and infrastructure investment—particularly in hydroelectric power and automotive manufacturing—will sustain demand for measurement and calibration equipment.

At the same time, the rise of Chinese and Korean suppliers is expected to intensify competition, potentially lowering procurement costs. However, leading brands from Europe and North America will remain vital for sectors that require high accuracy and durability standards.

Overall, the 2025 data suggest that measuring and control instruments have become integral to Paraguay’s modernization efforts, reflecting broader industrial and technological development trends across South America.

Data Source and Methodology

All trade statistics, company profiles, and transaction values in this article are derived from the 2025 Paraguay import dataset (HS 90262090) compiled by NBD DATA. Figures represent actual customs transactions for the period January 1 – December 31, 2025.

For detailed service access and historical trade reports, please visit NBD DATA’s service page.