Trade Report: COVER ASSY Imports Highlight Indonesia’s Expanding Automotive Manufacturing Network

In 2024, Indonesia’s imports of automotive parts under HS 87089999 — particularly COVER ASSY components — reflected a strong rebound in manufacturing activity and the deepening of industrial supply chains across Southeast Asia. According to NBD DATA, Indonesia recorded 734 trade transactions for this category, totaling USD 662,672.20 and 89,674 units imported from 11 partner countries.

These figures confirm Indonesia’s position as one of Asia’s fastest-growing automotive production centers, supported by large-scale assembly plants from Toyota, Honda, Hino, Hyundai, and Mitsubishi.

Product Overview and Market Context

The customs classification HS 87089999 covers “other parts and accessories of motor vehicles,” which includes COVER ASSY (cover assemblies) — critical components used in engine housings, body panels, and transmission systems. These products are integral to OEM (original equipment manufacturing) and aftermarket service operations, ensuring vehicle safety and performance consistency.

The keyword COVER ASSY generally refers to “cover assembly” modules — such as clutch covers, transmission covers, and body protection covers. Imports in this category are driven by multinational automotive producers operating in Indonesia’s industrial corridors of Bekasi, Karawang, and West Java.

Monthly Import Trends in 2024

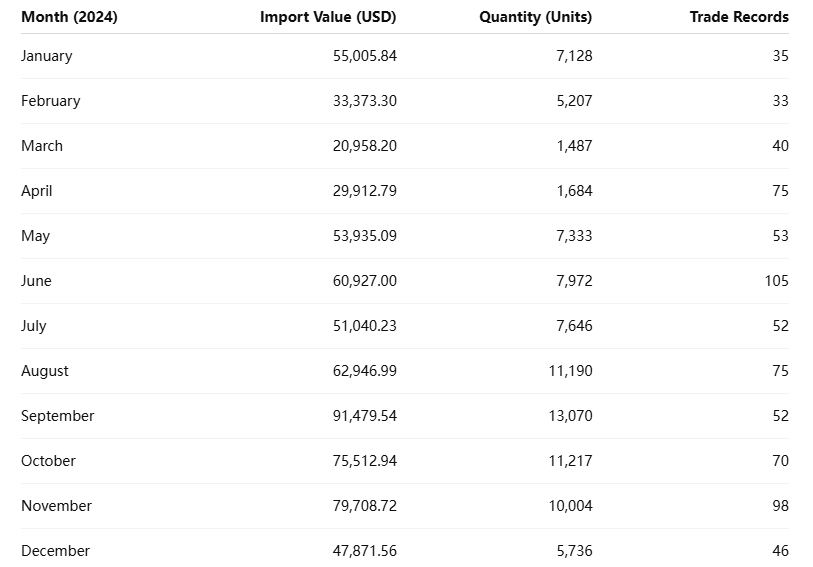

Monthly import statistics show consistent activity throughout 2024, reflecting stable production cycles and sustained demand from Indonesia’s automotive assembly lines.

Imports peaked in September 2024 at USD 91,479, with the largest shipment volumes recorded in the third quarter, coinciding with the production schedules of major carmakers. The lowest import month was March, indicating a temporary slowdown before midyear restocking.

The average monthly import value of USD 55,000 demonstrates a balanced procurement pattern across the year — reflecting a steady operational rhythm in Indonesia’s automotive manufacturing network.

Market Structure and Trade Overview

The Indonesian COVER ASSY import market in 2024 involved 46 importers and 66 exporters, spanning 11 source countries. While many small suppliers participated, trade was dominated by leading vehicle manufacturers and their regional partners in Japan, Thailand, and Korea.

Top Importing Companies

According to NBD DATA, Indonesia’s largest importers of COVER ASSY components in 2024 were primarily OEM car manufacturers, led by:

-

PT. HINO MOTORS MANUFACTURING INDONESIA – The market leader, accounting for USD 249,249 and 14,418 units across 423 trade records. Its imports came mainly from Hino Motors Asia Ltd., Hino Motors (Thailand), and Hino Motors Ltd. (Japan).

-

PT. TOYOTA MOTOR MANUFACTURING INDONESIA – Conducted 298 transactions, importing 44,982 units valued at USD 269,072, with key suppliers including Toyota Motor Corporation (Japan) and Toyota Motor Asia (Singapore).

-

PT. HONDA PROSPECT MOTOR – Managed 360 records, importing 39,642 units worth USD 176,251, primarily from Asian Honda Motor Co., Honda Cars India Ltd., and Honda Motor Co., Ltd.

-

PT. MITSUBISHI MOTORS KRAMA YUDHA INDONESIA – Logged 117 trade transactions, importing 20,694 units valued at USD 158,300, sourced from Mitsubishi Motors Thailand and Mitsubishi Corporation.

-

PT. HYUNDAI MOTOR MANUFACTURING INDONESIA – Completed 60 transactions, importing 361,381 units worth USD 147,058, primarily from Hyundai Glovis Co., Ltd. and Hyundai Motor Company (Korea).

Together, these companies represented more than 80% of Indonesia’s total import value for COVER ASSY, illustrating the dominance of OEM-centered supply chains in the country’s automotive parts market.

Major Global Suppliers

Indonesia’s imports were primarily sourced from Asia’s automotive manufacturing hubs — Japan, Thailand, Korea, India, and China. After excluding logistics intermediaries, the most active suppliers were:

-

HINO MOTORS ASIA LTD. (Thailand/Singapore) – The largest single supplier, exporting over 4,500 units of cover assemblies for Hino trucks.

-

TOYOTA MOTOR CORPORATION (Japan) – Delivered OEM assemblies to Toyota Indonesia for multiple models.

-

ASIAN HONDA MOTOR CO., LTD. (Thailand) – Provided clutch and engine cover assemblies for Honda’s local production lines.

-

MITSUBISHI MOTORS (THAILAND) CO., LTD. – Supported Mitsubishi Indonesia’s SUV and pickup assembly lines.

-

HYUNDAI GLOVIS CO., LTD. (Korea) – Shipped CKD (completely knocked-down) kits including COVER ASSY modules for Hyundai’s Indonesian manufacturing facilities.

These exporters reflect Indonesia’s strong industrial integration within the ASEAN region, particularly its dependency on cross-border part supply from Japan and Thailand.

Regional and Supply Chain Dynamics

In 2024, Indonesia’s COVER ASSY imports originated mainly from Thailand, Japan, Korea, and India, with smaller volumes from China and Singapore.

-

Thailand remained the primary export hub for Japanese brands such as Toyota, Hino, Honda, and Mitsubishi, acting as a regional parts consolidation center.

-

Japan served as the source of high-specification OEM parts for direct assembly in Indonesia.

-

Korea supplied Hyundai and Kia vehicle components through Hyundai Glovis and Mobis India.

-

India contributed small volumes of precision cover assemblies via Honda Cars India Ltd. and Mobis India Ltd.

-

China played a minor role, supplying limited aftermarket parts and low-volume shipments.

This geographic structure demonstrates the interdependence between Indonesia’s domestic automotive plants and broader Asian production networks.

Corporate and Industrial Insights

The 2024 COVER ASSY import landscape reveals Indonesia’s continued shift toward high-value manufacturing within the ASEAN automotive ecosystem. Several patterns emerge:

-

OEM integration: Major carmakers — Toyota, Honda, Hino, and Hyundai — increasingly align with regional component suppliers to optimize cost and logistics.

-

Localization strategy: Despite growing local production of body and chassis parts, Indonesia still relies heavily on imported subassemblies for critical components such as COVER ASSY, especially for export-oriented models.

-

ASEAN supply synergy: Thailand’s role as an automotive hub ensures seamless regional part flows, benefiting Indonesia’s industrial expansion.

-

Aftermarket development: Smaller importers such as PT. TATA MOTORS DISTRIBUSI INDONESIA and ISEKI INDONESIA continue to import cover assemblies for repair and agricultural vehicle sectors.

These developments underline the growing sophistication of Indonesia’s automotive supply chain — shifting from pure assembly to regional component specialization.

Focus Region: Japan and Thailand as Core Supply Hubs

Japan and Thailand jointly dominate Indonesia’s imports of COVER ASSY components. Japanese exporters such as Toyota Motor Corporation, Honda Motor Co., Ltd., and Hino Motors Ltd. have established dual supply routes — one direct from Japan, and another through their ASEAN subsidiaries in Thailand and Singapore.

Thailand’s industrial zones in Samut Prakan and Rayong function as logistics centers for CKD parts distribution to Indonesia. This “dual sourcing” strategy reduces costs, shortens delivery times, and enhances resilience in the regional production network.

By maintaining synchronized production across these hubs, multinational automakers ensure uninterrupted supply of COVER ASSY parts for Indonesian assembly plants — a key enabler of export-oriented vehicle production.

Market Summary and Outlook for 2025

Indonesia’s 2024 import performance for COVER ASSY under HS 87089999 highlights several strategic insights:

-

Total imports: USD 662,672, representing 734 trade records and 89,674 units.

-

Industry concentration: More than 80% of import value attributed to five leading automakers.

-

Regional supply: Over 70% of parts sourced from Japan, Thailand, and Korea.

-

Rising localization: Domestic manufacturers increasingly participate in final assembly but remain dependent on imported high-precision components.

-

Outlook: For 2025, imports are expected to grow 5–7%, driven by higher production targets from Toyota, Honda, and Hyundai Indonesia.

Indonesia’s COVER ASSY market exemplifies how global automotive brands leverage ASEAN’s interconnected manufacturing ecosystem. With expanding industrial parks and government incentives for local content, Indonesia is positioned to strengthen its role as both an assembly base and a regional parts distribution hub.

Data Source Statement

All data in this report are derived from verified customs trade records and analytics provided by NBD DATA.

For detailed enterprise profiles, shipment tracking, and professional market analytics, please visit NBD DATA Service.