April 2025: Namibia’s Import Market Sees 4.79% Monthly Rise, Led by Industrial Machinery

According to trade insights powered by NBD DATA, Namibia’s imports in April 2025 totaled USD 806.88 million, representing a 4.79% increase compared to March’s USD 770.01 million. Based on 262,428 customs records, the report reflects resilient import activity supported by steady transaction volume and sector diversification.

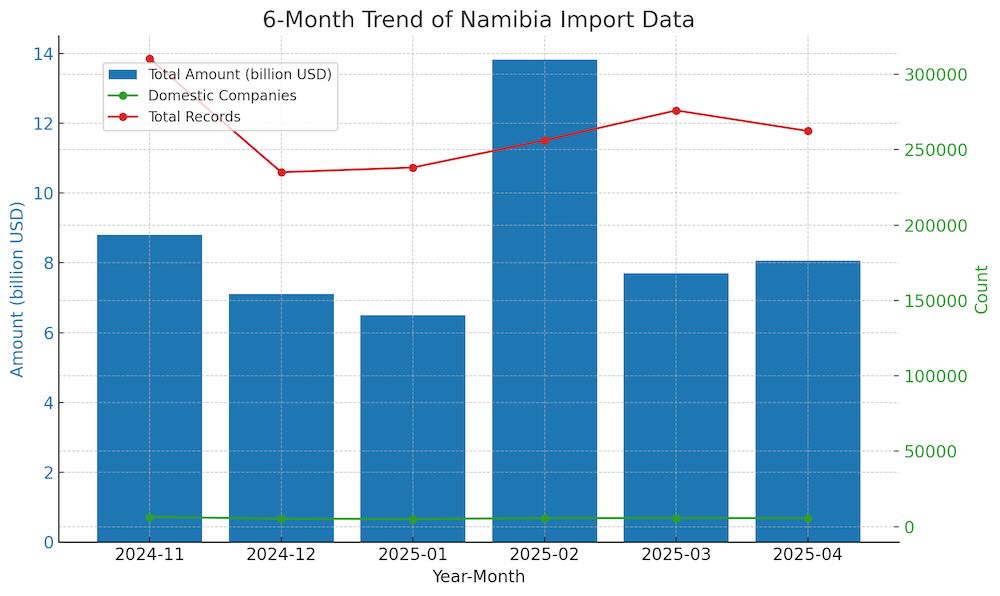

6-Month Import Trend Overview

As tracked by NBD DATA, Namibia’s import patterns over the past six months revealed significant volatility. While November 2024 saw the highest value at USD 880 million, activity tapered to USD 650 million in January before spiking to USD 1.38 billion in February. The rebound to USD 807 million in April signals stable market recovery, with consistent engagement from around 5,000–6,000 domestic importers monthly.

Analysis of Top 10 Trade Partners

South Africa remained Namibia’s top import source with USD 455 million, according to NBD DATA. The bilateral trade featured 4,721 Namibian importers and 10,386 South African suppliers covering 2,517 product types—highlighting deep regional integration.

India ranked second at USD 81 million. With 42 Namibian companies engaging 52 Indian suppliers across 58 categories, the India-Namibia axis reflects a focused and steadily expanding exchange.

Guyana and Equatorial Guinea each contributed USD 35 million, involving minimal participants—two firms from each side—indicating large-scale, commodity-based transactions. Meanwhile, China shipped USD 23 million worth of goods, with balanced engagement: 235 Namibian and 233 Chinese entities across 165 product types.

Together, Egypt, Oman, UAE, Estonia, and others added USD 97 million, enriching Namibia’s supplier diversification and trade adaptability..jpg)

Fastest-Growing Import Partners

NBD DATA highlights Equatorial Guinea’s explosive 553,428% monthly growth to USD 34.72 million—likely from large energy or equipment deals. Egypt followed with a 397,845% increase, signaling possible entry of high-value industrial inputs.

Taiwan (China) rose 54,361% to USD 48,633, likely electronics-related. Latvia and Gabon surged 35,062% and 33,101%, respectively, signaling either strategic one-time shipments or revived trade lanes..jpg)

Product Category and HS Code Trends

The standout performer was Boring or sinking machinery (HS 843143), surging 741.15% to USD 30.14 million. Key buyers included RHINO RESOURCES NAMIBIA LTD., TOTAL E AND P NAMIBIA, and RECONNAISSANCE ENERGY NAMIBIA PTY LTD..

Vehicle-related imports also rose sharply: compact spark-ignition cars (HS 870321) grew 168.09%, led by FIRST NATIONAL BANK OF NAMIBIA LTD. and PUPKEWITZ MOTOR HOLDINGS. Tyre imports (HS 401180) and diesel vehicles (HS 870333) also saw strong growth, involving WALVIS BAY CARGO TERMINAL, EUROPCAR NAMIBIA, and others.

Conclusion

Namibia’s April 2025 imports reveal a steadily recovering trade landscape, with industrial machinery, vehicles, and regional sourcing playing pivotal roles. Insights from NBD DATA underscore how targeted sourcing and product specialization are shaping the country’s evolving import profile—laying the foundation for more resilient and diversified trade channels in the months ahead.