Ecuador’s Imports Edge Up in April 2025: U.S. Holds Top Supplier Position

Ecuador's import activity in April 2025 showed moderate yet steady growth, reaching $2.74 billion, up 2.34% from March’s $2.68 billion. With over 2.22 million import records, the country continues to show healthy external demand and diversified sourcing. This growth trajectory, while not dramatic, confirms Ecuador’s ongoing reliance on international suppliers, especially from key global partners like the United States and China.

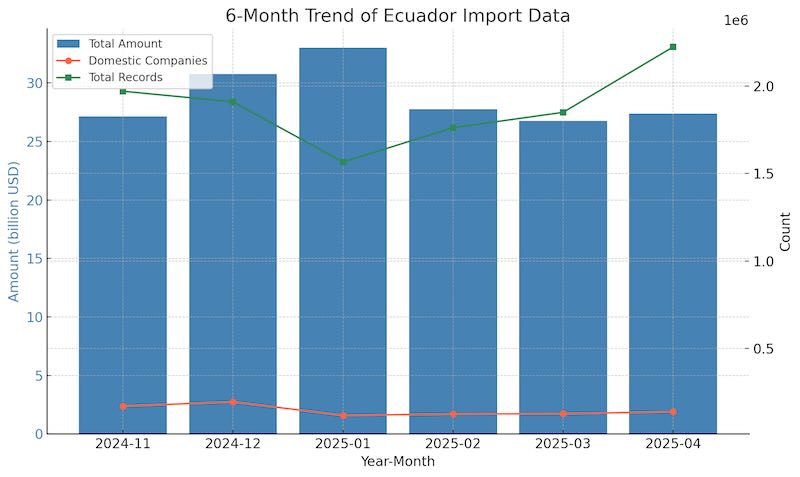

6-Month Import Trend: Signs of Stabilization After January Peak

Over the past six months, Ecuador’s imports have seen notable fluctuations. The country peaked at $3.3 billion in January, followed by a downward adjustment in February ($2.78 billion) and March ($2.68 billion). April’s rebound to $2.74 billion suggests a stabilizing trend. Meanwhile, the number of domestic importing companies has increased, from 126,971 in March to 138,683 in April, alongside a sharp rise in import record volume, now exceeding 2.22 million. This signals an expansion in transaction count and possibly more diversified procurement strategies across industries.

Top 10 Trade Partners: U.S. and China Dominate, Neighbors Expand Presence

United States continues to lead as Ecuador’s top trade partner, accounting for $806 million in imports. With 126,660 Ecuadorian importers engaging with over 2,800 U.S. exporters, and 2,374 product categories, the bilateral trade is both broad and deep—likely including machinery, electronics, and agricultural inputs.

China follows with $486 million, engaging 4,402 Ecuadorian firms and 4,228 Chinese suppliers. The China-Ecuador corridor remains strong, especially in electronics, consumer goods, and industrial machinery, reflecting China’s competitive pricing and supply chain scale.

Colombia, Ecuador’s immediate neighbor, delivered $169 million worth of goods. This robust figure underscores regional proximity and integrated sectors such as food processing, chemicals, and light manufacturing. 1,585 Ecuadorian importers sourced from 1,197 Colombian exporters, showing high bilateral responsiveness.

Peru shipped $127 million, serving 704 Ecuadorian companies. With strong ties in agriculture and processed food, Peru plays a growing complementary role.

The remaining six partners—Brazil, Argentina, Germany, Chile, Spain, and Panama—each contributed between $57 million and $112 million. While smaller in volume, their diversity in categories (from vehicles to pharmaceuticals and chemicals) suggests broad multi-sector trade resilience.

.png)

Fastest Growing Trade Partners: Surges from Lebanon, Somalia, and the Pacific

The most dramatic month-on-month growth came from Lebanon, whose exports to Ecuador jumped by 6,882.57%, totaling $31.6 million—possibly due to large one-off shipments or new trade channels. Similarly, Somalia (+3,613.86%), Serbia (+2,792.48%), and Kosovo (+2,471.34%) showed sharp, albeit low-base growth. Meanwhile, Kiribati, a Pacific Island nation, grew over 2,000%, reaching nearly $5.8 million, which could point to specialized commodity flows or logistics partnerships.

.png)

Fastest Growing Product Segments: Tuna, Vehicles, and Mobile Phones Surge

The product category with the highest monthly growth was HS code 100199, labeled as "Wheat and meslin" totaling $40.47 million—a 153.4% increase. Major importers included MODERNA ALIMENTOS S.A and GISIS S.A., likely covering bulk food commodities.

Next, HS code 030342—Yellowfin tuna—rose 141.75% to $21.37 million, with import leaders such as ASISERVY S.A and EMPELISA S.A.S. sourcing fresh and frozen seafood.

Mobile phones under HS code 851713 reached $56.9 million, a 62% jump, led by LIDENAR S.A., MPHONE MASTER PHONE S.A.S., and DUOCELL S.A..

In the automotive sector, HS code 870340—covering hybrid engine vehicles—jumped 53%, with leading importers like SZK DEL ECUADOR S.A. and TOYOTA DEL ECUADOR S.A..

Finally, HS code 030343—Skipjack tuna—climbed 52.99%, reaching $21.72 million, with major players including TECOPESCA and SEAFMAN.

Conclusion: A Diverse and Resilient Import Profile

April’s import data shows Ecuador’s resilience in maintaining trade flows despite global disruptions. The U.S. retains a dominant position, while China and regional neighbors continue to support critical segments. The growth of emerging partners and niche products—particularly in seafood, vehicles, and telecom—highlight Ecuador’s dynamic and responsive trade policy. For U.S. exporters, the message is clear: Ecuador remains an attractive and expanding market across sectors.