Analyzing Pakistan’s Feed Additive Import Market: Leading Buyers, Suppliers, and Trade Routes

The first half of 2025 has seen Pakistan’s animal nutrition sector continuing to strengthen its global linkages, with feed additives (HS Code 23099000) playing a crucial role in supporting livestock and poultry productivity. According to NBD DATA, Pakistan’s import of feed additives reflects dynamic sourcing behavior, growing diversification of supplier nations, and a notable increase in import volumes, particularly from China and Europe.

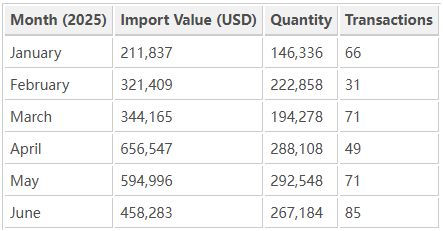

Overview of Feed Additive Imports (January–June 2025)

Between January and June 2025, Pakistan imported 1.41 million units (or equivalent metric quantity) of feed additives valued at approximately USD 2.59 million, across 373 recorded import transactions.

A total of 71 importers and 95 exporters were involved in this trade, representing 22 supplier countries, highlighting a diverse and globally integrated supply chain.

Import activity peaked in April 2025, coinciding with increased feed formulation demands in Pakistan’s poultry and dairy industries. The steady performance through May and June reflects stable consumption needs in animal husbandry and continuous dependence on external feed supplement sources.

Leading Importers

Pakistan’s feed additive imports are spearheaded by specialized distributors and veterinary pharmaceutical companies that maintain close relationships with international producers. The top-performing importers during the first half of 2025 are:

DMG PHARMACEUTICAL – The market leader, importing 243,000 units valued at USD 412,618. Major suppliers include NOREL S.A. (Spain) and ADISSEO NL B.V. (Netherlands).

SCHIWOPAKISTAN – Imported 87,735 units worth USD 289,716, sourcing primarily from NFA İLAÇ KİMYA SAN VE TİC LTD ŞTİ (Turkey) and ZHENGZHOU BAIRUI ANIMAL PHARMACEUTICAL CO., LTD (China).

IBKB (PRIVATE) LTD.– Recorded imports of 72,190 units valued at USD 58,941, working with M/S. METHODO CHEMICALS S.R.L (Italy) and TAV VETERINARIA S.L (Spain).

A&K PHARMACEUTICALS – Procured 46,440 units worth USD 137,035, collaborating with DSM NUTRITIONAL PRODUCTS EUROPE LTD (Netherlands) and BENTOLI AGRINUTRITION CO., LTD (Thailand).

MB MARKETING – Imported 37,630 units valued at USD 61,357, with suppliers from Malaysia and Jordan, including AMT LOGISTICS (M) SDN BHD and JORDANIAN EXPERT FOR VETERINARY MEDICINE AND FEED.

Collectively, these firms represent the core of Pakistan’s animal feed additive import ecosystem, ensuring supply continuity for poultry and livestock feed manufacturers nationwide.

Key Global Suppliers

The supplier network for feed additives in Pakistan demonstrates both regional proximity and global reach. European, Chinese, and Southeast Asian manufacturers dominate the export flow.

NFA İLAÇ KİMYA SAN VE TİC LTD ŞTİ (Turkey) – The largest exporter to Pakistan with USD 141,248 in shipments to SCHIWOPAKISTAN.

VEMEDIM CORPORATION (Vietnam) – Exported USD 25,878 worth of additives to AL-ASAR ENTERPRISES.

JINAN GSY BIOTECHNOLOGY CO., LTD (China) – Supplied USD 26,752 of feed additive products to multiple Pakistani importers.

ZHENGZHOU BAIRUI ANIMAL PHARMACEUTICAL CO., LTD (China)– Recorded USD 32,146 in exports of veterinary-grade additives.

FRACON AGRIFOOD TARIM URUNLERI A.S. (Turkey) – Exported 24,250 units valued at USD 11,918, maintaining a strong supply relationship with Dux Pharmaceuticals (Pakistan).

These partnerships highlight the increasing role of Turkish and Chinese manufacturers in supplying cost-effective nutritional solutions to Pakistan’s feed industry, while European firms retain influence in high-value specialty products.

Major Trade Regions

Pakistan’s imports originate from a wide range of partner countries, indicating robust supply diversification. The top ten trade regions by import value are:

China remains Pakistan’s dominant trade partner for feed additives, supplying both bulk ingredients and specialty formulations. Meanwhile, Turkey and Europe serve as critical secondary sources for branded additives and high-purity ingredients used in premium livestock feeds.

Market Analysis and Trends

Three notable dynamics characterize Pakistan’s feed additive imports in 2025:

-

Supply Chain Diversification – Imports span 22 countries, reducing overdependence on any single source. China leads in volume, but European suppliers contribute significantly to product quality diversity.

-

Shift Toward Nutrient-Enriched Additives – Importers increasingly favor high-efficiency blends that enhance animal performance and feed conversion ratios, reflecting modernization in livestock management.

-

Regional and Trade Policy Influence – The Pakistan-China trade corridor and proximity to Turkey and Vietnam provide logistic advantages, while European trade agreements continue supporting value-added imports.

Despite challenges such as currency fluctuations and transport costs, Pakistan’s feed additive market remains resilient, underpinned by a steadily expanding poultry and dairy sector.

Outlook

The feed additive market is projected to maintain stable growth throughout 2025, with increasing investment from both domestic distributors and international suppliers. Rising demand for fortified animal nutrition, biosecurity in livestock, and sustainable feed formulations will continue to drive import activity.

For Pakistan, enhancing local formulation capacity could reduce import dependency over time, but in the short term, global partnerships — particularly with China, Turkey, and the EU — will remain central to supply stability.

Data Source

All trade statistics are derived from official customs-based data processed by NBD DATA. The analysis covers transactions between January 1, 2025, and June 30, 2025, for HS Code 23099000 (FEED ADDITIVE) under the category of Pakistan Imports.

For further trade intelligence or customized data services, visit NBD DATA Service Portal.