High-Tech Machinery and Fertilizers Boost Ethiopia’s Imports Despite Monthly Decline

In May 2025, Ethiopia recorded total imports amounting to USD 1.53 billion, representing a 4.66% decrease from April’s USD 1.60 billion. Despite this month-over-month decline, the volume of trade activity remained resilient, as evidenced by 26,700 customs records. A total of 3,869 Ethiopian importers were active during the month, signaling consistent demand across key sectors.

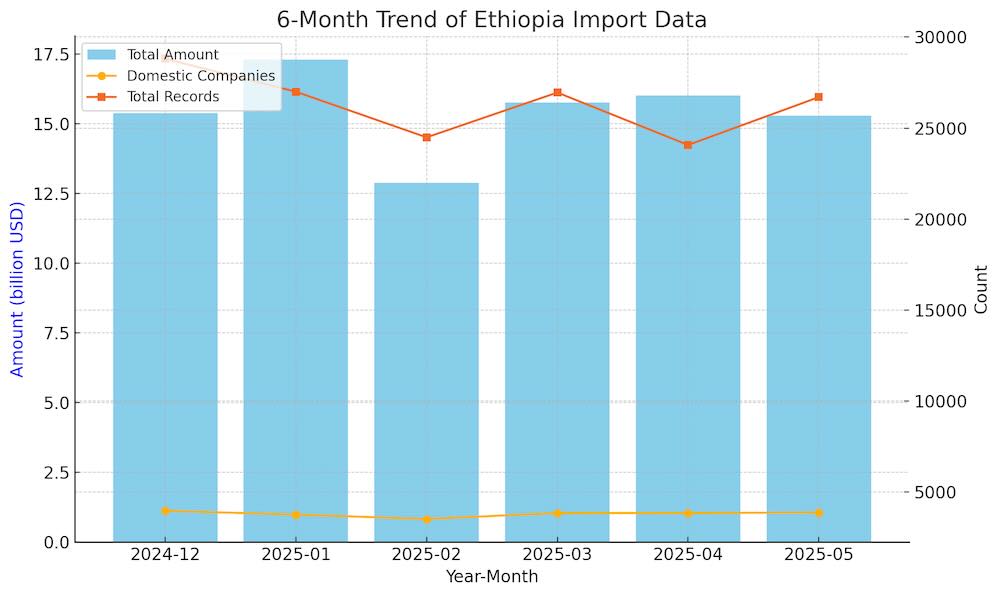

Over the past six months, Ethiopia’s import performance has shown a fluctuating trend. From USD 1.54 billion in December 2024, imports surged to USD 1.73 billion in January, dipped to USD 1.29 billion in February, then rebounded to USD 1.58 billion in March and USD 1.60 billion in April before tapering off in May. The number of domestic importers remained relatively stable, fluctuating modestly between 3,500 and 3,900. This pattern suggests strong underlying trade resilience despite cyclical adjustments.

Among Ethiopia’s top trading partners in May 2025, China remained the largest contributor, supplying goods worth USD 358 million across a wide spectrum of 1,889 product categories. A total of 1,719 Ethiopian importers were involved in this trade, highlighting China’s continued dominance as Ethiopia’s most diversified and critical supplier.

Djibouti ranked second with USD 346 million in imports and 943 Ethiopian companies engaged. As Ethiopia’s key maritime and transit gateway, Djibouti plays a vital logistical role in facilitating broad-based commodity inflows, spanning 817 product types.

Kuwait followed with USD 193 million in goods imported, although the trade was highly concentrated—only 2 Ethiopian companies participated, and just 3 product categories were recorded. This suggests focused imports likely related to energy or petrochemical inputs.

Saudi Arabia contributed USD 140 million in shipments involving 53 Ethiopian importers and 71 distinct product categories, underlining its role in supplying refined fuel, chemicals, and basic industrial inputs.

Other key trading partners included India, the United Arab Emirates, Russia, Belgium, South Korea, and Hong Kong (China). These six economies collectively contributed approximately USD 272 million in imports. The trade involved a wide array of goods—India (603 categories), the UAE (863), Belgium (165), South Korea (147), and Hong Kong (China) (281). Notably, Hong Kong continues to serve as a high-efficiency re-export hub for electronics, components, and consumer goods. The diversity and volume across these markets reinforce Ethiopia’s growing integration into multiple global supply networks.

.jpg)

The fastest-growing trade relationships in May were led by Romania, which surged by an astonishing 517,450.55% to USD 2.7 million, likely driven by the entry of new commodity categories. Lithuania, Qatar, and Colombia also showed explosive growth exceeding 6,000%, albeit from a low base. Sudan rounded out the top five with a 2,757.65% increase to USD 671,000, possibly indicating a recovery in regional supply chains. These countries, while representing modest absolute values, point to Ethiopia’s expanding diversification in trade channels.

.jpg)

By commodity, the most significant growth was recorded in turbine parts for jet engines (HS Code: 841191), which rose 146.44% month-over-month to USD 18.49 million. The top importer was ETHIOPIAN AIRLINES GROUP, indicating sustained investment in aviation assets.

Second came mechanical excavators and loaders (HS Code: 842959), with imports rising 115.90% to USD 23.90 million. Leading importers included MOTA-ENGIL, ENGENHARIA E CONSTRUCAO, JERR PRIVATE LIMITED CO., and ANHAMA TRADING P.L.C, reflecting construction and infrastructure momentum.

Ethiopian Agricultural Businesses led the import of diammonium phosphate fertilizers (HS Code: 310530), which more than doubled to USD 87.78 million, emphasizing sustained agricultural input demand.

Herbicides and plant-growth regulators (HS Code: 380893) reached USD 14.59 million (+107.18%), sourced primarily by OROMIA AGRICALTURAL COOPERAT.FEDERA, MEZGEBU DUGUMA DEBESA, and YOHAM PLC.

Finally, therapeutic retail medicaments (HS Code: 300490) grew by 78.48% to USD 41.38 million. The dominant buyer was ETHIOPIAN PHARMACEUTICALS SUPPLY SE, alongside KARE PHARMACEUTICALS PLC and BEKER GENERAL BUSINESS PVT.LTD., underscoring growing healthcare sector demand.

In conclusion, while Ethiopia’s import value contracted marginally in May, the strategic composition of its trade structure remains robust. Major gains in aviation, construction, agriculture, and healthcare suggest forward-looking investments. Powered by NBD DATA, such granular trade intelligence allows stakeholders to track opportunities, optimize sourcing, and anticipate market shifts in real time.