Paraguay Customs Import Data Update - July 2024

Overview

In July 2024, Paraguay's import activities showed significant fluctuations across various sectors, reflecting both global economic conditions and specific domestic demands. According to the latest data provided by NBD Data, the total number of import entries recorded this month reached 116,468, marking an increase of 22.50% from the previous month’s 94,659 entries. Year-over-year, the total entries saw a rise of 19.32% compared to July 2023, which recorded 97,611 entries.

The total import value for July 2024 amounted to $2.23 billion, a substantial increase of 26.79% from the previous month's $1.76 billion, and a 15.37% rise year-over-year from July 2023's $1.93 billion. The number of importers also saw a notable rise, with 3,597 registered importers, up by 8.87% from June 2024 and 12.38% compared to July 2023.

Top Imported Commodities

Paraguay’s top five imported commodities for July 2024 cover a diverse range of sectors, reflecting the country's ongoing industrial and agricultural needs:

HS 310520 - Mineral or Chemical Fertilizers: The import value for this category reached $245.59 million, marking an 82.09% increase from the previous month and an 18.92% rise year-over-year. This significant growth highlights the continued demand for fertilizers to support Paraguay's agricultural sector.

HS 271019 - Petroleum Oils and Oils Obtained from Bituminous Minerals: Imports in this category totaled $168.49 million, reflecting a 7.75% month-over-month increase and a 37.24% year-over-year rise. This increase underscores the country's reliance on petroleum products for energy and industrial purposes.

HS 851713 - Mobile Phones and Wireless Communication Devices: The import value for these goods was $139.11 million, up by 19.37% from June 2024. However, there was a significant 33.96% decrease year-over-year, indicating a potential saturation in the market or changes in consumer preferences.

HS 271012 - Light Oils and Preparations: Imports in this category reached $121.62 million, marking a 4.78% month-over-month increase and a substantial 76.17% year-over-year growth. The demand for light oils reflects the broader needs of the transportation and manufacturing industries.

HS 310420 - Potassium Fertilizers: The import value was $97.14 million, with a 53.15% month-over-month increase and a 61.90% year-over-year rise, highlighting the importance of potassium fertilizers in supporting crop yields.

Top Imports from the United States

The United States remains a key trading partner for Paraguay, contributing significantly to the country’s import profile. The top five imported commodities from the U.S. are as follows:

HS 851713 - Mobile Phones and Wireless Communication Devices: Paraguay imported $96.47 million worth of these goods in July 2024, a 20.26% increase from June 2024. However, there was a 48.48% decrease year-over-year, suggesting shifting trends in consumer demand.

HS 847130 - Portable Digital Computers: Imports totaled $30.99 million, a 22.89% month-over-month increase, yet a slight 1.20% decrease year-over-year. The steady demand for digital technology reflects the growing need for connectivity and remote work solutions.

HS 271019 - Petroleum Oils and Oils Obtained from Bituminous Minerals: Imports from the U.S. amounted to $13.75 million, marking a 5.88% increase from June 2024 and a 221.41% increase year-over-year, indicating a strong reliance on U.S. petroleum products.

HS 851762 - Data Processing Machines: Imports in this category were $13.01 million, a slight decrease of 10.63% month-over-month, yet a 12.35% increase year-over-year, showcasing the continued importance of data and communication technologies.

HS 852589 - Video Cameras and Other Recording Devices: Imports reached $9.36 million, with a 18.71% month-over-month increase and a significant 86.45% year-over-year rise, highlighting the increasing demand for surveillance and media technology.

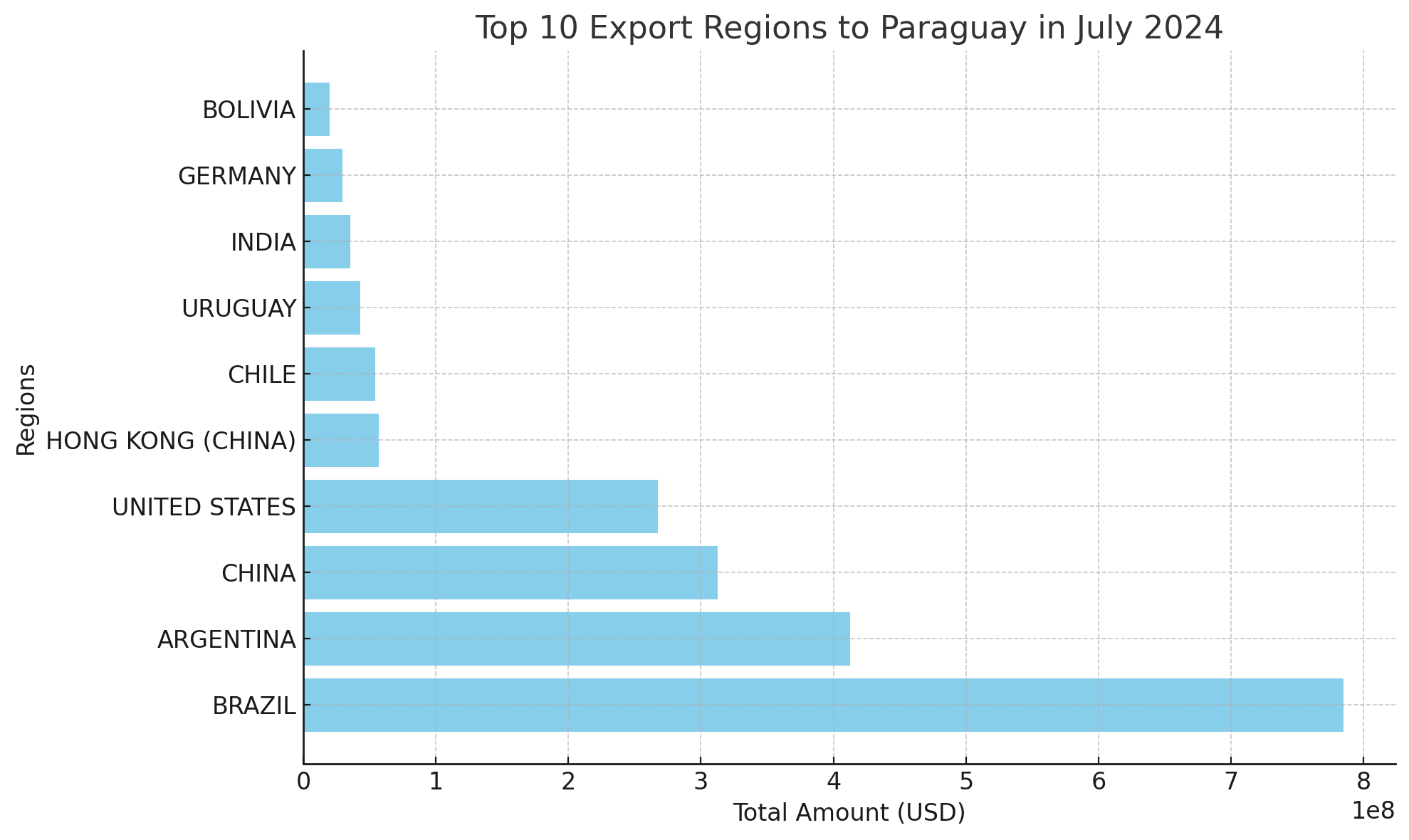

Key Export Regions to Paraguay

Paraguay’s import activity is strongly influenced by its trade relationships with key regions. The top ten regions exporting to Paraguay in July 2024 are:

Brazil: The leading exporter to Paraguay with $784.97 million worth of goods, a 40.07% increase from June 2024 and a 14.37% rise year-over-year. Brazil’s exports include essential commodities like oil, machinery, and agricultural products.

Argentina: Exports to Paraguay totaled $412.59 million, marking a 17.41% increase month-over-month and a 48.05% year-over-year rise, driven by the trade in foodstuffs and energy products.

China: Imports from China were $312.86 million, a 34.96% increase from the previous month and a 21.87% rise year-over-year. China continues to be a crucial partner, especially in the electronics and machinery sectors.

United States: The U.S. exported $267.66 million worth of goods to Paraguay, a 11.24% increase month-over-month. However, there was an 18.99% decrease year-over-year, indicating a potential shift in trade dynamics.

Hong Kong (China): Exports to Paraguay reached $56.67 million, a 22.63% increase from June 2024 and an impressive 112.00% year-over-year rise, driven by the demand for electronics and communication devices.

Chile: Chilean exports amounted to $54.29 million, a 43.96% month-over-month increase and a 54.89% year-over-year rise, with a focus on agricultural products and consumer goods.

Uruguay: Exports from Uruguay totaled $43.10 million, a 12.96% increase from June 2024. However, there was a 35.16% decrease year-over-year, possibly reflecting changes in trade priorities.

India: Imports from India were $35.16 million, an 86.31% month-over-month increase and a 55.25% year-over-year rise, with pharmaceuticals and textiles being major export items.

Germany: German exports to Paraguay amounted to $29.46 million, marking an 8.93% month-over-month increase and a 27.08% year-over-year rise, focusing on automotive and industrial machinery.

Bolivia: Imports from Bolivia reached $19.98 million, a 12.81% increase from June 2024 and a significant 94.23% year-over-year rise, driven primarily by natural gas and mineral exports.

Conclusion

The July 2024 import data for Paraguay reflects a robust and dynamic trade environment. The country continues to diversify its import sources while meeting the demands of its growing economy. NBD Data remains committed to providing detailed and accurate trade data to help businesses navigate the complexities of international trade.

For more detailed data and insights, please visit NBD Data's official website: en.nbd.ltd.