Pakistan’s Polyester Yarn FDY Market Analysis: Key Importers, Suppliers, and Trade Patterns

Between January and June 2025, Pakistan’s import market for POLYESTER YARN FDY (HS Code 54024700) demonstrated stable yet strong performance.

According to data from NBD DATA, the total import value reached approximately USD 53.92 million, with a combined import volume of 42.98 million kilograms, spanning over 2,009 transactions.

The primary imported products included 100% polyester FDY 50D/24F, 75D/72F, 150D/48F, and 300D/96F varieties in both semi-dull (SD) and trilobal bright (TBR) grades, widely used in the spinning, weaving, and knitting sectors. Typical product listings contained descriptors such as “POLYESTER YARN FDY 150D/48F TRILOBAL BR RW AA GRADE” and “100% POLYESTER YARN FDY 50D/24F SD RW AA GRADE,” illustrating the precision and standardization of Pakistan’s textile inputs.

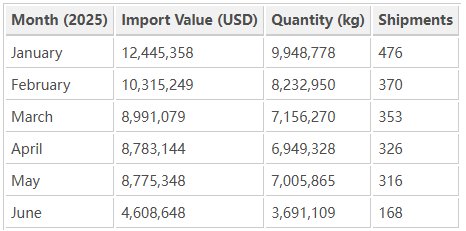

Monthly Import Overview

Pakistan’s monthly import trends indicate stable sourcing activity across the first half of 2025, with visible fluctuations linked to seasonal textile demand and cotton substitution cycles.

The first quarter (Jan–Mar) was the most active period, accounting for nearly 60% of total import value, with a peak in January (USD 12.4 million)—reflecting strong raw material procurement for Pakistan’s textile mills ahead of the production season. Import volumes began moderating after April, suggesting inventory stabilization and selective sourcing strategies.

Top Importers

Pakistan’s polyester yarn FDY import market is highly diversified, with over 200 active importers. The leading buyers by trade volume and value include:

HSA BROTHERS– imported approximately 3.3 million kg, worth USD 4.36 million, mainly from Jiangsu and Zhejiang producers such as Jiangsu Guowang High-Technique Fiber Co., Ltd. and Zhejiang Tiansheng Chemical Fiber Co., Ltd.

SALIM WINDING WORKS – with imports of 2.89 million kg (USD 3.49 million), sourcing from Zhejiang Jiabao New Fiber Group and Zhejiang Hengyi Petrochemicals.

M/S S.K.F. COLLECTION – handling 2.57 million kg (USD 3.12 million), diversified between Chinese and Malaysian suppliers.

KHWAJA INTERNATIONAL INDUSTRIES – imported 764,000 kg (USD 0.99 million), focusing on mid-grade FDY yarn from Fujian and Hangzhou manufacturers.

HAMNA TEXTILE – with 1.26 million kg (USD 1.58 million), mainly sourced from Zhejiang Hengyi, Fujian Jinlun, and Recron (Malaysia).

These importers represent Pakistan’s large-scale weaving and knitting segments, providing FDY yarn for apparel, home textiles, and industrial fabrics.

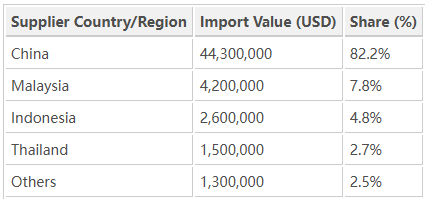

Key Suppliers and Export Partners

The supplier structure reveals a dominant role played by Chinese producers, alongside regional manufacturers in Malaysia and Fujian Province.

The top exporting companies include:

Jiangsu Guowang High-Technique Fiber Co., Ltd. – supplying major Pakistani importers such as HSA Brothers and M/S Osama Textile, specializing in fine-denier FDY for high-speed weaving applications.

Zhejiang Hengyi Petrochemical Co., Ltd.– a key petrochemical-based fiber manufacturer, known for consistent raw white TBR and SD yarn exports.

Zhejiang Jiabao New Fiber Group Co., Ltd.– a regular supplier to SALIM WINDING WORKS and M/S. M. Usman, exporting medium-denier FDY in bulk carton packaging.

Fujian Jinlun Fiber Shareholding Co., Ltd.– serving multiple Pakistani buyers, offering 150D/48F TBR AA grade yarn.

Recron (Malaysia) Sdn. Bhd.– the leading non-China supplier, maintaining steady trade with S.K.F. Collection and Hamna Textile.

Together, these five exporters account for over 70% of total import volume, underscoring Pakistan’s strong dependence on East and Southeast Asian FDY supply chains.

Regional and Trade Distribution

China remains the dominant origin, supplying over four-fifths of Pakistan’s FDY yarn imports. Malaysia’s Recron brand continues to hold a niche position as a reliable alternative for filament yarn blending. Imports from Indonesia and Thailand primarily consist of specialty bright yarn grades for high-value textile production.

Market Insights and Industry Context

-

Consistent reliance on China – China’s FDY producers maintain a strong price-performance edge, aided by integrated petrochemical supply chains and standardized production systems.

-

Rising regional diversification – Pakistani mills are gradually sourcing from Malaysia and Indonesia to hedge against currency volatility and shipping delays.

-

Value-driven product mix – The majority of imports are standard deniers (50D to 150D), but there is visible demand growth for thicker 300D and trilobal bright types used in furnishing textiles.

-

Cost competitiveness – The average import price across the period was around USD 1.25/kg, stable despite fluctuations in oil prices.

-

Textile sector recovery – Post energy normalization in Pakistan’s textile clusters (especially Faisalabad and Karachi) contributed to stable raw material imports.

Outlook

Pakistan’s polyester yarn FDY imports are expected to remain robust through the second half of 2025. Textile manufacturers continue to rely on synthetic yarn imports to offset domestic fiber shortages and meet export-oriented fabric orders.

As energy prices stabilize and trade logistics improve, Pakistan may strengthen long-term sourcing partnerships with major FDY suppliers in Zhejiang, Fujian, and Jiangsu provinces.

For textile exporters and analysts, tracking the FDY import trend provides valuable insight into Pakistan’s synthetic fiber consumption patterns and textile production capacity utilization.

Data Source

All trade data are derived from NBD DATA based on Pakistan’s import declarations for HS Code 54024700 between January and June 2025.

All values are rounded to two decimal places. For detailed shipment-level data and enterprise link analysis, please refer to the NBD DATA service portal.