From Shampoos to Hair Oils: Botswana’s Expanding Hair Care Import Market in 2025

During the first half of 2025, Botswana’s import market for hair preparations under HS Code 33059000 demonstrated steady growth, reflecting the nation’s rising consumer demand for personal grooming and beauty products. According to data from NBD DATA, the total import value reached USD 2.58 million, with an import weight of 642,496 kilograms and more than 2,836 recorded transactions involving 30 supplier countries, 341 importers, and 458 exporters.

The category includes shampoos, hair oils, creams, conditioners, gels, and other preparations for use on the hair, ranging from essential care items to premium beauty formulations. Typical imported products include Vatika Hair Oil (Garlic, Coconut, and Blackseed varieties), Dabur Amla Hair Oil, Glory Henna Colour, Neem Oil, Castor Oil, and Hair Growth Serums.

1. Overview of Botswana’s Hair Care Import Trends

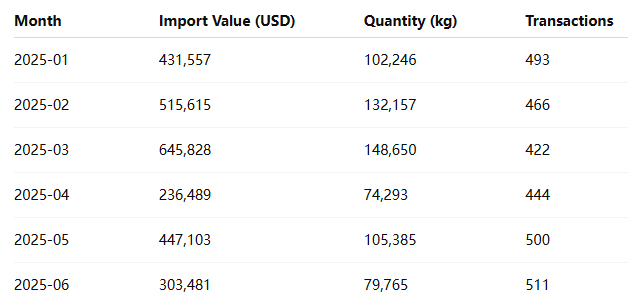

Between January and June 2025, imports of hair care products into Botswana showed consistent month-by-month activity, indicating both retail and wholesale market resilience.

Imports reached their highest value in March 2025, totaling approximately USD 645,828, supported by seasonal consumer demand and retail restocking across major supermarket chains. While April saw a temporary dip, trade activity rebounded sharply in May and June, reflecting sustained supply and retail stability.

Overall, Botswana’s import growth reflects a mature retail ecosystem where international brands continue to penetrate both high-end urban stores and mass-market outlets in suburban regions.

2. Key Importers in Botswana

Among the 341 active importers, several large-scale distributors dominate the import of hair care products. After removing non-trading logistics entities, the following key players stand out:

These enterprises collectively account for a large share of imported shampoo, hair oil, and treatment products.

Tsetseng Retail Group, affiliated with the SPAR supermarket chain, leads with over 600 recorded transactions. The Clicks Organisation and Dis-Chem, two of Southern Africa’s biggest pharmaceutical and cosmetics retailers, also play a significant role, ensuring continuous product availability across Botswana’s retail network.

3. Major Foreign Suppliers

Botswana’s hair care imports are predominantly sourced from neighboring and regional manufacturing centers, especially South Africa, which remains the country’s primary supplier of consumer goods. The main exporting manufacturers and suppliers include:

Amka Products—known for brands like Perfect Choice, Clere, and Black Like Me—dominates the export of hair oils, gels, and creams to Botswana. Colgate-Palmolive and Unilever South Africa complement the market with globally recognized lines such as Palmolive Shampoo, Vaseline Hair Tonic, and Sunsilk.

This strong supplier network ensures that Botswana’s retail sector is consistently stocked with both affordable mass-market goods and premium imported hair treatments.

4. Regional Trade Overview

Trade data shows that South Africa accounts for the majority of Botswana’s hair care imports, supported by efficient land transport routes and established distributor partnerships. The country benefits from the Southern African Customs Union (SACU) framework, which facilitates tariff-free trade among member states.

Beyond South Africa, India, United Arab Emirates, and the United Kingdom also contribute to Botswana’s import portfolio, mainly supplying herbal oils, essential oils, and natural-based treatments such as castor, coconut, and rosemary oils.

This diversified sourcing strategy allows Botswana to offer consumers a wide range of choices—from Dabur Vatika and Amla oils of Indian origin to European and African-manufactured shampoos and conditioners.

5. Product Insights and Market Focus

Analysis of product descriptions indicates that hair oils and creams dominate the import category. Commonly imported items include:

-

Vatika Hair Oil (Garlic, Blackseed, and Argan varieties)

-

Dabur Amla Hair Oil

-

Rosemary and Castor Hair Oils

-

Hair Growth Serums and Detangling Sprays

-

Henna Coloring Creams

-

Shampoos and Conditioners for Moisture and Volume

These products serve both personal care and professional salon use, appealing to Botswana’s expanding beauty and wellness sector. Local demand is driven by urbanization, increasing disposable income, and a growing middle-class consumer base with interest in self-care and grooming.

In particular, moisturizing, anti-dandruff, and hair-strengthening formulations are among the most sought-after types, as climatic conditions and hair texture diversity influence consumer preferences.

6. Market Dynamics and Retail Landscape

Botswana’s retail market for personal care products is anchored by large chains such as SPAR, Clicks, Dis-Chem, and PEP, which distribute products nationwide. Alongside these giants, numerous small-scale traders import niche or ethnic-focused hair care brands, catering to specialized consumer segments.

The increasing availability of natural and herbal-based products—like coconut oil, neem oil, and black seed oil—signals a clear consumer shift toward health-conscious and organic beauty solutions. Online sales and social media-driven marketing are also enhancing visibility for imported cosmetic and personal care brands.

7. Summary and Outlook

From January to June 2025, Botswana’s imports of hair preparations (HS 33059000) totaled USD 2.58 million, weighing 642 tons, with 30 trading partner countries involved. The market shows strong momentum supported by retail expansion and consumer demand for diverse hair care solutions.

As Botswana continues to modernize its retail and logistics infrastructure, imports from both regional and international manufacturers are expected to rise. The hair oil and cream segment will likely remain dominant, while premium and organic product categories—especially those containing herbal and essential oils—are expected to grow rapidly through 2026.

The country’s retail chains and wholesalers are therefore positioned to benefit from sustained import opportunities, particularly within the broader Southern African cosmetics and personal care ecosystem.

8. Data Source

All figures and trade insights in this report are sourced from NBD DATA, based on verified customs transaction records for HS Code 33059000 (Preparations for Use on the Hair) covering January–June 2025. For customized analytics or access to detailed importer and supplier profiles, please visit the NBD DATA Service Center