Air and Turbo Components in Ecuador: 2025 Import Performance and Industrial Demand

In 2025, Ecuador’s imports under HS Code 8414909000—covering parts of air compressors, fans, and turbo machinery—recorded significant activity across the country’s automotive, industrial, and refrigeration sectors. According to NBD DATA, Ecuador imported over USD 10.05 million worth of these components, totaling 9,398 shipments, 528 tons, and nearly 968,000 individual items from 46 source countries.

This steady flow of mechanical parts underscores Ecuador’s dependence on advanced compressor and ventilation technologies, particularly for the automotive, food processing, and manufacturing industries.

Monthly Import Performance

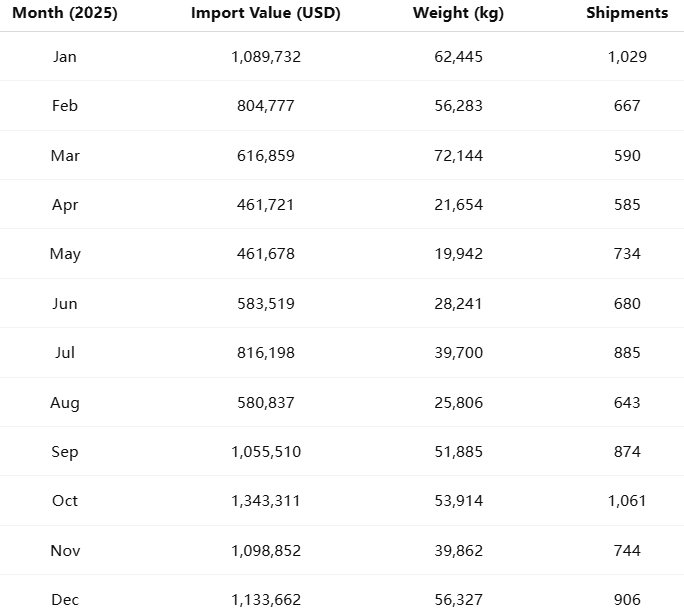

Throughout 2025, Ecuador’s import levels for air compressor and turbo parts remained consistent, with a noticeable peak in October 2025, when monthly imports reached USD 1.34 million.

Imports were concentrated in the second half of the year, correlating with higher demand for industrial maintenance and replacement parts.

Key Importers and Global Suppliers

The Ecuadorian market for compressor and turbo components in 2025 was led by several large industrial and automotive importers. The top five importers were:

These companies represent the backbone of Ecuador’s compressor and ventilation systems market, ensuring the supply of key spare parts and replacement units across industries.

Product Overview

According to customs data, common imported items under HS 8414909000 included:

-

Fan blades, impellers, and housings

-

Air compressor filters, shafts, and seals

-

Turbocharger repair kits

-

Evaporator fans and air-conditioning parts

-

Industrial ventilation components

Example import descriptions from 2025 include: “Fan blade evaporator,” “Compressor repair kit,” “Turbocharger body,” “Evaporator for air conditioning,” and “Industrial fan part with variable blades.”

These items are vital for the performance and efficiency of systems in refrigeration, automotive, mining, and manufacturing sectors.

Trade Partners and Regional Insights

Ecuador’s imports were diversified, with Germany, Japan, China, Mexico, and Brazil standing out as major supply sources.

-

Germany accounted for a large portion of high-value industrial compressor systems and OEM parts.

-

Japan and Mexico supplied precision components for automotive compressors and turbochargers.

-

China contributed a broad range of cost-effective replacement parts for industrial use.

The balance between premium European products and affordable Asian alternatives indicates a maturing procurement strategy across Ecuadorian industries.

Market Outlook

Ecuador’s import demand for compressor and turbo components is expected to remain stable in 2026, supported by infrastructure upgrades, manufacturing expansion, and increased adoption of energy-efficient systems.

As industries focus on equipment reliability and reduced downtime, suppliers like KAESER, CATERPILLAR, and MAYEKAWA are likely to retain strong positions in the market.

With the country’s ongoing economic diversification, demand for air-handling and turbo systems will likely see gradual growth, particularly in the construction, petrochemical, and logistics sectors.

Data Source

All figures and trade data in this report are sourced from NBD DATA global trade intelligence. For enterprise access to detailed importer-exporter networks, monthly shipment data, and industrial equipment analytics, visit NBD DATA Services