Automotive and Industrial Giants Drive India’s PIN Import Market in 2025

In 2025, India’s imports under HS Code 73182990—covering PIN and similar fasteners—showed dynamic growth, fueled largely by the country’s robust automotive and industrial sectors. According to data compiled by NBD DATA, total imports reached USD 17.76 million, spanning 34,306 transactions and involving 61 source countries. This performance highlights India’s expanding reliance on precision fastening components to support both its manufacturing and assembly lines across industries from automobiles to heavy machinery.

Representative imported items include “steel cotter pins” and “stainless mechanical locking pins”, illustrating the dual demand for automotive-grade and high-strength industrial types that meet ISO and JIS standards.

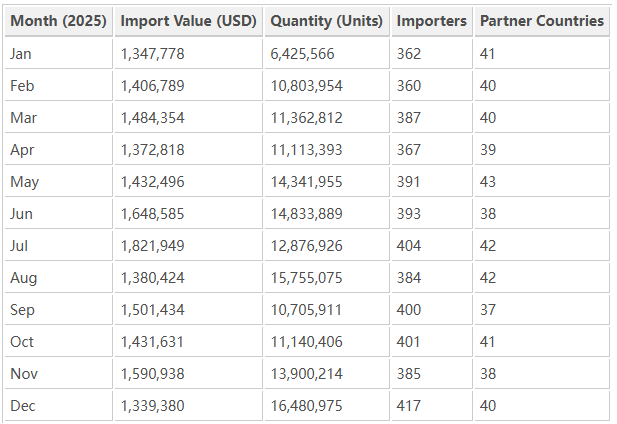

Monthly Performance Trends

Across 2025, India’s import value for PINs maintained remarkable stability with moderate fluctuations. The monthly import values ranged between USD 1.33 million and USD 1.82 million, indicating a consistent flow of industrial inputs.

The highest import value appeared in July 2025, driven by large orders from Japan and Germany for the automotive supply chain, coinciding with seasonal production peaks in India’s passenger vehicle segment.

Leading Importers in India

India’s PIN import structure is dominated by automotive manufacturers and tier-one suppliers. Top importers in 2025 include:

-

TOYOTA TSUSHO INDIA PRIVATE LIMITED

-

Major partners: Toyota Tsusho Corporation (Japan), Toyota Tsusho Asia Pacific (Singapore)

-

-

-

Major partners: HASCO Hasenclever GmbH & Co KG (Germany), McMaster-Carr Supply Company (USA)

-

-

GE OIL & GAS INDIA PRIVATE LIMITED

- Partners include Dresser Italia S.R.L. and Tornitura Sud S.R.L. (Italy)

-

GOODRICH AEROSPACE SERVICES PRIVATE LIMITED

-

Suppliers: NMG Aerospace (USA) and Pattonair Limited (UK)

-

-

DYNAMATIC TECHNOLOGIES LIMITED

-

Partners: Spirit AeroSystems (Europe) Ltd. (UK)

-

These firms represent India’s high-end manufacturing clusters—automotive, aerospace, and energy—where advanced fastening technologies are essential to ensure safety, performance, and production consistency.

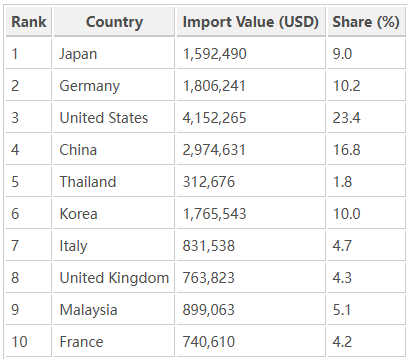

Key Foreign Suppliers

India’s PIN imports are mainly sourced from Japan, Germany, the United States, and China. The 2025 data indicate a diversified supplier base:

ISUZU MOTORS INTERNATIONAL OPERATIONS (THAILAND) CO. – supplying for Isuzu’s Indian assembly operations

TOYOTA MOTOR ASIA (SINGAPORE) PTE LTD. – major regional logistics node for Toyota components

TOYOTA TSUSHO CORPORATION – strategic parts supplier integrating Japanese production lines

BMW AG – consistent source for automotive-grade fasteners

HONDA MOTOR CO., LTD.– shipping structural pins and precision fittings for domestic assembly

These global suppliers together contributed a major portion of India’s import value, underscoring the deep integration between Indian OEMs and international automotive ecosystems.

Regional Trade Distribution

According to NBD DATA’s trade analysis, India’s PIN imports were geographically concentrated across a few industrialized regions:

Japan and Germany remain key technical suppliers, particularly for high-tolerance automotive and aerospace fasteners, while China and Korea provide high-volume industrial and construction-grade pins at competitive prices.

Focus on China as a Partner

As India’s largest Asian trading counterpart for this HS category, China contributed nearly USD 3 million in 2025, representing 17% of total import value. Product examples include “machined steel dowel pins” and “cold-forged spring pins” used in automotive subassemblies and general machinery.

China’s suppliers offered an array of mid-range and customized fastening components that supported both automotive and electronics manufacturing in India. The bilateral exchange demonstrates how India’s fastener market is diversifying supply chains while maintaining cost competitiveness.

Market Insights and Outlook

The 2025 data underline several key developments in India’s PIN import market:

-

Automotive recovery – Strong demand from passenger-vehicle production boosted imports, particularly from Japan and Thailand.

-

Diversification of sources – European suppliers expanded their footprint in aerospace-grade and precision fasteners.

-

Rising localization – Indian assemblers such as Toyota Kirloskar Motor and Honda Cars India increased procurement through domestic affiliates but still relied on imported high-specification components.

-

Supply chain resilience – Stable month-to-month imports indicate improved inventory management and supplier integration.

Looking forward, India’s PIN import market is expected to grow in line with its manufacturing ambitions under “Make in India 2.0”. With continuous investment from automotive and industrial giants, the country will likely shift toward hybrid sourcing models combining local production and strategic imports.

Summary

The PIN market (HS 73182990) serves as a clear reflection of India’s industrial momentum. The country’s 2025 import value of USD 17.76 million underscores robust industrial consumption and technical collaboration with Japan, Germany, the US, and China. Automotive and aerospace manufacturers remain the main importers, ensuring continued modernization of fastening systems and production quality.

Data Source

All trade data and company details are derived from NBD DATA

global customs analytics. For enterprise-level dashboards, please visit the service portal:https://en.nbd.ltd/service