Nigeria May 2025 Import Report: Volume, Partner Insights, and Sector Highlights

In May 2025, Nigeria’s total import value reached $7.639 billion, up from $7.126 billion in April 2025—an increase of 7.20%. During this period, Nigerian importers generated 128,027 distinct transaction records, underscoring sustained market activity and robust supply chain engagement.

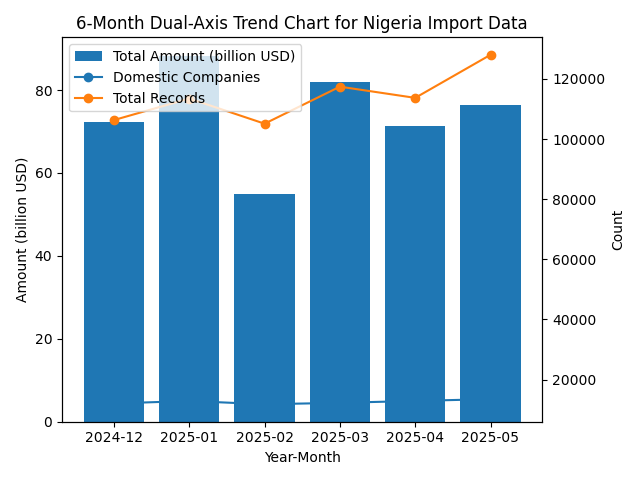

Over the past six months, Nigeria’s import values have fluctuated notably. In December 2024, imports stood at $7.221 billion with 12,052 active domestic firms and 106,327 records; January 2025 peaked at $8.829 billion alongside 12,890 firms and 113,480 records before dipping to $5.486 billion in February with 11,798 firms and 105,116 records. March saw a recovery to $8.204 billion (12,269 firms; 117,431 records), April settled at $7.126 billion (12,903 firms; 113,702 records), and May rebounded to $7.639 billion with 13,497 firms and 128,027 records. These movements reflect seasonal purchasing patterns, inventory restocking cycles, and evolving demand dynamics.

China remained Nigeria’s top supplier in May 2025, accounting for $1.392 billion in imports. Nigerian procurement involved 4,125 domestic companies, while 6,913 Chinese suppliers dispatched goods across 2,234 distinct product categories, highlighting deep bilateral industrial linkages and diversified sourcing strategies.

India ranked second with $247 million in exports to Nigeria. A total of 1,169 Nigerian importers engaged with 1,694 Indian exporters across 1,056 product lines, driven by substantial trade in pharmaceuticals, textiles, and machinery components.

Togo secured the third spot with $208 million in exports. Despite only 18 Nigerian buyers and 15 Togolese suppliers, trade spanned eight categories—primarily agricultural produce and processed food—underscoring niche cross-border commerce.

The United States supplied $207 million worth of goods. Some 3,927 Nigerian companies procured from 2,142 U.S. exporters across 1,120 product categories, especially electronics, aerospace components, and specialized chemicals.

Collectively, the remaining partners—Belgium ($136 million; 451 Nigerian buyers; 443 Belgian suppliers; 463 categories), the United Kingdom ($96 million; 732 buyers; 1,399 suppliers; 793 categories), the Netherlands ($82 million; 376 buyers; 478 suppliers; 533 categories), the United Arab Emirates ($71 million; 519 buyers; 734 suppliers; 606 categories), and Brazil ($66 million; 50 buyers; 71 suppliers; 63 categories)—contributed $451 million in imports, reflecting moderate but diverse contributions to Nigeria’s procurement landscape.

Liberia led month-on-month growth with imports surging to $28.33 million from virtually zero ($14) in April—an extraordinary 196,447,528.50% increase, largely driven by expanded timber and rubber shipments as bilateral relations strengthen.

Burkina Faso’s imports rose from $1 million to $0.52 million—a 38,205.93% uptick—fueled by burgeoning trade in staple grains and artisanal metallurgy.

Mauritius saw imports climb to $621,705 from $2,244, up 27,597.21%, reflecting growing demand for specialized apparel and electronic components.

Namibia’s shipments increased to $8.08 million from $52,648, marking a 15,245.15% rise, driven by expanded trade in minerals and meat products.

Gabon recorded $250,311 in imports versus $1,663 in April—a 14,951.17% leap—anchored by crude wood products and agricultural commodities.

The fastest-growing product category in May was 851762, communication apparatus, with imports jumping from $34.63 million to $83.45 million (+140.94%). Major Nigerian buyers include MTN Nigeria Communications PLCand Airtel Networks Ltd., which collectively accounted for over $72 million in purchases.

HS 851779 (miscellaneous data transmission machines) climbed 135.38% to $29.03 million; leading importers were MTN Nigeria Communications PLC and Samsung Electronics West Africa Ltd..

Refined petroleum preparations (HS 271012) rose 67.42% to $420.05 million, with Vitol S.A. and Matrix Energy Ltd. leading at nearly $173 million combined.

HS 854143 (electronic parts) increased 47.55% to $26.88 million, notably imported by Dangote Cement PLC.

Polyethylene terephthalate (HS 390769) grew 32.16% to $15.65 million; key buyers were Firstchem Import and Export Co., Ltd. and Sentric Vik Limited.

May 2025’s import landscape reflects Nigeria’s strategic diversification of suppliers, with China and India maintaining leadership while emerging partners like Liberia and Burkina Faso exhibit meteoric growth. High-velocity product segments—especially communication apparatus and petroleum preparations—underscore shifting industrial priorities. Looking ahead, sustained infrastructure investments and trade facilitation measures are poised to drive continued expansion and broader market integration.