March Trade Data Signals Strategic Pivot in Mexico’s Import Composition

Mexico’s latest import figures suggest a clear structural shift, moving away from traditional commodities toward high-tech and energy-related goods. In March 2025, the country recorded $17.18 billion in imports, a 3.73% increase from February, according to NBD DATA. This rebound is not merely cyclical—it highlights a deepening reorientation of Mexico’s supply priorities.

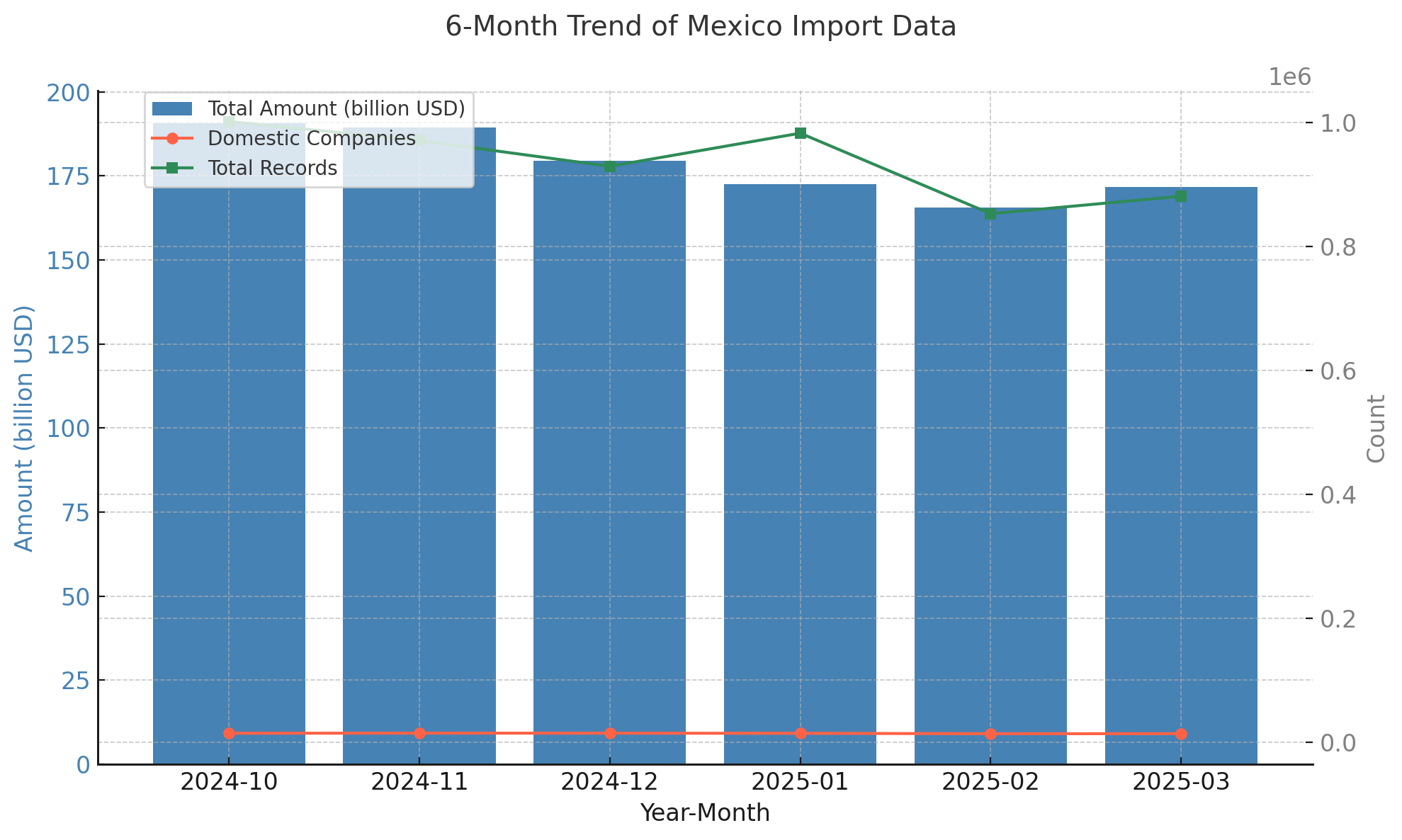

A Modest Rebound After a Multi-Month Decline

Over the past six months, Mexico’s import volumes had been under steady pressure, dropping from $19.08 billion in October 2024 to just $16.56 billion in February 2025. March’s uptick marked the first sign of recovery, supported by 881,115 trade records and a marginal increase in the number of active domestic importers, now totaling 13,810.

China Maintains Dominance, U.S. and Germany Follow

China remains Mexico’s leading import source with $5.635 billion, accounting for more than 30% of the country’s total inbound trade. The trade relationship spans over 3,000 product categories and involves 16,180 Chinese suppliers—a strong indicator of deep industrial integration. By contrast, the United States supplied $2.073 billion, driven mainly by advanced manufacturing components and intermediate goods, supported by 963 unique product lines.

Germany and Japan followed closely, contributing $1.175 billion and $988 million, respectively, primarily in precision machinery and electronics. A second-tier cluster—Korea, Brazil, India, Vietnam, Spain, and Italy—each delivered between $400 million and $940 million, reflecting growing participation in Mexico’s evolving industrial ecosystem..png)

Surge from Non-Traditional Partners

Five countries experienced meteoric month-over-month import growth: Senegal, Cuba, Haiti, San Marino, and Lebanon. While absolute values were small, the percentage growth—ranging from 4,500% to over 612,000%—reflects dynamic, if volatile, sourcing patterns. These spikes could represent pilot orders in pharmaceuticals, chemicals, or niche manufacturing..png)

Technology-Led Import Categories

Mexico’s import surge in March was driven largely by goods aligned with energy, electrification, and next-generation vehicles:

HS code 290919 (“Other chemical compounds”) nearly tripled in value to $229 million. Key buyers included PETROLEOS MEXICANOS, PEMEX TRANSFORMACION INDUSTRIAL EPS, and VALERO MARKETING AND SUPPLY DE MEXICO.

HS code 850760 (Lithium-ion batteries) grew 144.63% month-over-month to $153.6 million, led by MAQUILA SOLUTIONS MEXICO, TECHTRONIC INDUSTRIES MEXICO, and SCHENKER INTERNATIONAL SA DE CV.

-

HS code 870380 (Fully electric vehicles) reached $151 million, up 92%, with leading imports by BYD MEXICO, CHANGAN AUTO MEXICO, and NISSAN MEXICANA.

HS code 870360 (Plug-in hybrid vehicles) also jumped over 63%, topping $197 million. Purchases were led by BYD MEXICO, BMW DE MEXICO, and CHANGAN AUTO MEXICO.

HS code 120190 (“Other oilseeds”) grew 66% to $93 million, pointing to increased demand in agri-processing. Major importers included ACEITES GRASAS Y DERIVADOS, INDUSTRIAL PATRONA, and PROTEINAS Y OLEICOS.

Strategic Implication

According to NBD DATA, Mexico is no longer just rebounding in terms of volume—it is realigning its import mix to support industrial upgrading, energy transition, and resilient supply chains. As EVs, batteries, and advanced chemicals gain prominence in the import ledger, March 2025 may well be remembered as a pivotal month in the evolution of Mexico’s trade structure.