Evaluating Lesotho’s May 2025 Import Dynamics and Partner Landscape

In May 2025, Lesotho’s import sector recorded a total import value of $146,261,342, up from $129,994,730 in April 2025, marking a 12.51% month-on-month increase across 108,667 individual transactions. This solid uptick underscores growing demand among domestic importers and suggests sustained momentum in Lesotho’s foreign procurement activities.

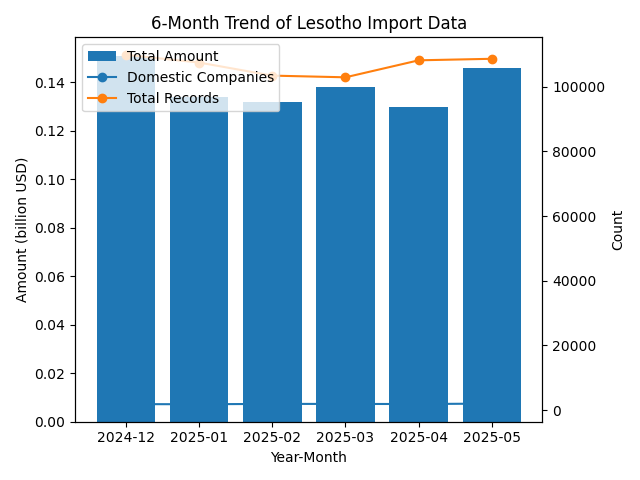

Recent Six-Month Trend Analysis

Over the past six months, Lesotho’s import values have fluctuated modestly between $130 million and $151 million. Starting at $151 million in December 2024, imports eased to $134 million in January 2025 before dipping slightly to $132 million in February. In March, values rebounded to $138 million and then receded to $130 million in April, before surging to $146 million in May. Domestic importer counts ranged from 1,802 to 1,915 firms, while total transaction records varied from 102,938 to 109,898. Overall, this reflects stable importer engagement despite some volatility in transaction volume, highlighting a resilient import market in Lesotho.

Top 10 Trade Partner Analysis

South Africa remained by far Lesotho’s dominant supplier in May 2025, with imports totaling $118 million. Some 1,827 domestic importers engaged with 4,400 South African suppliers across 2,729 distinct product categories, reflecting deep regional integration and diverse supply lines in sectors such as textiles, foodstuffs, and machinery.

China ranked second, providing $10 million in goods through 122 domestic importers and 177 Chinese exporters, covering 623 product types. This underscores China’s role in supplying electronics, building materials, and consumer products to Lesotho’s growing market.

Taiwan (China) held the third position at $6 million, involving 9 local importers and 19 Taiwanese suppliers across 63 categories. Key imports include specialized textile machinery and high-precision components, indicating niche but strategic links.

Japan supplied $2 million worth of goods via 46 domestic importers and 68 Japanese exporters in 21 product categories, with strength in automotive parts and industrial chemicals that support Lesotho’s manufacturing and infrastructure projects.

The remaining partners—India ($2 million), Brazil ($1 million), Hong Kong (China) ($1 million), Mozambique ($1 million), and Korea (negligible value)—together represented an additional $6 million in imports. These relationships span pharmaceuticals, agricultural commodities, electronics, and basic manufactured goods, collectively enhancing Lesotho’s import diversity.

.png)

Fastest 5 Countries Growth Analysis

Vietnam led May’s surge with imports jumping from $159 to $110,047—a staggering 68,921% increase—driven largely by new apparel and textile lines that align with Lesotho’s growing garment sector.

Botswana followed, rising from $3,028 to $45,820 (1,412.87%), reflecting expanded regional trade in foodstuffs and construction materials after border facilitation measures.

Thailand’s imports climbed from $613 to $6,713 (994.75%), powered by heightened demand for processed foods and automotive components.

Turkey saw a 654.10% increase, from $22,479 to $169,516, as Lesotho diversified into Turkish machinery and home appliances.

Singapore recorded a 396.88% rise, from $9,371 to $46,564, highlighting its role in supplying electronics and pharmaceuticals following strengthened bilateral trade agreements.

HS Commodity Trends and Buyer Analysis

The most rapidly expanding commodity category was 600690 Fabrics; knitted or crocheted fabrics, other than those of headings 60.01 to 60.04, and other than those made of wool, fine animal hair, cotton, synthetic or artificial fibres, with imports climbing 145.06% from $941,198 to $2,306,485. Leading domestic purchasers include TAI-YUAN GARMENTS PTY LTD. at $1,064,529 and ECLAT EVERGOOD TEXTILES MANUFACTURERS (PTY) LTD. at $751,056, underscoring robust demand in Lesotho’s garment manufacturing industry.

Next, 600632 Fabrics; knitted or crocheted fabrics of synthetic fibres, dyed rose 104.96% to $1,033,955. Major buyers include ECLAT EVERGOOD TEXTILES MANUFACTURERS (PTY) LTD. (UXH190188718) with $609,538 and DUTY FREE SOURCING INC (PTY) LTD at $202,701, reflecting Lesotho’s focus on value-added textile inputs.

The third fastest was 520100 Cotton; not carded or combed, up 99.34% to $2,446,536, driven by purchases from FORMOSA TEXTILE COMPANY (PTY) LTD at $2,440,745 and SMC BRANDS PTY LTD (NBDD3Y525117659) at $2,983.

Also notable was 170113 Sugars; raw cane sugar, solid form, which rose 73.23% to $1,234,618, with LESOTHO FLOUR MILLS (PTY) LTD (NBDD3Y525116892) at $895,671 and LESOTHO SPLIT PEAS BEANS SUGAR PACKERS & DISTRIBUTERS (PTY) LTD at $338,918 leading imports.

Finally, 151219 Vegetable oils; sunflower seed or safflower oil, refined increased 72.87% to $1,290,894, with top buyers SEFALANA TRADING (PTY)LTD (NBDD3Y525117044) at $463,987 and DE FENG ENTERPRISE (PTY) LTD (NBDD3Y525117167) at $162,374, reflecting diversified demand in Lesotho’s food processing sector.

May 2025’s import performance demonstrates Lesotho’s resilient and diversifying procurement landscape. The significant month-on-month increase, robust engagement with South Africa and China, and explosive growth from emerging partners like Vietnam highlight evolving trade dynamics. Key commodity surges in textiles, cotton, sugar, and oils, driven by major domestic manufacturers, point to strategic opportunities for supply chain optimization. Looking ahead, Lesotho is well-positioned to deepen partnerships, capitalize on high-growth sectors, and continue its steady import expansion.