Plastic Tray Exports from Vietnam: Electronics Packaging Drives Continuous Growth

In the first half of 2025, Vietnam’s export performance for plastic trays (HS 39231090) continued its upward momentum, strongly supported by the expansion of electronics manufacturing and packaging demand. According to NBD DATA, Vietnam exported approximately 138.4 million plastic trays during this period, reaching a total export value of USD 31.04 million across 23,662 trade records.

The export market remains dominated by high-tech and precision packaging applications, with “electronics tray” and “component packaging tray” appearing frequently in customs descriptions. The majority of these trays are used by electronics assemblers, camera module producers, and automotive component plants operating in northern Vietnam.

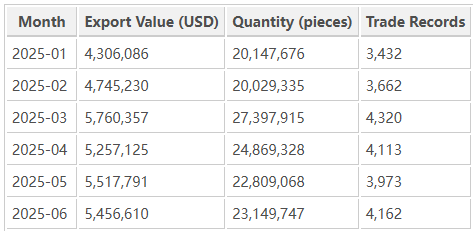

Monthly Export Trend

Vietnam’s monthly export trend for plastic trays in early 2025 shows a steady and balanced growth pattern, peaking in March and May:

The first half of the year demonstrates a 6.7% overall increase compared to the same period in 2024. Demand was particularly strong from Japan, the United States, and China—countries with major investments in Vietnam’s electronics industry.

Market Observation: Leading Exporters and Key Buyers

Top Exporters

Vietnam’s export network for plastic trays is concentrated among a few large electronics packaging manufacturers and precision molding companies:

CANON VIETNAM CO LTD - QUE VO FACTORY – the largest exporter, contributing USD 6.85 million, primarily supplying Canon Inc. factories across Asia.

KYOCERA VIETNAM COMPANY LIMITED – key supplier to Japan and China, exporting USD 1.26 million worth of high-quality molded trays.

TSK VN– an industrial packaging firm exporting over 3 million trays to major electronic component assemblers.

ETOWA CO., LTD. – exported 1.6 million trays, servicing Nidec, Fujikura, and other precision manufacturers.

PALOMA VIETNAM COMPANY LIMITED – focused on mass-production of lightweight trays for general electronics packaging.

Major Global Buyers

The primary importers purchasing Vietnam-made plastic trays are concentrated in Japan, China, and the United States. Leading international partners include:

CANON INC.– purchases more than 200,000 trays monthly for printer and camera assembly lines.

KYOCERA CORPORATION– integrates Vietnamese trays in multi-country packaging operations.

TSK CORP. – coordinates supply for automotive component packaging in Japan.

NIDEC POWERTRAIN SYSTEMS CORPORATION – sources over 490,000 trays, reflecting strong demand in the motor assembly sector.

AAC TECHNOLOGIES VIET NAM – supplies molded trays for mobile device components and precision acoustic modules.

Together, these firms account for more than 55% of Vietnam’s total export volume of HS 39231090 products in the first half of 2025.

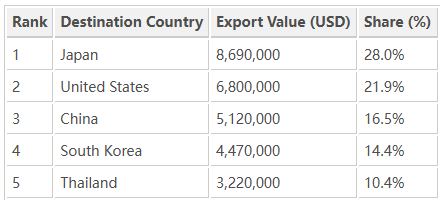

Main Export Destinations

Vietnam’s plastic tray exports are widely distributed across Asia and North America. The top five destinations by export value are as follows:

Japan remains the top destination, driven by long-term supply relationships with Canon, Kyocera, and Tamron factories. Meanwhile, the U.S. and South Korea show growing demand, reflecting shifts in electronics supply chains seeking cost-effective packaging alternatives in Vietnam.

Trend and Outlook

The export structure of Vietnam’s plastic tray industry reflects the country’s deep integration into global electronics supply chains. As investment in high-tech manufacturing continues to expand—particularly from Japan and South Korea—demand for molded and anti-static trays will likely grow further.

For the remainder of 2025, exports are expected to maintain a stable monthly volume of around 22–25 million trays, supported by increasing orders from camera, semiconductor, and electronic assembly industries. With continuous upgrades in mold precision and material innovation, Vietnam’s plastic tray producers are well positioned to capture more high-value packaging contracts.

Data Source

All figures are based on NBD DATA global customs database, analyzing Vietnam’s export declarations for HS 39231090 (Plastic Tray) between January and June 2025.

For detailed exporter directories, buyer profiles, or pricing intelligence, please visit the NBD DATA Service Page.