Medical Instruments and Pet Foods Drive Panama’s Import Expansion in April 2025

In April 2025, Panama’s imports totaled USD 1.25 billion, marking a 7.21% increase over the previous month’s USD 1.16 billion. The uptick was supported by 148,717 import records, reflecting a healthy level of transactional activity. According to NBD DATA this momentum signals sustained demand diversification across critical sectors, particularly in healthcare, agriculture, and consumer products.

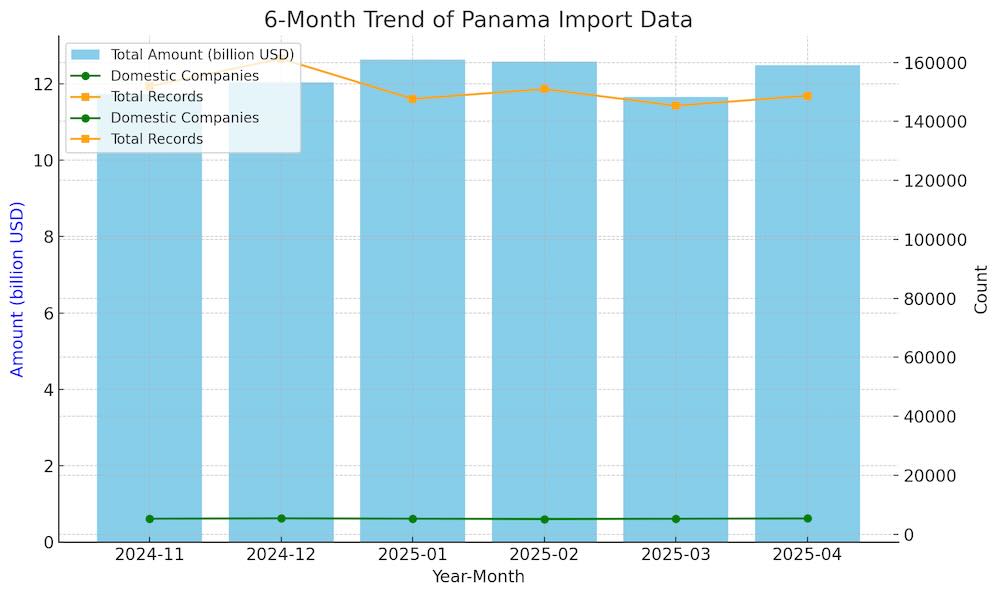

From November 2024 through April 2025, Panama’s import volumes demonstrated relative resilience and consistency. Monthly totals fluctuated within the range of USD 1.17 billion to USD 1.26 billion. The number of active Panamanian importers has remained steady—hovering around 5,200 to 5,400 firms—with April seeing 5,354 domestic entities engaging in cross-border transactions. Total record counts showed minor seasonal variations, indicating a robust data footprint.

The United States remained Panama’s dominant trade partner, contributing USD 247 million in imports. With 1,911 Panamanian buyers transacting with 3,019 American suppliers, the bilateral corridor covered an impressive 2,284 product categories. This underscores Panama’s heavy reliance on U.S.-sourced industrial goods, technology, and consumer merchandise.

China followed closely with USD 161 million, spanning 1,732 local firms and 2,858 Chinese exporters, touching 1,964 categories. The China-Panama trade corridor reflects a high degree of vertical integration and cost efficiency, especially in electronics, machinery, and household goods.

Mexico ranked third with USD 55 million, involving 461 Panamanian companies and 755 Mexican suppliers. Despite the smaller network, its 765-product range points to focused imports in food and intermediate industrial goods. Costa Rica came in fourth with USD 39 million, involving 313 local firms, supplying 413 categories through 384 Costa Rican exporters—a reflection of regional supply-chain connectivity.

The remaining six of Panama’s top 10 partners—Colombia, Spain, France, Japan, and Guatemala—contributed a collective USD 150+ million. Though individually smaller, their trade portfolios enhance Panama’s market diversity and product sourcing flexibility..jpg)

While traditional partners maintained volume leadership, new entrants surged. Algeria led the growth board with a staggering 71,713.96% month-over-month increase—from just USD 137 in March to nearly USD 99,000 in April. Malta and Estonia posted similarly sharp expansions, with 42,895.72% and 31,203.56% increases, respectively.

Guyana and the Netherlands Antilles also showed exponential gains, driven by niche commodities and smaller-volume experimental shipments. These figures signal a potential broadening of Panama’s supplier base in energy, agro-commodities, or medical materials..jpg)

At the commodity level, the fastest-growing product was the HS code 851713, likely referring to mobile communications equipment, with import values rising from USD 8.68 million to USD 18.30 million (+110.88%). Key importers included COMPUTACION MONRENCA PANAMA S A, CABLE & WIRELESS PANAMA S A, and BRIGHT PANAMA CORP., signaling ongoing infrastructure upgrades in the telecom sector.

Medical instruments under HS code 901890 saw imports jump 108.58%, led by CYBER ROBOTICS PANAMA S.A. and PROMOCION MEDICA S.A. This aligns with broader regional investments in healthcare infrastructure.

Other notable gainers included 100119 (non-seed durum wheat) with USD 7.94 million, 040690 (unprocessed cheese) at USD 5.29 million, and 230990 (non-retail pet food) at USD 7.06 million. Importers such as HARINAS DEL ISTMO S.A., NESTLE PANAMA, S.A., and OPEN BLUE SEA FARMS PANAMA S A underscore Panama’s evolving food ecosystem and rising consumer sophistication.

In conclusion, Panama’s April 2025 import profile demonstrates a well-balanced combination of traditional trade strength and emerging opportunities. Medical equipment and pet food categories represent both economic and social transitions, while the surge from new trade partners suggests a strategic diversification in procurement routes. As geopolitical dynamics and supply chains evolve, NBD DATA anticipates that Panama will continue leveraging its logistical position to optimize import flows and expand bilateral trade horizons.