Assessing Namibia’s May 2025 Import Performance: Key Trends and Drivers

In May 2025, Namibia’s import sector recorded a total value of $636.64 million, down from $806.88 million in April, marking a 21.10% month-on-month decline, based on 279,945 documented transactions. This contraction reflects both seasonal adjustments and shifting demand dynamics, underscoring the importance of ongoing market monitoring to anticipate supply chain impacts and policy implications.

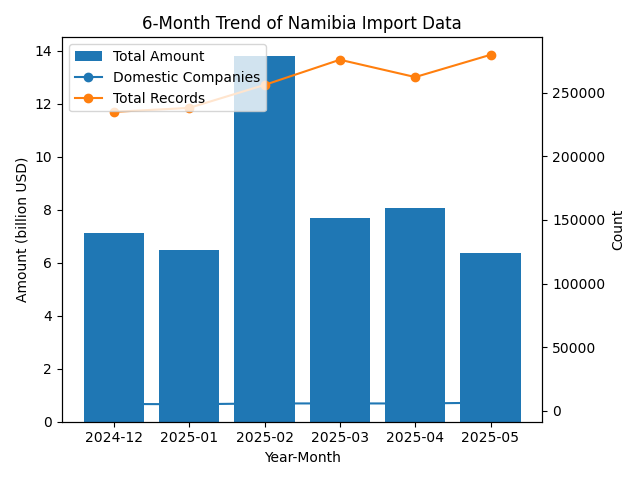

Over the past six months, Namibia’s import values and market activity have exhibited notable fluctuations. Beginning in December 2024, imports stood at $711 million, served by 5,294 domestic purchasing entities across 235,064 records. January saw a moderate dip to $650 million with 5,057 companies and 238,197 entries, before a pronounced surge to $1.382 billion in February—driven by bulk commodity orders—accompanied by 5,682 firms and 256,247 transactions. March’s activity stabilized at $770 million with 5,712 companies and 276,063 records, while April recorded $807 million via 5,658 purchasers and 262,428 entries. May’s figure of $637 million was facilitated by 6,298 domestic buyers across 279,945 transactions, indicating a rebound in participation despite lower overall spend.

South Africa remained Namibia’s largest import partner in May 2025, accounting for $449 million. Domestic purchaser count reached 5,226, while 10,504 South African suppliers delivered 2,558 distinct product categories—ranging from refined fuels to automotive parts—reflecting long-standing regional trade integration.

India followed with $15 million in imports, supported by 32 local buyers and 54 Indian exporters across 73 product lines, notably pharmaceuticals and electronics components, indicating growing diversification of sourcing.

Oman supplied $13 million worth of goods to Namibia, facilitated by only five domestic purchasers and four Omani suppliers, focused predominantly on liquefied natural gas—a strategic niche.

The Netherlands contributed $10 million through 39 Namibian importers and 38 Dutch firms offering 55 product categories, including machinery and chemicals, underscoring Europe’s role in specialized equipment imports.

The remaining partners—United Arab Emirates, Ghana, Italy, Botswana, and China—collectively accounted for $41 million in imports. These five countries engaged 527 domestic purchasers and 582 foreign suppliers across 767 product categories, spanning construction materials, agricultural inputs, and consumer goods, highlighting broadening procurement channels.

.png)

Ghana emerged as the fastest-growing supplier in May, with imports leaping from $543 in April to $8.54 million—a staggering 1,571,777% increase—driven by sudden demand for processed cocoa products amid shifting regional trade agreements.

Bulgaria delivered $61,532 worth of goods, up from $28 in April, representing 214,973% growth, primarily in industrial machinery components as Namibia expands its manufacturing base.

Hungary’s exports to Namibia rose from $139 to $17,594, a 12,515% increase, powered by specialty chemical imports linked to mineral processing.

Slovenia’s shipments increased 2,178.77%, from $3,732 to $85,055, reflecting niche automotive part orders aligned with local vehicle assembly initiatives.

Finland recorded $443,415 in May imports—up from $22,120—marking 1,904.55% growth, largely driven by telecommunications equipment for network upgrades.

The ranking of fastest-growing import products highlights significant shifts in Namibia’s procurement needs:

170199: Sucrose; chemically pure, not containing added flavouring or colouring matter, in solid form saw a 201.37% increase, rising to $11.97 million. Major purchasers include BOKOMO NAMIBIA PTY LTD. and NAMIB MILLS (PTY) LTD..

490700: UNUSED POSTAGE, REVENUE OR SIMILAR STAMPS… climbed 197.19% to $6.09 million, with top buyers Bank of Namibia and Namibia Post Ltd..

300490: OTHER MEDICAMENTS… increased 164.04% to $16.35 million, chiefly procured by Ministry of Health and Social Servi and NAMPHARM (PTY) LTD..

382491: Chemical products… (complex phosphonate mixtures) grew 128.25% to $6.70 million. Leading purchasers are INTERLOGIX NAMIBIA PTY LTD. and NAKARA (PTY) LTD..

382499: Chemical products, mixtures and preparations; n.e.c. heading 3824 rose 61.10% to $6.44 million, with Transworld Cargo (PTY) Ltd. and Bulk Mining Explosives Namibia Pty Ltd. as principal buyers.

conclusion

May 2025’s import performance underscores a market in transition: a marked month-on-month reduction in overall value contrasts with increased buyer participation, while emerging partners and product segments exhibit explosive growth. Strategic diversification—particularly in pharmaceutical, chemical, and telecommunications imports—suggests Namibia’s procurement landscape is broadening. Looking ahead, sustained monitoring of high-growth corridors and deepening trade ties with both established and nascent partners will be critical for steering investment and policy decisions.