Trade Snapshot: U.S. Maintains Strong Position in Paraguay's Imports as China, Brazil Dominate

Paraguay’s total imports reached $1.62 billion in April 2025, marking a notable 9.85% increase over the previous month. The rebound—recorded across more than 300,000 import transactions—reflects rising industrial demand and stable procurement momentum. This update is based on real-time customs intelligence from NBD DATA, a global trade analytics platform tracking more than 3 million companies worldwide.

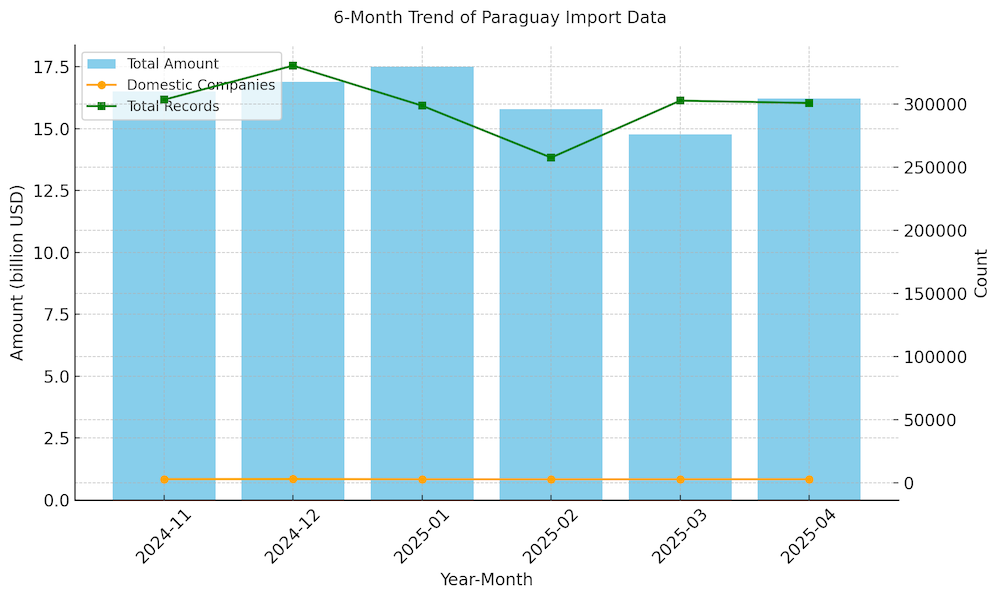

6-Month Trends Indicate Market Resilience

From November 2024 through January 2025, Paraguay’s imports steadily increased, peaking at $1.75 billion in January. A soft dip followed in February and March—down to $1.58B and $1.48B respectively—before rebounding in April. The number of domestic importers hovered around 2,900–3,100 over the six-month window, while transaction volume remained robust, highlighting a resilient and active trade environment.

Brazil, Argentina, China Lead; U.S. Holds Fourth

Brazil continued its dominance, supplying $440 million worth of goods, including over 2,200 product types. More than 1,400 Paraguayan importers sourced from 2,438 Brazilian exporters, underlining strong bilateral dependency.

Argentina followed with $331 million, serving 448 Paraguayan companies with goods spanning 836 categories—largely focused on agricultural inputs and fuels.

China, a major supplier of electronics, chemicals, and machinery, ranked third at $303 million. The country supported trade across 1,551 product categories, engaging 891 Paraguayan importers and 1,109 Chinese exporters.

The United States retained a firm fourth position at $178 million. Trade between the U.S. and Paraguay involved 509 domestic buyers and 603 U.S. exporters across 995 product categories, especially in sectors like advanced machinery, industrial chemicals, and agri-tech.

Rounding out the Top 10: Chile ($46M), Hong Kong ($43M), Uruguay ($39M), UAE ($27M), Germany ($25M), and Vietnam ($17M). These smaller yet strategically significant partners highlight Paraguay’s increasingly diversified sourcing landscape..png)

Fastest-Growing Partners: Latvia and Egypt Show Exponential Rises

Latvia surged by 32,996%, climbing from just over $6,000 to $2 million in a month—likely tied to specialty or niche commodities.

Egypt and Hungary followed with growth rates of 3,793% and 2,106%, respectively, with both likely contributing specialized chemical or processed goods.

Bulgaria and Finland also showed sharp upticks above 900%, reinforcing the expansion of Paraguay’s procurement base toward non-traditional sources..png)

Commodity Spotlight: Fertilizers and Energy Lead Growth

In April, fertilizer and energy-related commodities dominated growth trends:

Potassium chloride (HS 310420) surged 338.96% to $28 million. Key importers included

AGROTEC S.A.: $19.99M

LAR S.R.L: $3.61M

ABONOS DEL PARAGUAY S.A: $1.91M

NPK mixed fertilizers (HS 310520) rose 183.96% to $40M, led by

AGRO FERTIL S.A.: $18.8M

-

AGROTEC S.A. and TECNOMYL S.A.

Ammonium phosphate blends (HS 310540) also posted a 113% increase to $13M.

Other fast-growing items include misc. electronic equipment (HS 854370)—up 93.6%, with INCOME COMPANY IMPORT EXPORT S.A. importing $46.7M—and light oils and petroleum products (HS 271012), which grew 82.8% to $71M, led by importers like

BARCOS Y RODADOS, S.A.: $13.7M

VITOL ARGENTINA...PARAGUAY: $12.0M

Outlook: A Broader Trade Network, Anchored by Strategic Partners

Paraguay’s April import surge reflects a broader shift toward diversification and sector-specific procurement. While traditional trade partners—Brazil, Argentina, China, and the U.S.—maintain leadership, the rise of niche suppliers and sharp growth in agri-inputs and electronics suggests dynamic repositioning in supply chains.

To access granular company-level intelligence and real-time product movement insights, visit NBD DATA, the authoritative platform for global trade professionals.