Bangladesh’s Imports Fell to $6.49B in April 2025, with China Dominating the Trade Landscape

In April 2025, Bangladesh reported total imports of $6.49 billion, reflecting a 3.25% decline from the previous month’s $6.71 billion. Despite the contraction in total value, activity remained elevated with 394,489 customs entries recorded, underscoring continued procurement momentum across key industries. This analysis is based on transactional-level intelligence extracted by NBD DATA, a global leader in customs analytics.

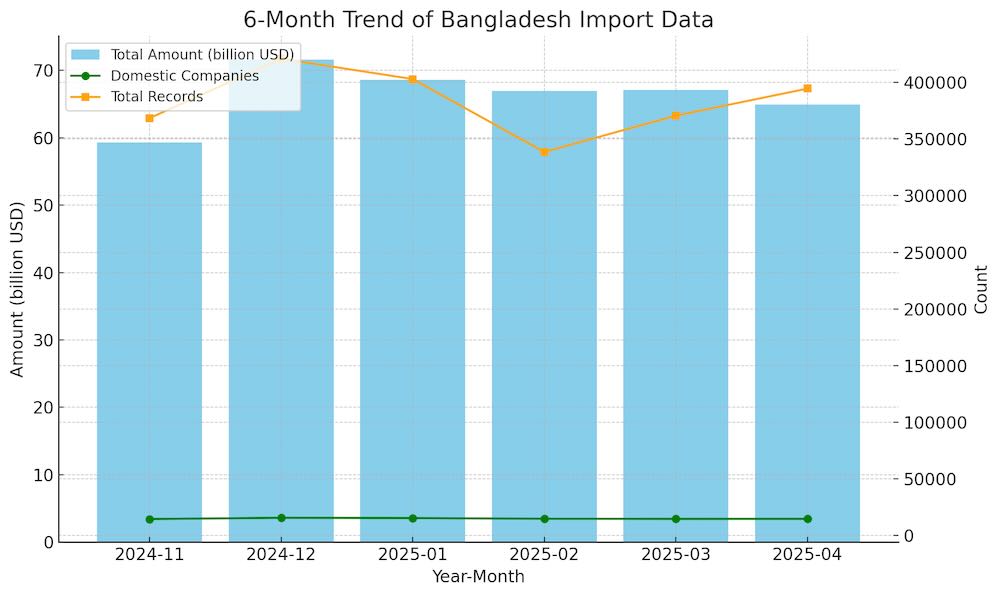

6-Month Dual-Axis Trend Analysis

The past six months reveal a gradual downward trajectory in import volume following a peak of $7.16 billion in December 2024. While April’s figure marks a continued decline, Bangladesh’s import ecosystem has proven resilient. 14,706 domestic firms were active in April—broadly in line with previous months—while the total number of records increased for the second consecutive month, pointing to a possible shift toward smaller, more frequent orders and diversified sourcing.

Top 10 Trade Partners: China Extends Its Lead

China remains Bangladesh’s primary import source, contributing $1.989 billion, which accounts for nearly 31% of total monthly imports. The breadth of this partnership is significant—8,352 Bangladeshi importers engaged with 29,023 Chinese exporters, spanning 3,073 distinct product categories. This robust channel underscores China’s critical role in supplying raw materials, equipment, and intermediate goods.

India ranked second with $851 million, facilitated by 5,102 domestic importers and 9,119 Indian suppliers across 2,019 product lines. This long-standing corridor continues to support Bangladesh’s textile and industrial base.

Indonesia and Brazil contributed $495 million and $377 million, respectively. Indonesia maintained a relatively balanced exchange between 563 Bangladeshi firms and 608 Indonesian exporters, while Brazil’s narrow product focus—just 67 categories—suggests a concentration in agro-based and primary commodities.

Other notable partners include Singapore, Japan, Malaysia, Saudi Arabia, the United States, and Vietnam. Together, they accounted for nearly $13 billion in cumulative trade value, enhancing the country’s access to electronics, chemicals, and finished goods.

.jpg)

Nontraditional Markets See Explosive Month-Over-Month Growth

April’s data revealed surprising momentum from several nontraditional partners. Trinidad and Tobago surged by a staggering 427,946%, albeit from a negligible base, reaching $111,292. Similarly, Bosnia and Herzegovina, Moldova, Croatia, and Estonia posted growth rates ranging from 7,194% to 17,660%. While absolute values remain small, these figures indicate Bangladesh is actively expanding its supplier network to hedge supply chain risks and optimize price dynamics.

.jpg)

Product Trends: Technical Fabrics and Electronics Take the Lead

April’s import surge was led by five high-performing HS codes, signaling robust demand in textiles and technology:

HS 600192: Pile synthetic fabrics surged 184.11% to $67.16 million. Top importers included AKH STITCH ART LTD. with $2.19M and KNIT ASIA LIMITED with $2.07M—both major players in Bangladesh’s apparel exports.

HS 600410: Wide elastic knitted fabrics rose 132.52%, totaling $88.39 million. Leading buyers were CRYSTAL MARTIN APPAREL BANGLADESH and LIZ FASHION INDUSTRY LIMITED, key suppliers for international retail brands.

HS 540752: Dyed polyester woven fabric increased 71.74%, with TITAS SPORTSWEAR INDUSTRIES LTD. and YOUNGONE (CEPZ) LIMITED as top importers.

HS 590320: Polyurethane-coated textiles grew 61.39% to $44.15M. SNOWTEX OUTERWEAR LTD and BARIDHI GARMENTS LTD. were key actors in this segment, reflecting strong demand for technical outerwear materials.

HS 854239: Electronic integrated circuits gained 53.36%, with monthly volumes reaching $30.04 million. Major technology importers included ISMARTU TECHNOLOGY BD LTD. and BENLI ELECTRONIC ENTERPRISE CO..

Conclusion

While Bangladesh’s total imports dipped slightly in April 2025, deeper insights from NBD DATA suggest underlying expansion in strategic sectors. Established channels with China and India remain strong, while a notable rise in technical fabrics and semiconductors marks the country’s evolving industrial priorities. Simultaneously, growth from smaller economies and rare trade partners reflects a tactical diversification of sourcing strategies.

As the global supply chain landscape continues to evolve, Bangladesh appears to be positioning itself for greater flexibility and competitiveness in key manufacturing sectors.