Ethiopia’s Imports Edge Higher in April 2025, Fueled by Energy and Transport Sectors

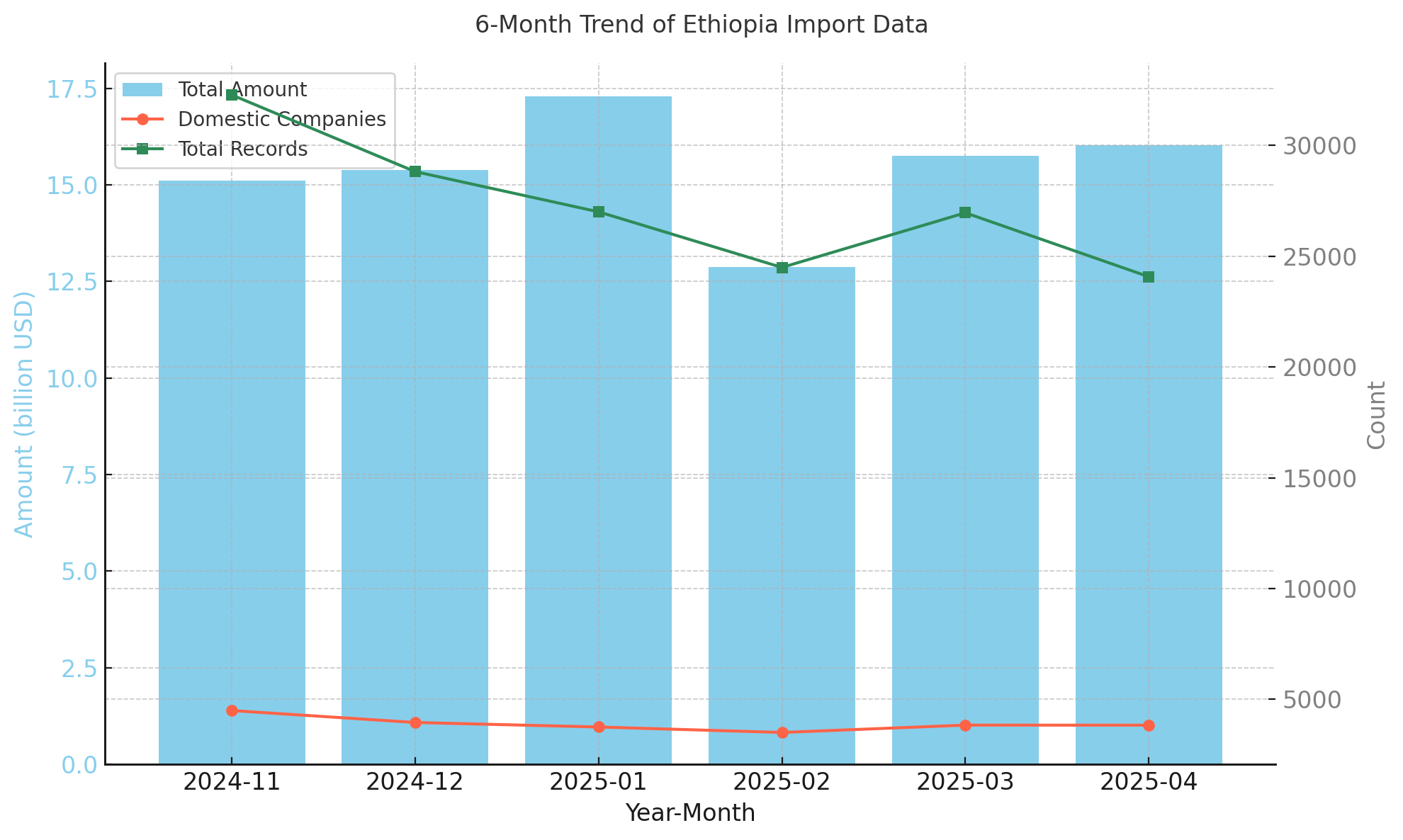

Ethiopia's external trade activity exhibited modest but steady growth in April 2025. The country imported goods worth $1.60 billion, representing a month-over-month increase of 1.77% from March's $1.57 billion. This performance, based on 24,071 recorded transactions, points to a cautiously expanding import landscape, supported primarily by critical sectors such as petroleum and logistics.

Over the past six months, Ethiopia’s import volume has fluctuated within a notable range. Following a sharp dip in February 2025 ($1.29 billion), the country quickly rebounded to levels above $1.5 billion in March and April, suggesting a short-lived contraction. Company participation remained stable during this period, with April witnessing 3,837 Ethiopian importers, only slightly down from the prior month. Meanwhile, the overall record count declined—indicating either larger consolidated transactions or reduced variety in imported commodities.

Bilateral Trade: A Concentrated Matrix of Influence

The distribution of Ethiopia’s top import partners in April underscores a highly asymmetrical structure. China led all trade counterparts with $399 million in exports to Ethiopia, servicing 1,766 domestic buyers across 1,806 product categories. This confirms China’s expansive footprint in Ethiopia's industrial, consumer, and infrastructure-related imports.

Djibouti ranked second with $323 million, likely reflecting continued reliance on the Red Sea gateway for port and transit services, rather than diversified goods per se. Kuwait and Saudi Arabia, with $245 million and $210 million respectively, primarily fulfilled Ethiopia’s critical demand for refined petroleum products. Notably, Kuwait’s trade contribution was driven by a single transaction class with a lone importer and supplier—an archetype of bulk energy trade.

Further down the list, India ($68 million), the UAE ($49 million), and Jordan ($41 million) contributed through a more varied range of goods, such as processed foods, chemicals, and light machinery. The United States, Hong Kong SAR, and Indonesia each recorded smaller volumes under $30 million, but their involvement reflects Ethiopia’s growing links to global supply chains across different commodity clusters..png)

Surge from Unexpected Quarters: Emerging Trade Contributors

A more dynamic story unfolds when examining growth rates. Ukraine’s import value skyrocketed from a negligible $236 in March to over $12 million in April, an astronomical leap of over 5.1 million percent. While this change is clearly anchored in a low base effect, it hints at the initiation of a new trade corridor—perhaps in agricultural inputs or defense logistics.

Slovakia, Australia, Ireland, and Canada also posted triple- and quadruple-digit growth rates, ranging from 727% to over 4,700%. Canada, with $11.7 million in exports to Ethiopia, appears to be reasserting itself as a mid-tier supplier, possibly in sectors such as agri-tech, transportation, or pharmaceuticals.

Commodity Dynamics: Fuels and Functional Goods Dominate

From a product standpoint, refined petroleum oils (HS 271020) dominated the import ledger with $448 million in value—a 160% increase over March. The Ethiopian Petroleum Supply Enterprise alone accounted for $447 million, reaffirming the centrality of public energy procurement. Two smaller importers, MISBAH MAMMA HAJIAMAN and ABDELLA ADEM GUUTAA, also participated, albeit marginally.

Heavy-duty trucks between 5–20 tons (HS 870422) ranked second among fast-growing commodities, with import value increasing by 141%. Primary buyers included BELAYNEH KINDE MEKONNEN, GOLDEN STAR PLC, and ETHIOPIAN AGRICULTURAL BUSINESSES, indicating demand from agribusiness and infrastructure logistics.

Other notable product categories included milled rice (HS 100630), which surged 115% to reach $13.6 million in imports. Key importers like AHMED HUSSEN MOHAMMED, QUDWA BUSINESS PLC, and NAJIB AHMED ALI underline the role of staple grains in food security.

The aviation sector made a substantial entry this month, with HS 880730 accounting for $23 million in aircraft components—up 64%. ETHIOPIAN AIRLINES GROUPwas the dominant acquirer, perhaps linked to maintenance operations or fleet expansion.

Finally, sugarcane derivatives (HS 170114) brought in $27.8 million, registering a 54% growth. Importers such as EAST AFRICA BOTTLING SHARE CO. and YASIN MOHAMMED OUMER emphasize industrial usage in beverages and confectionery.

Conclusion

Ethiopia’s import performance in April 2025 reinforces a broader trend of structural resilience anchored by energy, transport, and essential commodities. While traditional partners such as China and the Gulf states continue to dominate in scale, the emergence of new contributors like Ukraine and Slovakia highlights a diversification of origin markets. With steady volumes and targeted procurement behavior, Ethiopia appears poised to navigate both supply volatility and developmental demand with growing sophistication.