Lithium Metal Price: Analyzing Global Trade Trends with Exclusive Data

Introduction

Lithium metal plays a crucial role in the manufacturing of batteries for electric vehicles and energy storage systems, making its price a key driver in the energy sector. Recently, interest in the "lithium metal price" has surged as industries adapt to the growing demand for sustainable energy. This article provides an exclusive analysis based on global import and export data from NBD DATA, examining the pricing, procurement, and market trends related to lithium metal.

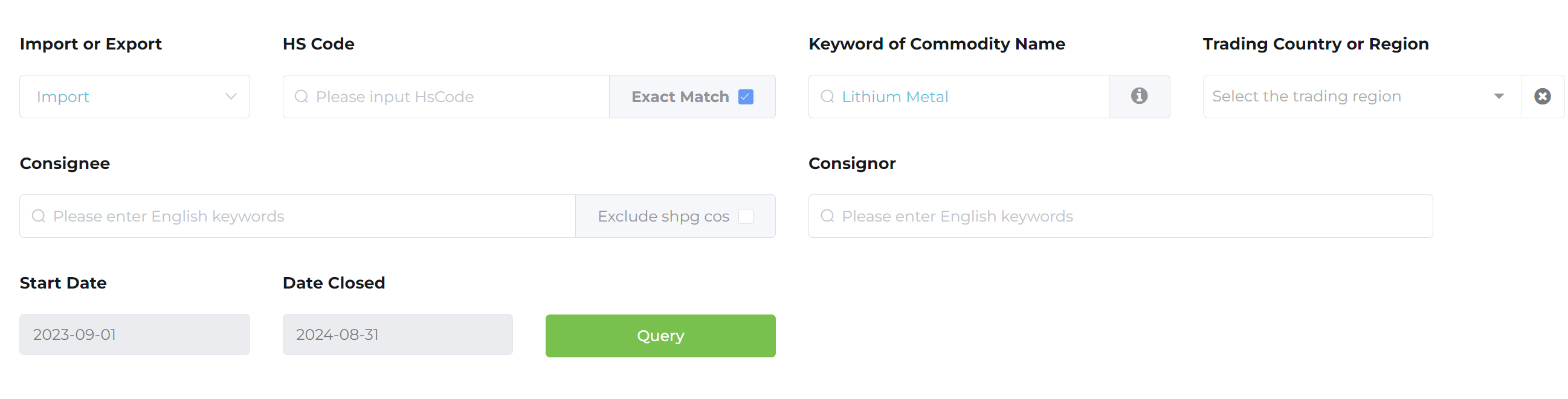

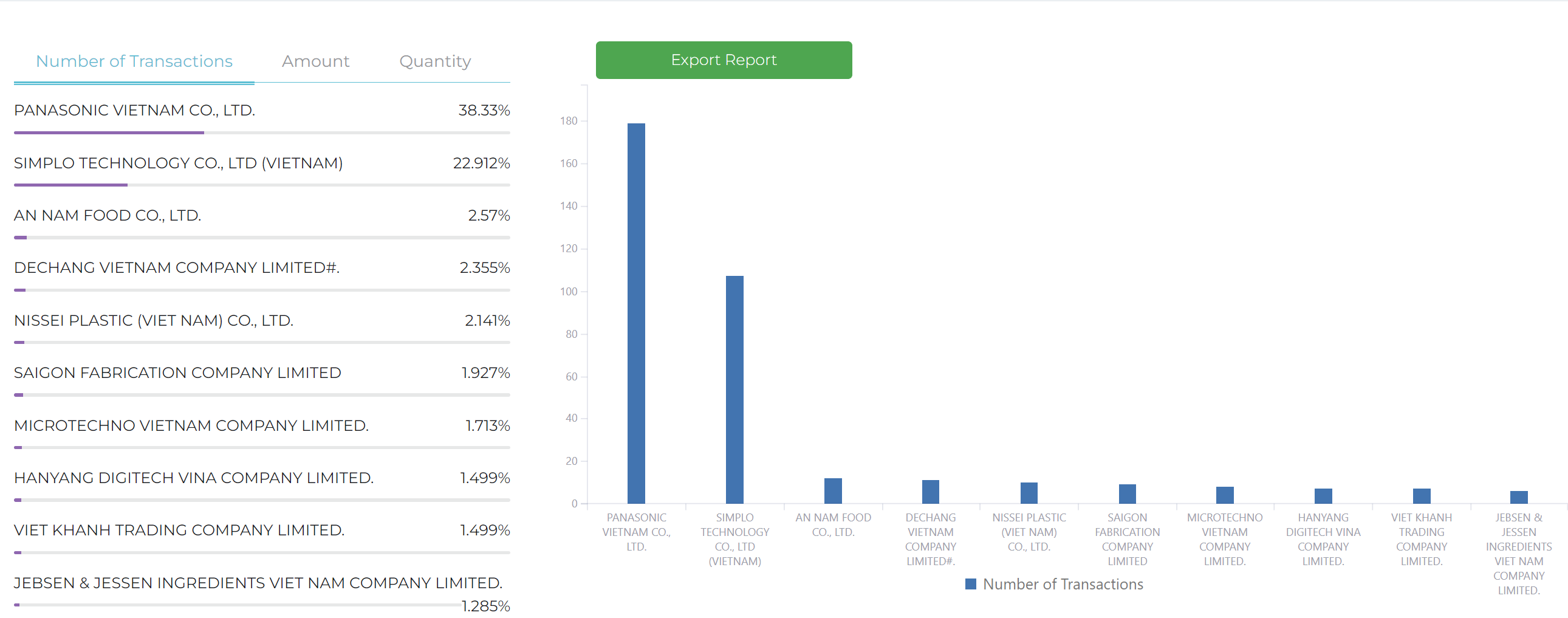

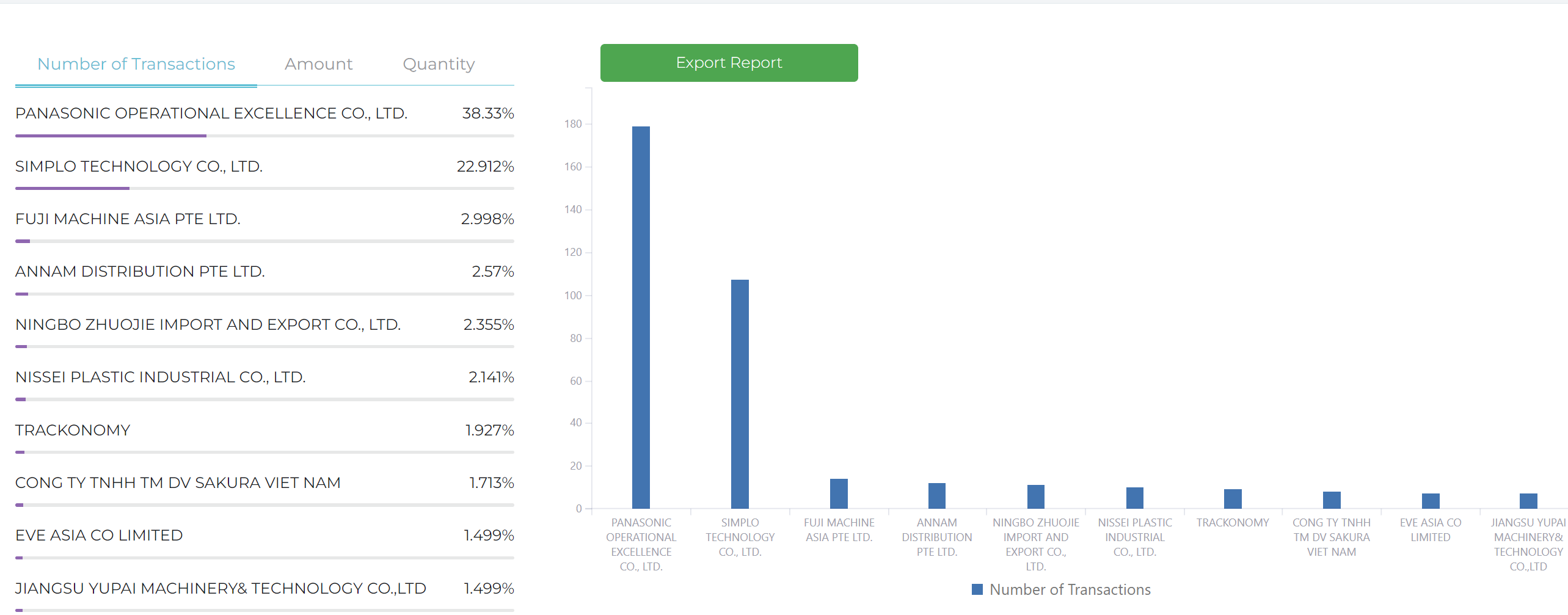

Overview of Lithium Metal Imports and Exports

The data we analyzed comes directly from the NBD DATA platform, providing unique insights into the international trade of lithium metal. Key players in the import and export of lithium metal include countries such as the United States, Vietnam, Mexico, Portugal, and Germany. The procurement records, including suppliers, buyers, and shipment details, help reveal valuable patterns in global lithium metal supply chains.

For instance, major importers in the United States like VINFAST USA DISTRIBUTION, LLC have sourced from suppliers such as VINFAST TRADING AND PRODUCTION JOIN in Vietnam. This indicates a strong supply connection between Vietnam and the United States for lithium-related automotive components.

HS Codes for Lithium Metal and Related Products

Understanding the Harmonized System (HS) codes used for lithium metal trade helps in tracking market trends and regulatory differences between countries. The HS code 850760 (used for lithium-ion batteries) is one of the most relevant codes when dealing with lithium metal products. You can find more detailed information about this HS code here.

Different HS codes used for lithium metal and associated battery products reveal how countries classify imports and exports. Such variations can influence tariffs, import regulations, and trade agreements, impacting the overall pricing. The differentiation among HS codes like 850720 (other batteries) versus 850760 may seem minor, but it plays a critical role in the movement and pricing of lithium metal globally.

Lithium Metal Supply Chains and Major Trade Routes

The NBD DATA records show that lithium metal is imported mainly through ports like Los Angeles, California in the United States and Bremerhaven in Germany. These ports serve as vital gateways for lithium metal and associated components entering their respective markets.

Analyzing the supply chains, Vietnam emerges as a significant exporter of automotive parts containing lithium metal, particularly to the U.S. This highlights the growing reliance on Vietnamese suppliers to meet the American demand for lithium-based technologies, particularly in the automotive industry.

Procurement Insights and Key Market Participants

In examining procurement records, prominent buyers like MASTER METER from the United States have consistently sourced from suppliers such as ARAD LTD DALIA in Mexico and Portugal. This insight highlights the importance of maintaining diversified supply lines, especially as lithium metal demand continues to rise.

Notably, the HS codes also provide insight into the product types. Lithium metal shipments destined for automotive use might be classified differently compared to those for energy storage systems, reflecting different supply chain requirements and market segments.

Factors Influencing Lithium Metal Price

One of the key factors influencing the price of lithium metal is the transportation route and the regions involved. Data from NBD DATA reveals that import volumes and the frequency of shipments significantly affect the cost structure. Ports like Los Angeles see large volumes of lithium-related imports, providing opportunities for economies of scale, which can help stabilize prices.

Additionally, the growing emphasis on electric vehicles in countries like the United States further boosts the demand for lithium metal. The trade dynamics between the U.S. and Vietnam suggest a stable pricing trend, bolstered by established relationships between key buyers and suppliers.

Conclusion

The price of lithium metal is influenced by a combination of international trade relationships, procurement channels, and market demands. The unique data from NBD DATA reveals the complexities in lithium metal trade, providing insights that are crucial for understanding price trends and supply chain dynamics.

For anyone involved in the lithium industry—be it in procurement, manufacturing, or investment—understanding these supply chain relationships is essential for making informed decisions.

Disclaimer

This report's data and analysis come from NBD DATA's statistics and may contain some discrepancies. Users should verify these data independently. NBD DATA does not take responsibility for any consequences resulting from using the information in this report.